Unlock the Future of Credit Card Programs

Banks often face outdated systems and limited resources to build modern card solutions. Pliant makes it easy to launch an innovative credit card program, fully labeled in your bank’s branding, and seamlessly integrated into your existing technical and regulatory infrastructure.

Best-in-class card programs to go

Legacy systems and limited internal resources make it difficult for banks to launch new credit card products quickly. As customer expectations grow, staying competitive requires faster execution, greater flexibility, and fewer resource demands.

Choose your setup

Launch a fully managed platform by Pliant or take complete control in-house plugging our cards into your infrastructure.

Exceed expectations

Offer your customers an innovative credit card program with best-in-class features.

Accelerate go-to-market

Get your corporate credit card program to market in weeks instead of months.

Increase revenue

Increase revenue with high interchange yields and flexible pricing options.

Boost your brand

Deliver a fully white-labeled experience that matches your bank’s design, so customers instantly recognize it as your product.

Stay in control

Manage your entire card program with intuitive back office tools, track performance, and gain real-time insights without complex setup.

Scale card programs on your terms

Launch a corporate credit card program with full flexibility. Choose a fully managed setup by Pliant or integrate directly into your own infrastructure. The platform is compatible with any banking setup and built on an API-first approach, making it easy to implement and offer a best-in-class card program.

See how credit cards grow your revenue

Monetize card spend, FX and additional software fees without building a card program from scratch yourself.

Modular regulatory & technology setup with Pliant

Pliant’s modular card platform allows you to select only the layers you need, making it easy to configure and manage your corporate card program.

Backend layer

Always included. Pliant provides the complete technology stack with APIs, processing, and infrastructure needed to run and scale your card program.

Frontend layer

Use ready-made applications for admins, cardholders, and your back office.

Support layer

Get expert help at every stage, from setup to daily operations and quick issue resolution.

Regulatory layer

Stay compliant with built-in checks like KYC/AML and ongoing risk monitoring.

Banking layer

Leverage Pliant’s banking infrastructure or integrate your own to cover all credit card requirements.

Adapt innovative built-in features

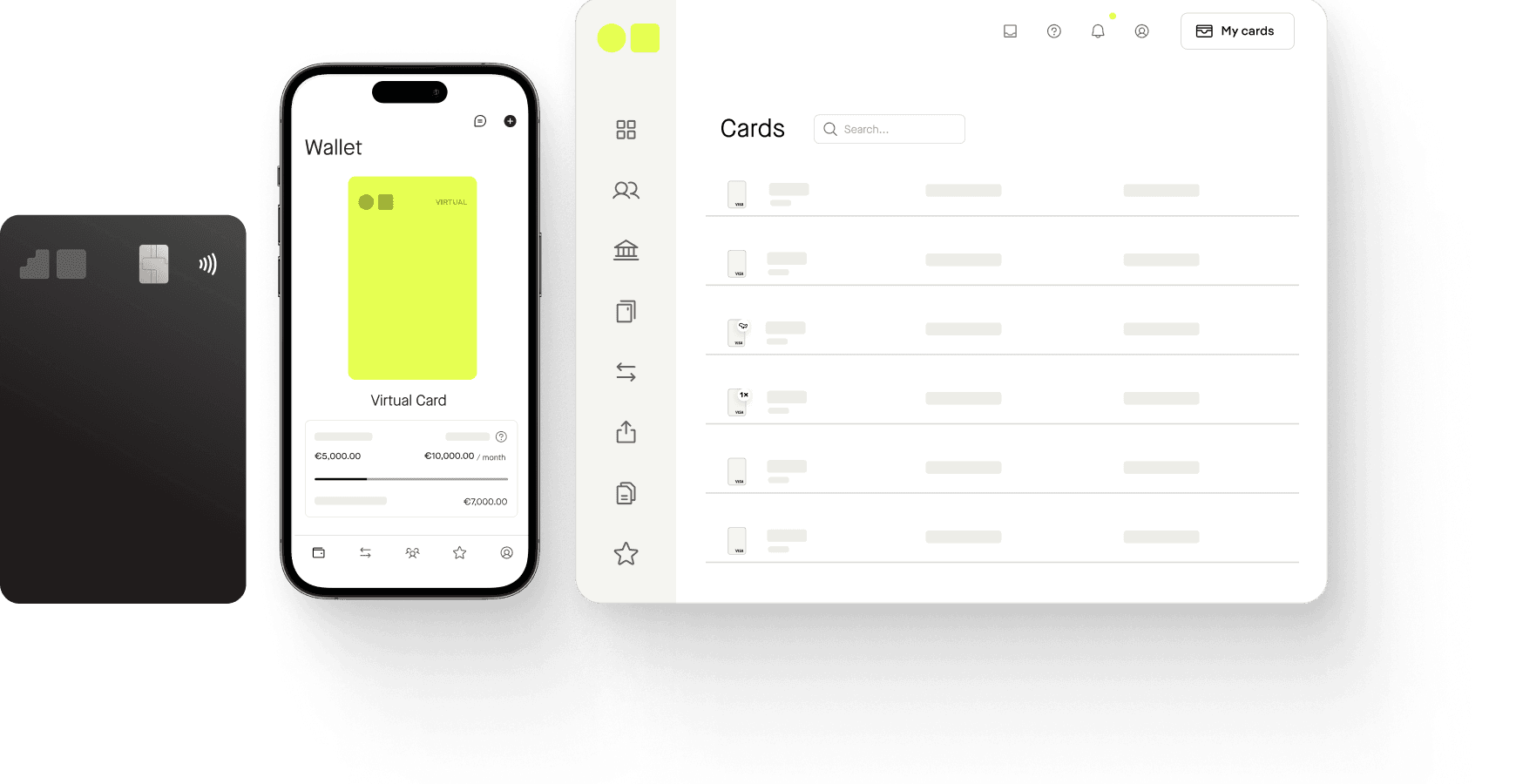

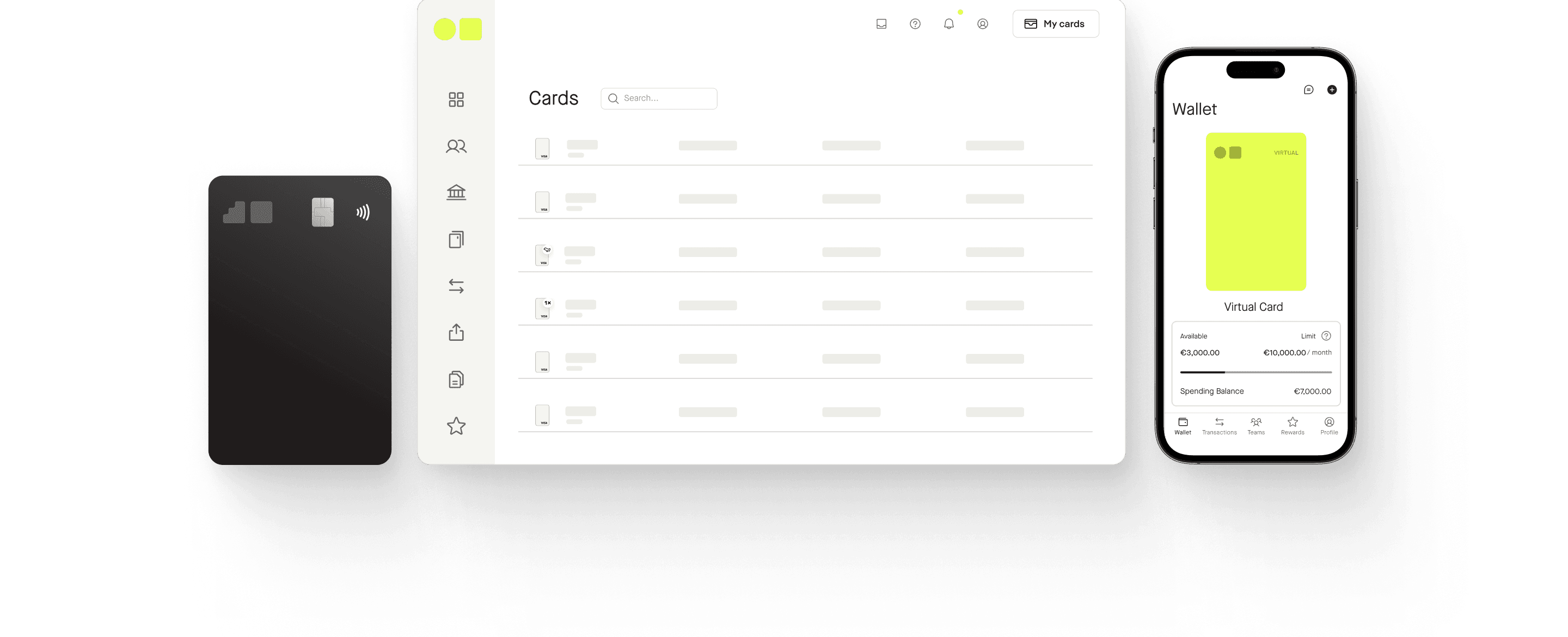

White-label capabilities

Launch and scale corporate card programs in your branding with flexible deployment and integration options.

Next-generation financial infrastructure

Offer modern card management, flexible issuance, automated workflows, and seamless integrations.

Scalable backoffice tools

Manage and scale your card programs with real-time visibility, operational controls, and powerful back-office tools.

Modular features & detailed customization

Create tailored card programs with modular features, custom pricing, and full control over product configuration and functionality.

Global bank transfers to third-party beneficiaries

Enable secure, cross-currency bank transfers with built-in compliance and fraud potection.

Accounting automation & integrations

Benefit from integrations that make accounting easier, improve accuracy, and reduce manual tasks.

Enterprise-grade compliance & security

PCI DSS certified

Certified PCI DSS Service Provider ensuring secure data handling.

ISO certified

ISO 27001-2022 certification for robust information security management.

Advanced security

Full compliance with financial and banking regulations.

Ready to transform your credit card offering?

Contact our partner team to discuss the possibilities for your financial institution’s card offering.