Choose the payment solution made for the travel industry

When it comes to travel, Pliant means business. We help TMCs, OTAs, tour operators, bed banks, and other travel intermediaries navigate an ever-changing travel market, providing a payment solution that ensures efficiency and flexibility with virtual credit card (VCC) technology. Get in touch today and discover how Pliant can help your travel business increase margins and operating capital, increasing efficiency as you do.

When it comes to travel, Pliant means business. We help TMCs, OTAs, tour operators, bed banks, and other travel intermediaries navigate an ever-changing travel market, providing a payment solution that ensures efficiency and flexibility with virtual credit card (VCC) technology. Get in touch today and discover how Pliant can help your travel business increase margins and operating capital, increasing efficiency as you do.

Virtual card solutions for Travel Companies

At Pliant, we know travel and the challenges faced by every kind of travel company. Low margins, restricted access to working capital and slow back-office processes aren’t just a headache for your business: they’re a threat to the entire industry.

That’s where Pliant comes in: a payment solution for the travel industry that meets these challenges head on. Our platform helps travel businesses achieve robustness and profitability, whichever segment of the travel industry they occupy, and whichever model they use.

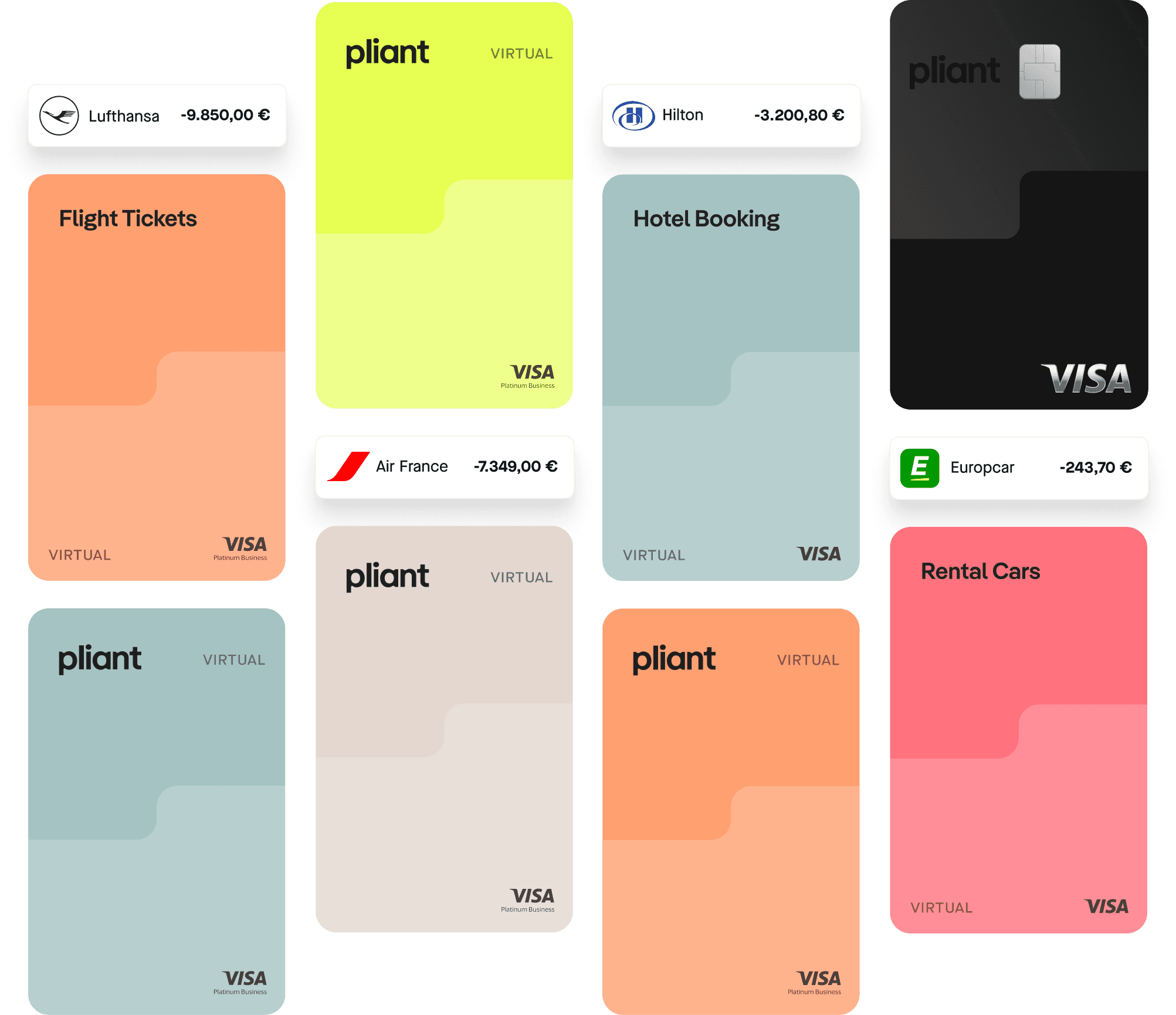

Pliant's virtual and physical cards, payment apps, and API solutions can maximize margins for your TMC, OTA, tour operator or bed bank. With a digital platform to speed up processes, Visa cards for worldwide acceptance, and exceptional terms for currency exchange, we’re your partners for global, scalable success.

"With Pliant Pro API, we can automate thousands of daily transactions, streamlining everything from card creation to reconciliation. This capability allows us to integrate more partners into our systems and has transformed our cash flow management."

"Based on our experience, Pliant cards have an almost perfect acceptance rate, so we haven’t heard any complaints about failed transactions."

"Our previous virtual credit card system had several shortcomings. After getting familiar with Pliant, we found that practically all of them were covered and solved."

Pliant: made for your travel company

TMCs

Travel management companies (TMCs) are at the center of the business travel market: facilitating payments every day to airlines, hotels, car rental companies and more.

OTAs

Your online platform lives and breathes efficiency, and you need a platform that ensures full automation from day one. With Pliant, you can ensure seamless purchasing with VCCs, as well as a massive reduction of your payment support burden.

Tour operators

If you’re buying flights, hotel rooms and experiences in bulk, you need a payment solution that enables you to scale your operations effectively. Pliant’s flexible billing cycles mean that you plan for the long term with larger individual payments.

Bed banks

For bed banks, margins are the name of the game – and acquiring your inventory effectively is a huge step forward. Pliant’s payment platform for travel makes it simple to increase your margins with generous cashback offers on purchases.

Grow your margins

When costs are rising and competition is at an all-time high, your travel company is being squeezed from all sides. However, even in this tough environment, it’s still possible for travel companies to increase margins.

With features such as rebates to open new revenue streams, as well as a flexible, expense-saving approach to currency interchange, our payment solution helps travel companies expand their margins one transaction at a time.

Increase your operating efficiency

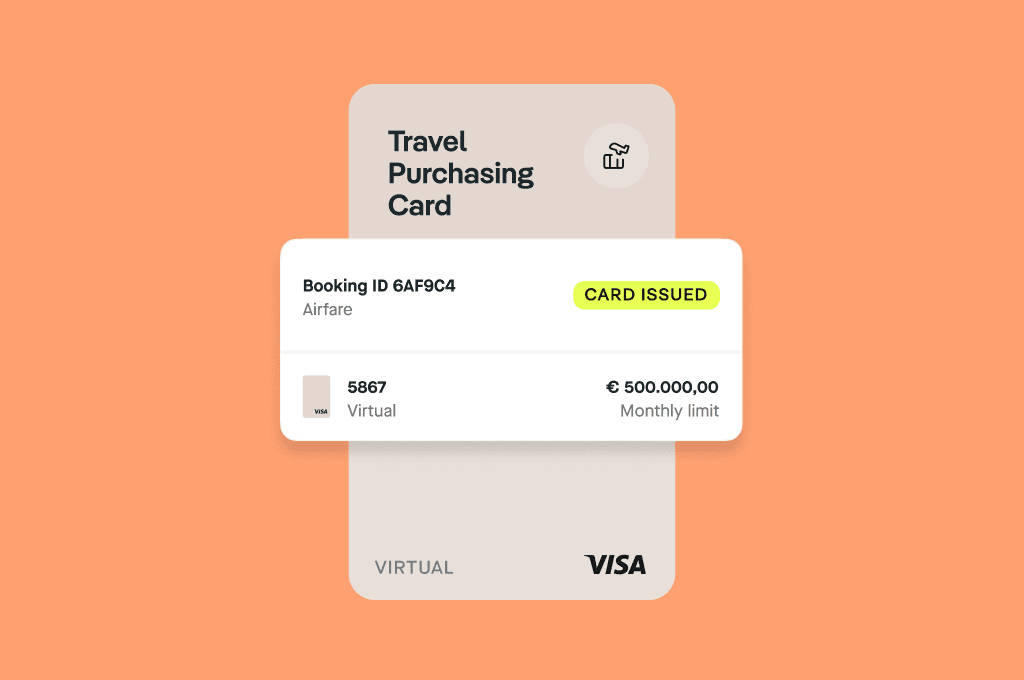

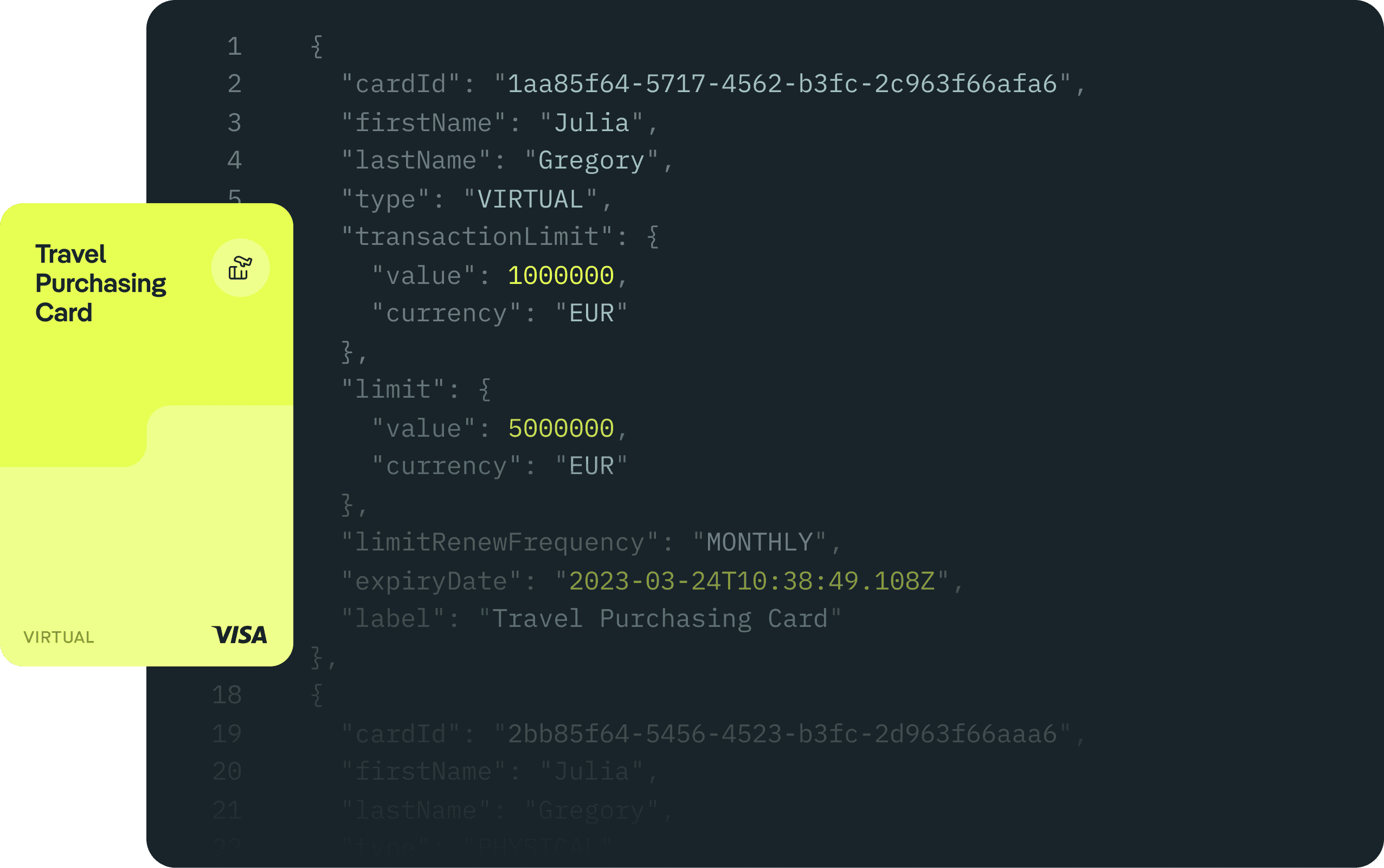

There’s no time to lose: the more travel purchases you make, the more important automation and efficiency become. Let Pliant lead the way. Use our payment solution to access a dedicated travel purchasing card: enabling seamless purchasing for your organization.

With Pliant Pro API, as well as integrations to the travel tech stack your company already uses, you can streamline payment processes: reducing the need for support staff and cutting down on operational expenses.

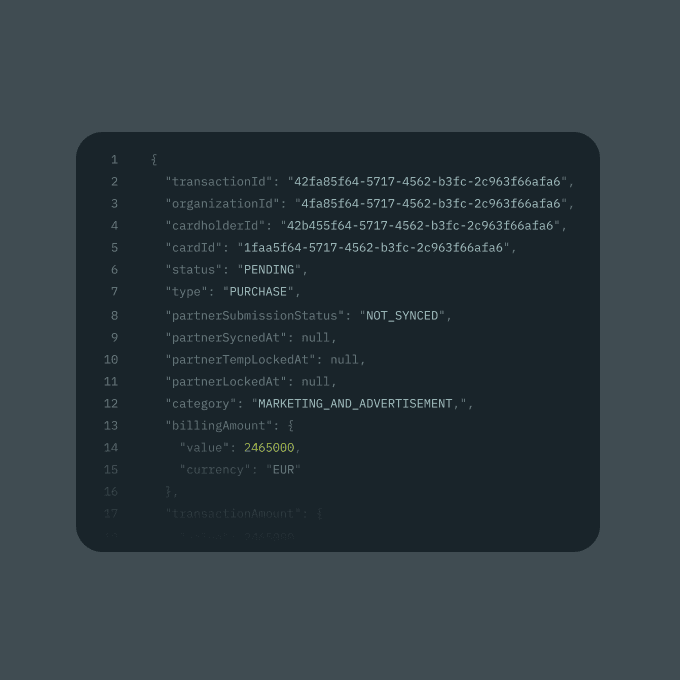

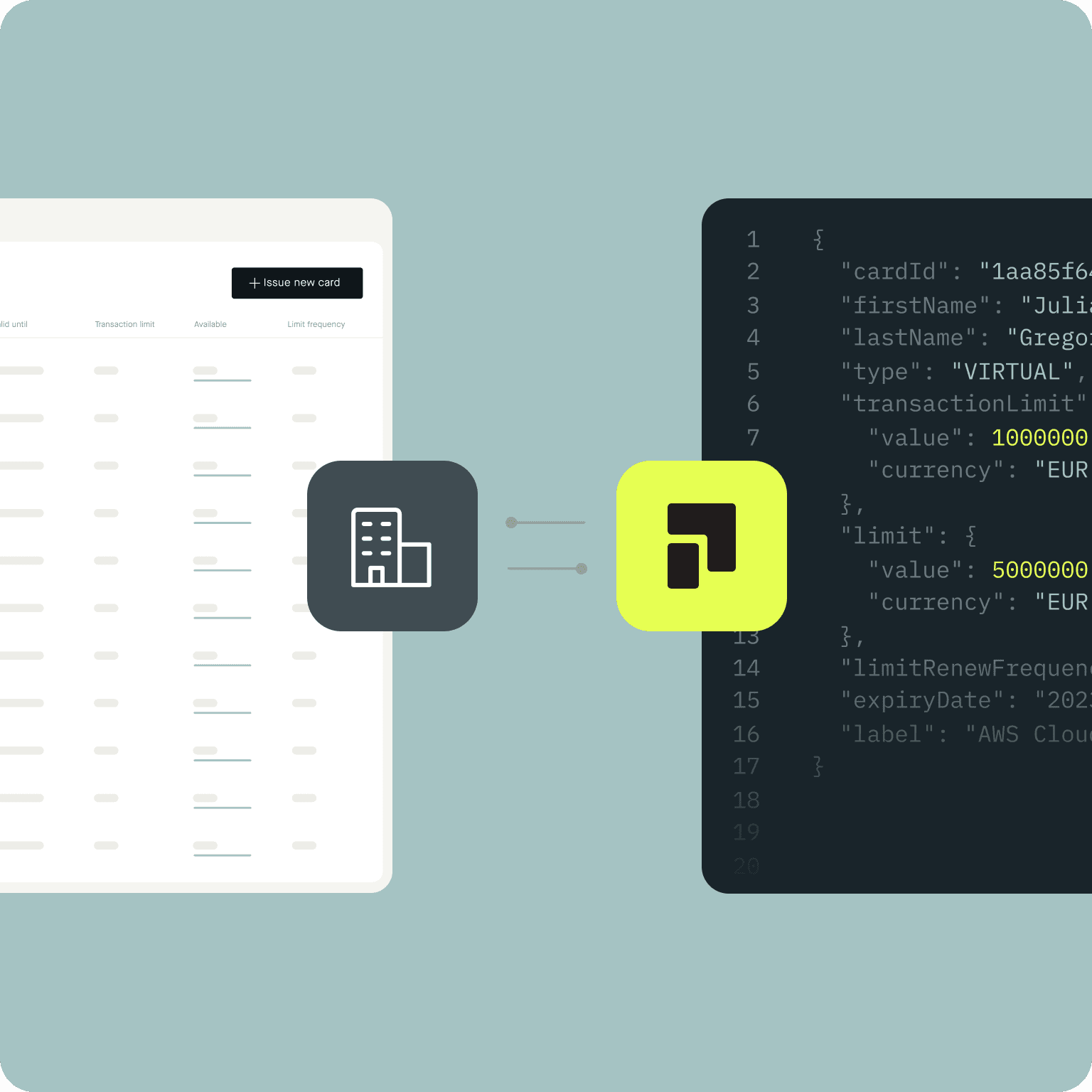

Plug it. Play it. Pay it. Meet Pliant Pro API.

Our easy-to-implement API enables you to:

Automate bulk processes for travel purchasing

Issue new virtual credit cards (VCCs) for each travel purchase, reducing risk and simplifying accounting workflows

Use your Pliant VCCs alongside your traditional bank or credit card provider

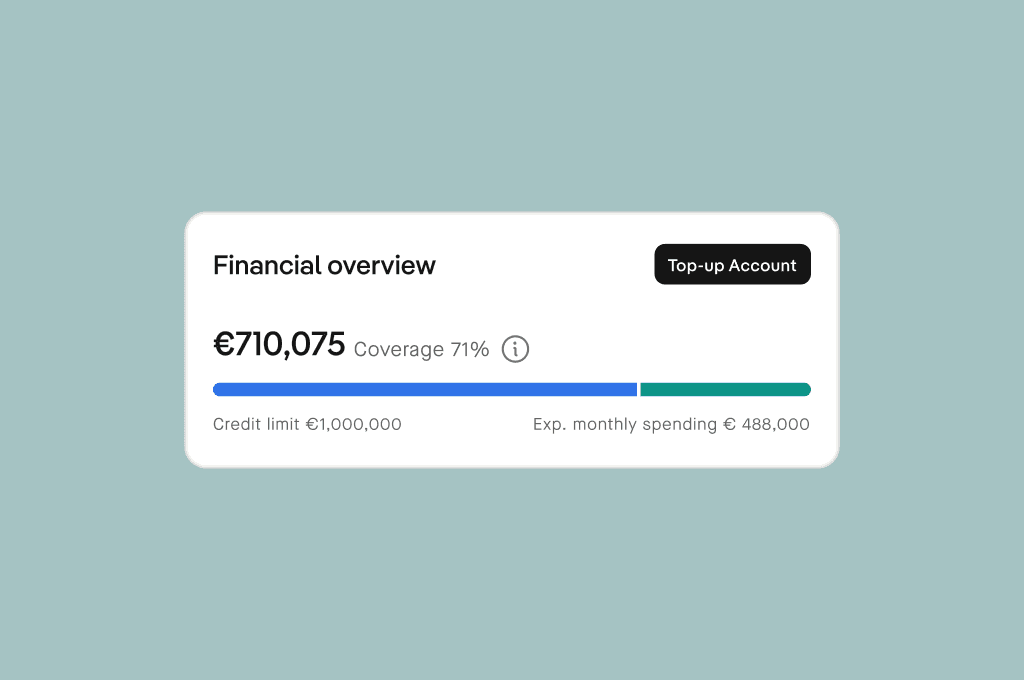

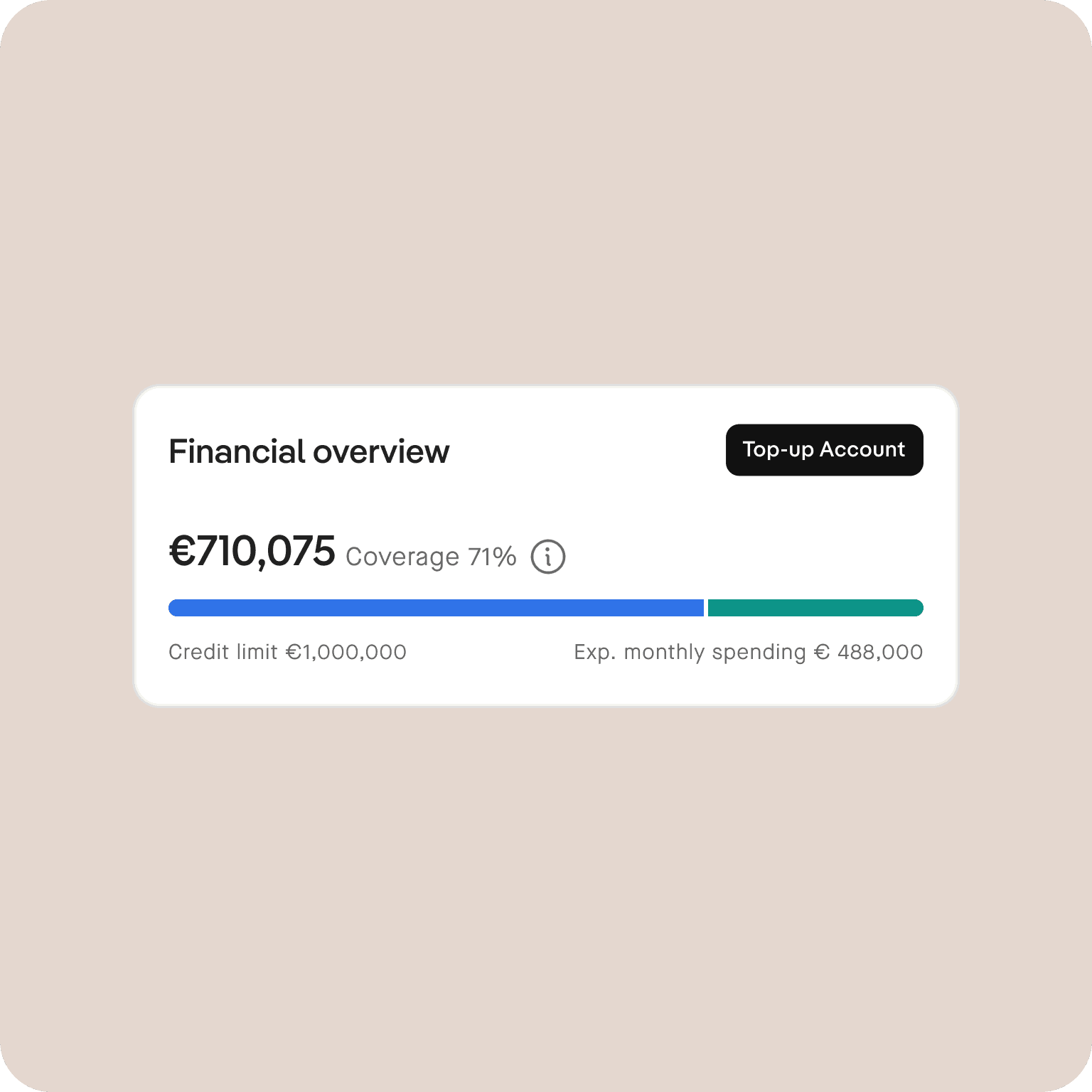

Flexible credit lines and payment terms

For travel companies, working capital is among the most important indicators of your performance and, as such, low working capital can become a major pain point: particularly for Travel Management Companies (TMCs) and traditional travel agencies.

The reason for this is that the structure of these types of travel companies means that capital has the potential to get “tied up,” and the bigger your business grows, the greater the risk that low working capital poses.

A payment solution for merchants of record

Transitioning to become a merchant of record needn’t be a burden to your business. On the contrary – with Pliant as your payment solution, your travel company can use it as an opportunity.

We provide flexible credit lines to merchants of record that can be customized to fit specific needs: providing greater financial control during peak travel seasons. Our flexible repayment options mean that Pliant can be completely adapted to your business model.

FAQs

Although it’s sometimes used to describe a way for end users to purchase travel, we use the term “travel payment solution” to describe tools that enable companies within the travel industry to purchase inventory – such as flight tickets, hotel reservations and car rentals – from one another.

Travel companies use different payment methods, each varying in flexibility and efficiency. Some methods, such as IATA BSP, automate transactions and data exchange between agencies and airlines, although IATA charges a commission for those.

For non-IATA providers, manual invoicing and wire transfers are commonly used. However, these present challenges like slow processing times and high fees for international payments. Virtual Credit Cards (VCC), including those offered by the Pliant travel payment solution, offer more flexibility, allowing quick issuance and streamlining reconciliation processes.

Virtual Credit Cards (VCCs) provide significant advantages for travel companies. Firstly, they contribute to higher margins through cashback programs, enabling businesses to maximize returns on their expenditures.

Secondly, VCCs offer increased access to operating capital, thanks to high credit limits and flexible repayment options offered by the Pliant travel payment solution.

Additionally, the potential for automation is enhanced with tools like Pliant Pro API, streamlining processes and reducing manual effort, ultimately improving operational efficiency for travel companies.