Black cards that cover all your needs

Designed for high transaction volumes and international usage, our black credit cards offer extensive features to improve spending control and streamline financial operations.

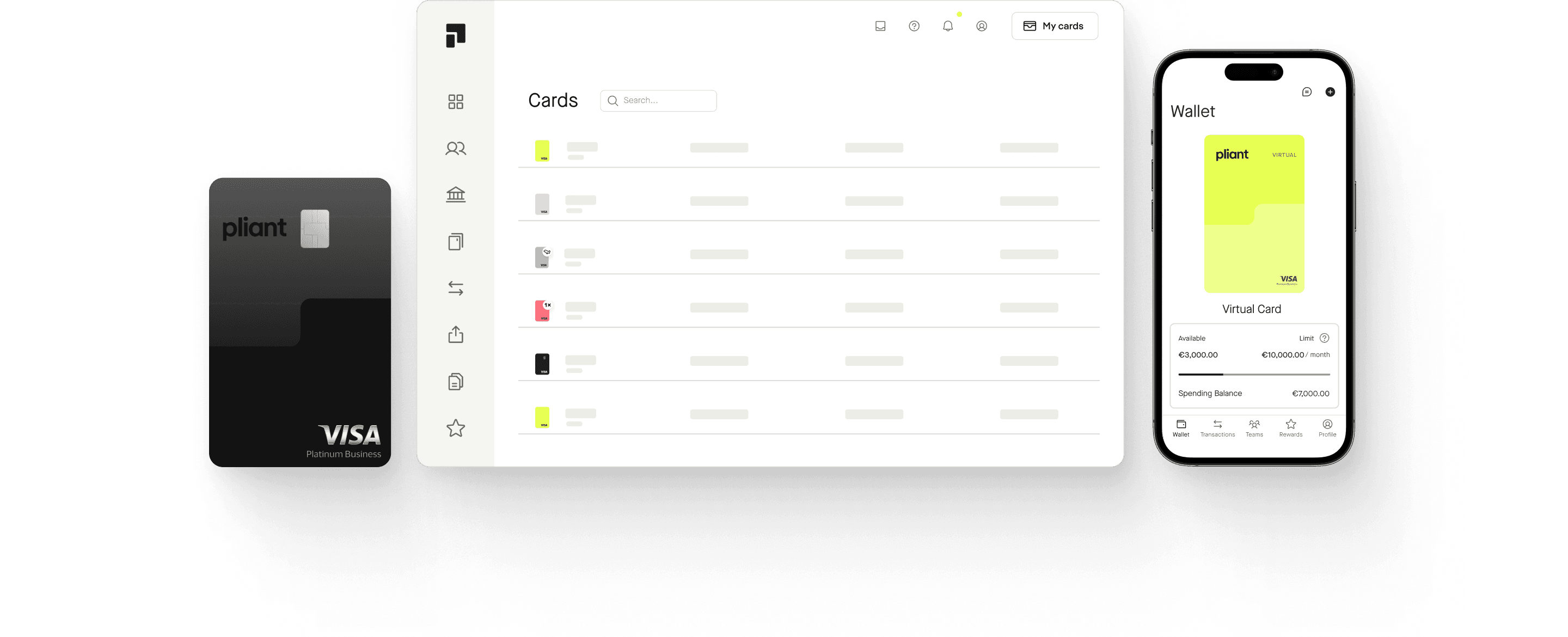

Customizable for all use cases

Manage your physical cards spending with customizable controls and limits. Benefit from high credit limits for substantial transactions and tailored billing cycles that enhance your working capital. Accepted across various markets, corporate Visa cards ensure seamless payments wherever your business operates.

Seamless mobile payments

The physical card integrates effortlessly with Apple Pay and Google Pay. Manage spending across multiple channels—mobile, online, and point-of-sale locations worldwide. Combine the power of your card with our mobile app to streamline offline spending and stay on top of your transactions.

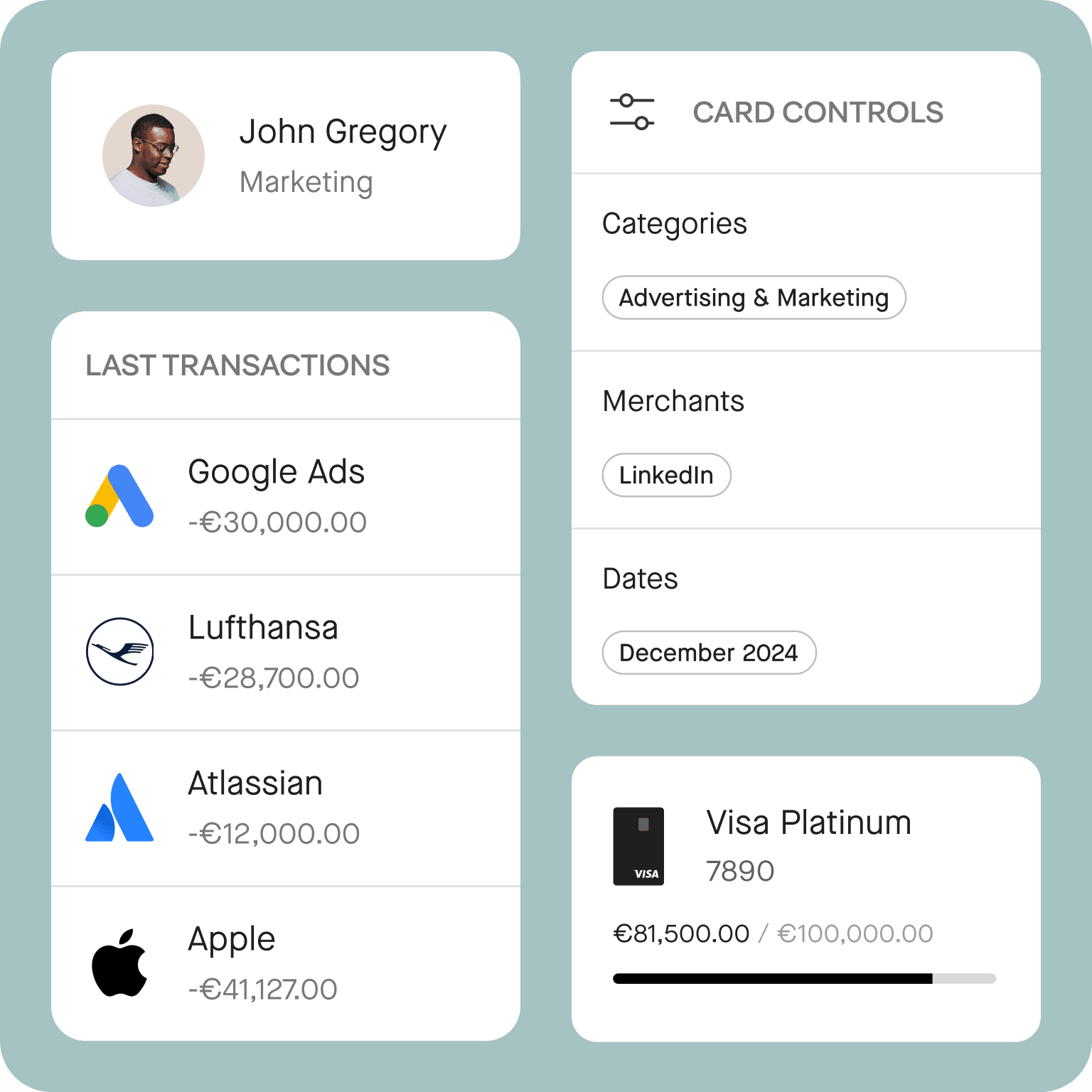

Advanced spend control

Customize card-level controls for categories, international transactions, and more. Provide your team with cards that have built-in spending policies and set specific limits—by transaction, time period, or total spending. Adjust limits as needed to match your business needs and streamline approval processes.

Streamline Expenses with Pliant's Corporate Visa Cards

Real credit cards

Highest acceptance rates, ideal for hotels, car rentals, and more.

Mobile payments

Use Apple Pay and Google Pay for easy mobile transactions.

Advanced spend control

Manage card usage with customizable controls and limits.

World-class travel insurance

Optional coverage for medical expenses, lost baggage, travel cancellation, and more.

Fully digital card management

Save time when you manage all your cards and card settings.

Effortless receipt management

Upload receipts in one step via phone, browser, or email; receipts are automatically matched to transactions using machine learning.

How do you use Pliant?

Benefit from our best-in-class solution in 4 simple steps.

Register

and get real credit cards with high limits regardless of your company account

Issue

virtual & physical cards with individual limits to your employees with a single tap.

Track

all your card spending in real time and effortlessly manage receipt collection and accounting tasks

Benefit

from card perks and save money on every transaction with attractive cashback terms

FAQs

Pliant offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits, real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes. On top of that, Pliant offers competitive terms with attractive cashbacks and partner deals. Our Visa Infinite Business cards are equipped with useful features like tailored insurance packages and worldwide airport lounge access.

Registered corporations and private companies, associations and partnerships with good credit rating and high credit card spend.

Pliant offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between black credit cards (Visa Platinum Business) and metal cards (Visa Infinite Business credit cards). Pliant is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Every plan includes one standard card per user. Reach out to our team to get a plan tailored to your unique needs.

Pliant offers Visa cards, which are accepted by over 40 million online and offline retailers in over 200 countries.

Yes, you can easily use Pliant cards along with any existing corporate bank account.

Pliant assigns security and data protection the highest priority. Access to the Pliant platform is secured by strong passwords and two-factor-authentication. All personal data is stored in accordance with the European General Data Protection Regulation (GDPR). Critical card data are stored and processed in line with the very high data security standards of the payment card industry (PCI DSS). Additionally, Pliant cards are enabled for 3DS to ensure additional protection for online purchases.

Cashback means that for every transaction done with a Pliant card, our customers will get back a certain percentage of the transaction value. We provide different cashback percentages for different repayment frequencies. You can also earn extra cashback payments based on a range of partner deals in categories such as IT equipment, hotel & travel, as well as office supplies.

Pliant provides flexible CSV exports that can be imported into a range of accounting solutions. We also offer bespoke integrations into our customers’ accounting systems and expense management solutions.

3D Secure is a free service facilitated by VISA that lets you transact securely on “Verified by Visa“ / “Visa Secure” online merchants using your Pliant credit cards. It adds a security layer by an additional verification step. During this verification you must provide a one-time password that is only available to you.

All Pliant credit cards are automatically equipped with 3D Secure. During your online purchase you will receive the one-time password via SMS for the verification. This password you can input into the verification page that will show the Visa logo and confirm the payment by clicking confirm / send. If the password is correct, the transaction will be successful and otherwise declined. Pliant credit cards also work at merchants that do not participate in Visa 3D secure program.

This service is offered due to the EU’s Second Payment Services Directive (PSD2) which will mandate Strong Customer Authentication (SCA) before initiation of the payment. Therefore, Visa recently enhanced its security for online purchases including both e-commerce and m-commerce transactions to satisfy this new standard.

In case you are not receiving your one-time password, please check that your phone number is up to date within your user area or call our hotline.

Learn more about Visa 3D Secure.

Yes, Pliant offers an optional travel insurance package with their cards. This package provides coverage for medical assistance, lost baggage, travel cancellation and inconvenience, travel accidents, and more.

Enhance your financial operations with Pliant

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.