Choose the plan that’s right for your business

Maximize what Pliant can do for you with a plan that’s tailored to your unique needs.

Light

Pliant’s solution for businesses that make a lot of transactions but don’t need advanced features or integrations.

The benefits of Light:

- 1 standard card per user

- 25 virtual cards

- 5 single-use virtual cards per month

- Premium cards available upon request

- 1 standard integration

- Live chat support

All the benefits of Light, plus:

- Unlimited cashback*

- Unlimited virtual cards

- Unlimited single-use cards

- Premium cards available upon request

- Access to advanced features

- Unlimited integrations

- Insurance package**

- Support via email & phone

All the benefits of Standard, plus:

- Dedicated onboarding support & training

- Dedicated customer success manager

- Custom integrations

- Access to Pro API

* Depending on transaction volume ** Custom extra fee depending on plan terms & number of users

Is Pliant the right fit for your business?

Pliant is not the right fit if:

You’re a freelancer, a sole trader, or run a microenterprise

Pliant’s B2B focus means that we’re most qualified to solve the unique challenges of businesses instead of individuals.

Your total business credit card spending is less than €10,000 per month

As a credit card provider, Pliant works best with high-spending companies that can get the most out of our best-in-class features.

Want to go even further?

Pro API

Are you interested in Pro API, our powerful API-based solution?

Contact us to learn moreCaaS

Are you interested in launching your own card program with our CaaS solution?

Contact us to learn more

FAQs

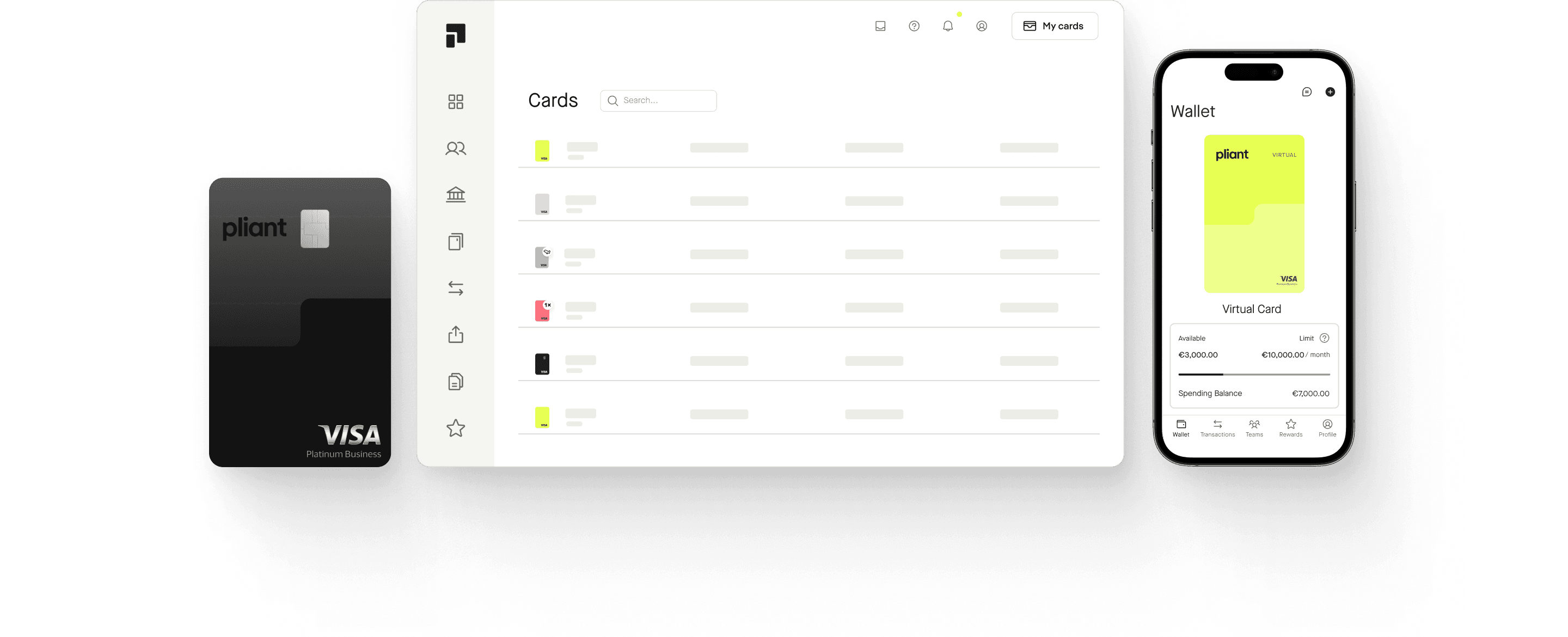

Pliant offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits, real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes. On top of that, Pliant offers competitive terms with attractive cashbacks and partner deals. Our Visa Infinite Business cards are equipped with useful features like tailored insurance packages and worldwide airport lounge access.

Registered corporations and private companies, associations and partnerships with good credit rating and high credit card spend.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between black credit cards (Visa Platinum Business) and metal cards (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Pliant app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

We’re here for you.

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.