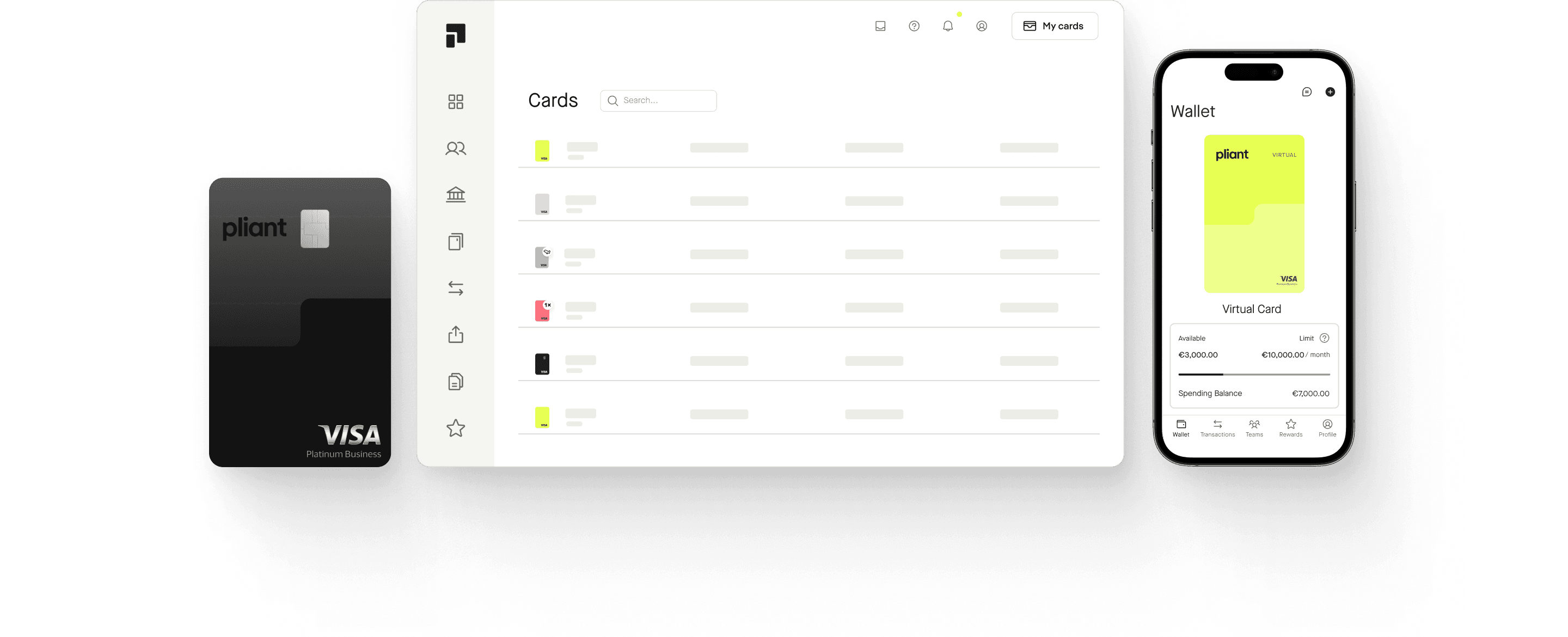

Virtual credit cards

Virtual cards that plug into your company’s world

Customize virtual Visa cards for various use cases. Instantly available and easy to manage, they offer strong security and streamlined accounting for efficient payments.

Instant issuance for immediate use

Pliant’s virtual credit cards are created with just a few clicks and are ready for immediate use. This eliminates the waiting time associated with physical cards, ensuring that your financial operations remain uninterrupted. Companies can issue an unlimited number of virtual cards for various purposes, providing flexibility for different projects and vendors.

Seamless mobile payments with virtual credit cards

Virtual cards enable seamless mobile payments through Apple Pay and Google Pay, allowing efficient spending management across platforms. Instantly create and use new virtual cards within the Pliant Payment Apps for secure in-store and online transactions worldwide, ensuring streamlined spending and effective financial control.

Issue virtual cards yourself for full control

Take control of your business spending with our all-in-one solution:

Register

and obtain real credit cards with high limits, independent of your company account.

Issue

single-use cards instantly, giving you full control with just a few clicks.

Track

all your card spending in real-time, managing receipts and accounting tasks effortlessly.

Benefit

from card perks and save money on every transaction with attractive cashback terms.

Virtual credit card for businesses

Pliant’s virtual credit cards are entirely digital. This ensures that the card details, such as the credit card number, cardholder's name, and card verification number, are securely available only online. This digital-only nature enhances both convenience and security.

Comprehensive card management

Administrators can easily manage virtual credit cards through the Pliant app. Set individual limits and rules for each card, update settings instantly, and maintain full control over all issued cards. The intuitive interface makes managing your financials simpler than ever.

Automate card issuance with Pro API

Seamlessly issue virtual cards, manage cardholders, and adjust limits with ease through Pliant’s Pro API. Automatically issue new virtual cards to every new hire and ensure secure termination of all cards when an employee leaves. Equip your team with the right virtual cards instantly, streamlining workflows and enhancing operational efficiency while maintaining full control over your card program.

Key features of Pliant corporate virtual cards

Instant issuance

Create and use virtual Visa cards instantly with just a few clicks.

Multi-level controls

Administer cards, set limits, and update settings effortlessly through the app.

Enhanced security

3D-Secure and two-factor authentication protect against misuse.

Automated accounting

Invoices can be directly uploaded into the app for fast reconciliation.

Real-time spend control

Monitor transactions in real-time for precise budget tracking.

Apple Pay and Google Pay

Add your virtual cards to your preferred mobile payment app

FAQs

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Pliant app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between black credit cards (Visa Platinum Business) and metal cards (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Pliant offers Visa cards, which are accepted by over 40 million online and offline retailers in over 200 countries.

Pliant assigns security and data protection the highest priority. Access to the Pliant platform is secured by strong passwords and two-factor-authentication. All personal data is stored in accordance with the European General Data Protection Regulation (GDPR). Critical card data are stored and processed in line with the very high data security standards of the payment card industry (PCI DSS). Additionally, Pliant cards are enabled for 3DS to ensure additional protection for online purchases.

3D Secure is a free service facilitated by VISA that lets you transact securely on “Verified by Visa“ / “Visa Secure” online merchants using your Pliant credit cards. It adds a security layer by an additional verification step. During this verification you must provide a one-time password that is only available to you.

All Pliant credit cards are automatically equipped with 3D Secure. During your online purchase you will receive the one-time password via SMS for the verification. This password you can input into the verification page that will show the Visa logo and confirm the payment by clicking confirm / send. If the password is correct, the transaction will be successful and otherwise declined. Pliant credit cards also work at merchants that do not participate in Visa 3D secure program.

This service is offered due to the EU’s Second Payment Services Directive (PSD2) which will mandate Strong Customer Authentication (SCA) before initiation of the payment. Therefore, Visa recently enhanced its security for online purchases including both e-commerce and m-commerce transactions to satisfy this new standard.

In case you are not receiving your one-time password, please check that your phone number is up to date within your user area or call our hotline.

Learn more about Visa 3D Secure.

Simplify and secure your payments today

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.