FAQ

You have questions. We have answers.

General questions

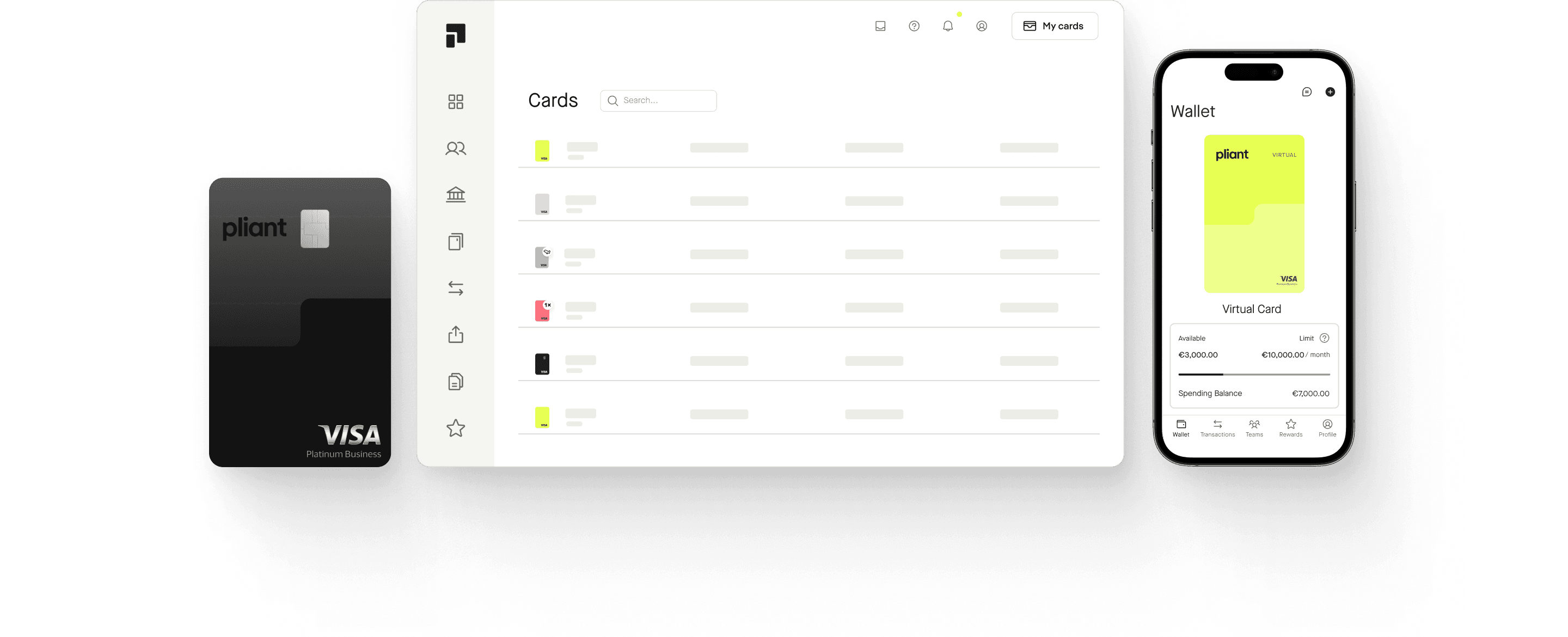

Pliant offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits, real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes. On top of that, Pliant offers competitive terms with attractive cashbacks and partner deals. Our Visa Infinite Business cards are equipped with useful features like tailored insurance packages and worldwide airport lounge access.

Registered corporations and private companies, associations and partnerships with good credit rating and high credit card spend.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between black credit cards (Visa Platinum Business) and metal cards (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Virtual cards work the same way as physical cards, only that no plastic version of the card is provided, with card data being only accessible via your Pliant app. Advantages of virtual cards include their instant availability. They also cannot be lost and are offered with a range of flexible usability options. Since they are offered at no extra cost, separate virtual cards can be issued for specific merchants or purchases with individual settings tailored to the specific use case. That way, if something is wrong with one card, there is no need to update card data across multiple merchants.

Pliant offers Visa cards, which are accepted by over 40 million online and offline retailers in over 200 countries.

Yes, you can easily use Pliant cards along with any existing corporate bank account.

Pliant assigns security and data protection the highest priority. Access to the Pliant platform is secured by strong passwords and two-factor-authentication. All personal data is stored in accordance with the European General Data Protection Regulation (GDPR). Critical card data are stored and processed in line with the very high data security standards of the payment card industry (PCI DSS). Additionally, Pliant cards are enabled for 3DS to ensure additional protection for online purchases.

Cashback means that for every transaction done with a Pliant card, our customers will get back a certain percentage of the transaction value. We provide different cashback percentages for different repayment frequencies. You can also earn extra cashback payments based on a range of partner deals in categories such as IT equipment, hotel & travel, as well as office supplies.

Pliant provides flexible CSV exports that can be imported into a range of accounting solutions. We also offer bespoke integrations into our customers’ accounting systems and expense management solutions.

Visa Infinite Business is the highest credit card standard offered by Visa. We are proud to be the first provider in Germany meeting these high standards for businesses through its unique value proposition including premium card perks lounge access and insurances. Corporates can achieve access through significant card volumes or the paid premium package.

3D Secure is a free service facilitated by VISA that lets you transact securely on “Verified by Visa“ / “Visa Secure” online merchants using your Pliant credit cards. It adds a security layer by an additional verification step. During this verification you must provide a one-time password that is only available to you.

All Pliant credit cards are automatically equipped with 3D Secure. During your online purchase you will receive the one-time password via SMS for the verification. This password you can input into the verification page that will show the Visa logo and confirm the payment by clicking confirm / send. If the password is correct, the transaction will be successful and otherwise declined. Pliant credit cards also work at merchants that do not participate in Visa 3D secure program.

This service is offered due to the EU’s Second Payment Services Directive (PSD2) which will mandate Strong Customer Authentication (SCA) before initiation of the payment. Therefore, Visa recently enhanced its security for online purchases including both e-commerce and m-commerce transactions to satisfy this new standard.

In case you are not receiving your one-time password, please check that your phone number is up to date within your user area or call our hotline.

Learn more about Visa 3D Secure.

Due to increased security risks, payments in certain countries are only possible to a limited extent or not at all. We monitor these payments closely and divide them into 3 categories. High-Risk Countries are countries where there is an increased incidence of card fraud or which are not subject to the general Visa guidelines. Find out more.

Welcome to the exclusive Pliant Premium Card program! With your Premium Card membership, you have access to over 1,000 airport lounges worldwide. Regardless of your airline or travel class, you can enjoy the convenience and luxury of an airport lounge wherever you go. Your membership grants you complimentary refreshments, comfortable seating, and a relaxing atmosphere. Find out more.

Pliant Earth is a feature that automatically calculates and compensates for travel-related CO₂ emissions. Find out more

Apple Pay

To add a Pliant card to Apple Pay, just open the Wallet page of your Pliant mobile app and select your card. Then tap on the “Add to Apple Wallet” button at the bottom of the page and follow the instructions from there.

Alternatively, you can add a Pliant card directly via the Apple Wallet app on your Apple device. Here’s how to get started:

On an iPhone, open the Wallet app and tap the “+” sign.

For an Apple Watch, open the Apple Watch app on your iPhone and select “Wallet & Apple Pay,” then tap “Add Credit or Debit Card.”

On an iPad, go to Settings, open “Wallet & Apple Pay,” and select “Add Credit or Debit Card.”

On a MacBook Pro with Touch ID, go to System Preferences, select “Wallet & Apple Pay,” then select “Add Card.”

You can use Apple Pay on iPhone, Apple Watch, iPad and Mac. Devices compatible Apple Pay.

All physical, virtual and single-use cards can be added to Apple Wallet and used for Apple Pay, both in stores and online.

To select your Pliant card as your default card in your Apple Wallet, go to Settings on your iPhone and scroll down to Wallet & Apple Pay. There you can select your default card under “Transaction defaults”.

You can use Apple Pay in stores, on the web, and in apps. Just look out for one of these symbols:

We’re here for you.

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.