Single-use Credit Cards

Cards for maximum security and control

Designed for one-time use, these credit cards simplify expense management and provide strong fraud protection for secure payments.

Secure your online transactions

Pliant’s single-use credit cards offer superior protection for online transactions, designed for one-time use and automatically terminated after each transaction. Ideal for large purchases or unfamiliar merchants, they safeguard your account by generating a unique card number for every payment, ensuring your real account details remain secure.

Efficient card management

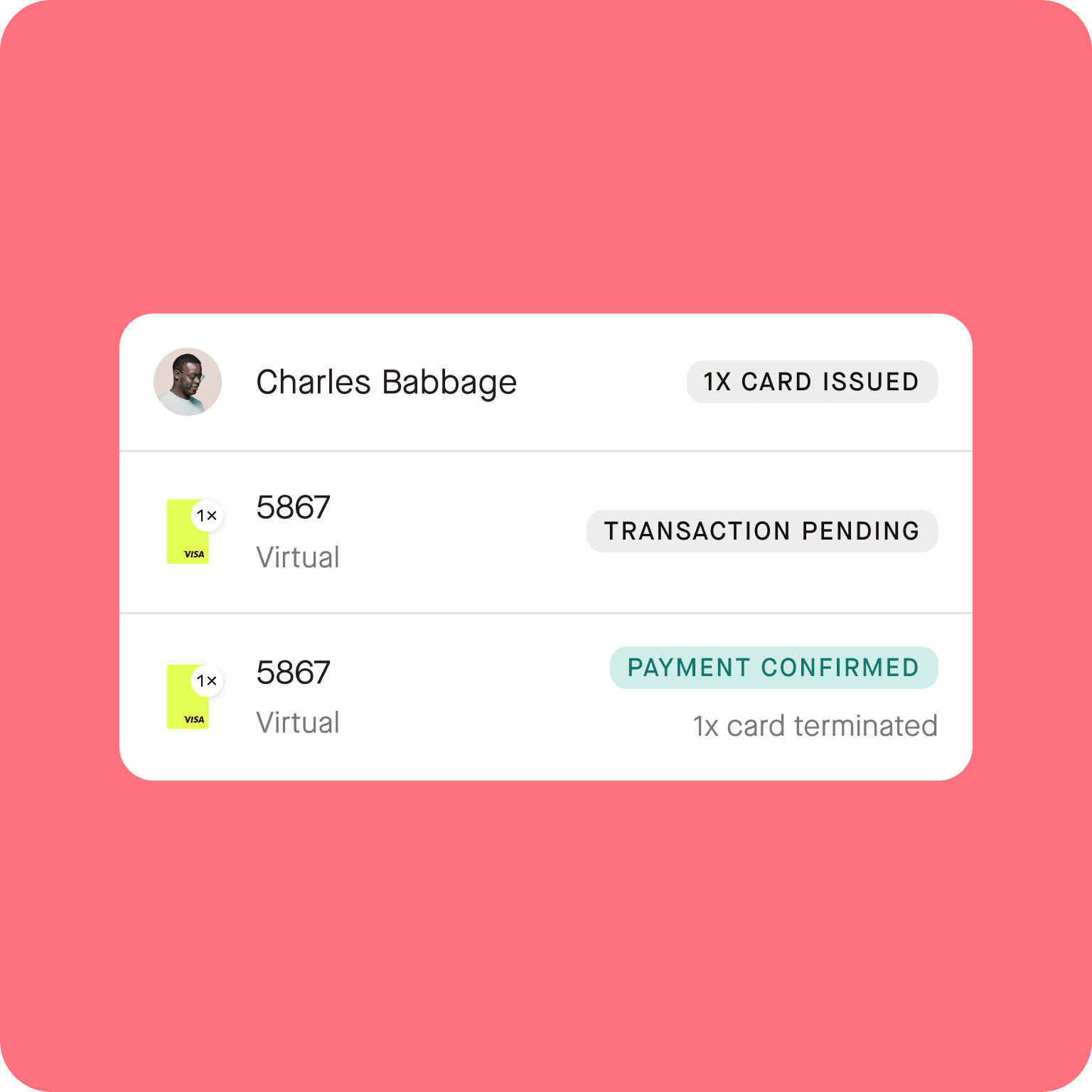

Issue single-use credit cards in real-time when you need one. Once a transaction is pending, no additional charges can be made. If declined or reversed, the card stays active until a confirmed payment is processed, after which it is terminated but remains available for refunds for up to three months.

Simple steps to use Pliant’s single-use cards

Take control of your online spending with our secure and easy-to-use solution:

Register

and obtain real credit cards with high limits, independent of your company account.

Issue

single-use cards instantly, giving you full control with just a few clicks.

Track

all your card spending in real-time, managing receipts and accounting tasks effortlessly.

Benefit

from card perks and save money on every transaction with attractive cashback terms.

Full control over transactions

Single-use virtual cards offer precise oversight of your spending. Customize card-level controls for specific purchases, securely control spending to prevent recurring charges, and eliminate the need for high permanent limits or frequent adjustments.

Streamline Bulk Issuance with Pliant’s Pro API

Easily issue single-use virtual cards at scale with our Pro API, perfect for corporate purchases and travel bookings. Benefit from real-time card issuance for high-frequency transactions, allowing you to customize each card's attributes, including spending limits, merchant categories, and validity dates.

Key features of the Pliant single-use credit card

Virtual only

Exclusively virtual cards designed for single transactions with automatic termination.

Enhanced online security

Ideal for large one-time purchases with added protection against fraud.

Real-time issuance

Issue and manage single-use cards instantly with complete control.

Spend control

Prevent overspending and avoid recurring charges by setting specific limits for each card.

Confidential transactions

Use unique card numbers for each transaction to keep your real account details safe.

Automated accounting

Invoices can be directly uploaded into the app for fast reconciliation.

FAQs

A single-use credit card is a virtual credit card designed for one-time transactions. Each card is generated for a single purchase and is automatically terminated after the first successful transaction. This ensures enhanced security and control over online spending.

A single-use credit card works by providing a unique card number that is valid for only one transaction. Here’s how it functions:

Once a transaction is successfully completed and confirmed, the card is automatically terminated and cannot be used again.

If a transaction is in a pending state, no further transactions can be processed. Any additional attempts will be declined with a specific reason provided.

If a transaction is marked as declined or reversed, or if only a card check is performed, the card remains active. You can make new transactions until a payment is confirmed.

Although the card is terminated after a confirmed transaction, refunds can still be processed within a 3-month period.

This approach ensures that your card details are protected and that each card is used securely for a single transaction.

Using a single-use credit card offers several benefits:

Enhanced Security: Protects your real account details from exposure, reducing the risk of fraud.

Control Over Spending: Ensures that merchants can only charge the card once, preventing unwanted recurring charges.

Convenience: Perfect for large one-time purchases and transactions with unfamiliar merchants.

Pliant’s virtual credit cards are Visa cards, which means they are accepted at over 40 million online and offline retailers across more than 200 countries. You can use them for transactions with any merchant that accepts Visa payments, offering extensive flexibility and convenience for your global spending needs.

Yes, single-use credit cards are highly secure. By using a unique card number for each transaction, they eliminate the risk of card details being reused or stolen. Your real account number is never revealed to the merchant, providing an additional layer of protection against fraud.

Increase your online spending security today

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.