Commerzbank to Launch Fully Digital Credit Card Solution for Businesses

Commerzbank plans to expand its credit card offering for business customers in Germany, adding a fully digital card with card management and usage features.

Commerzbank plans to expand its credit card offering for business customers in Germany, adding a fully digital card with card management and usage features.

B2B credit card platform Pliant is planning to expand after raising $19 million.

Berlin-based startup Pliant secures €8 million in additional funding, raising the total to €33 million. The firm provides corporate credit card services in 25 countries across Europe.

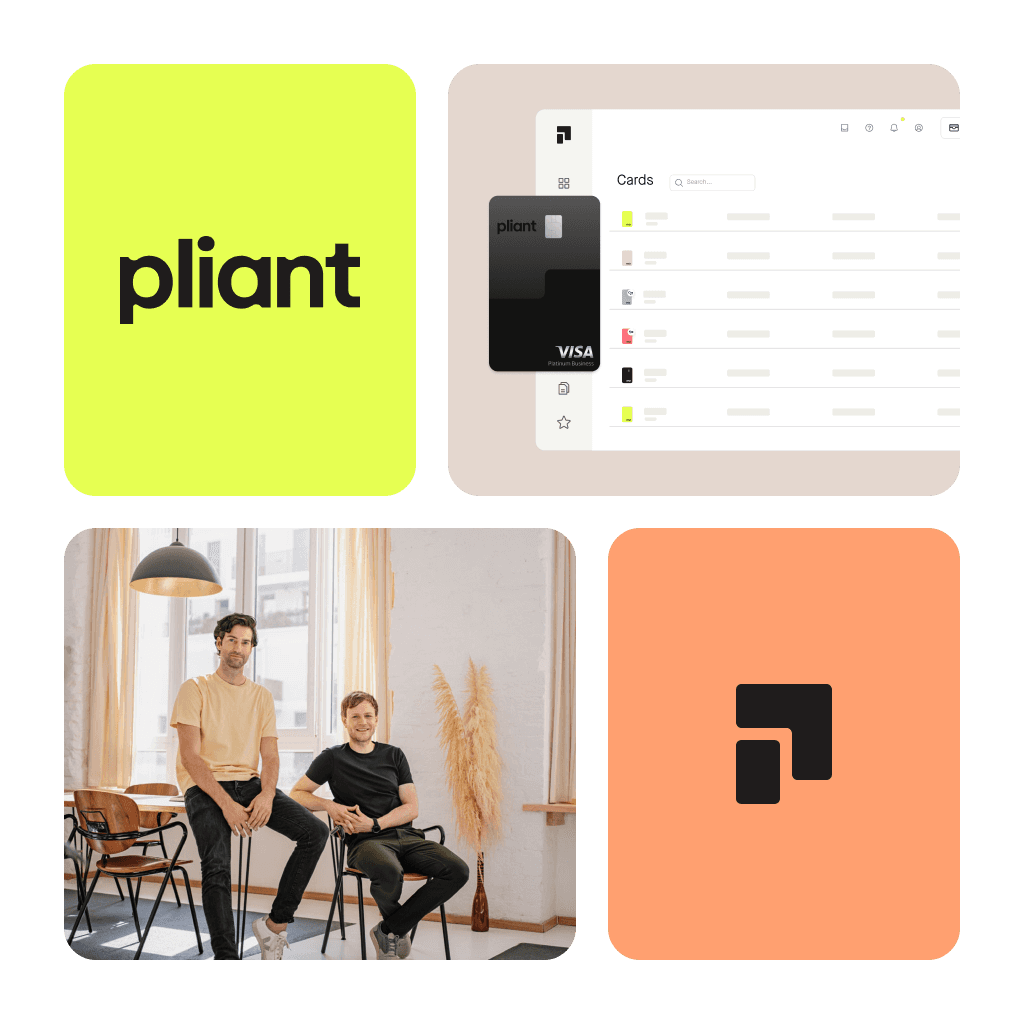

Berlin-based Pliant, a company specialised in making the latest generation of corporate credit cards, announced on Tuesday that it has raised €8M in a Series A extension round of funding, bringing the total Series A funding round to €33M.

Having started 2023 with the announcement of its Series A funding round, Pliant is closing the year with an extension that brings its total Series A to €33 million, the largest of any fintech in Germany. The new investment comes from Molten Ventures, joining existing Series A investors SBI Investment, Alstin Capital, and Motive Ventures. In addition, Pliant has secured €100 million in debt refinancing to solidify its financial position going into 2024.

In our latest instalment of “Product Spotlight” by PL Talents, we delve into the realm of Cards-as-a-Service (CaaS) — a pioneering shift in the tech landscape that’s simplifying the way companies launch and manage card programs.

Pliant is a German fintech offering corporate credit cards to small and midsize businesses. It raised $28 million from Japan's VC SBI and others.

The world of business travel is rapidly evolving. In this landscape, efficiency and cost control have become essential, and digital solutions for managing corporate travel are now a top priority.

Pliant announces a new strategic partnership with VVRB.

Pliant has partnered with Voxel, an Amadeus company, to fully integrate our virtual credit card solution with Bavel Pay, Voxel’s B2B payment solution. Together, we offer our customers an even better user experience than ever before. With this close cooperation we are combining two unique solutions for the travel market. Pliant is an industry leader for travel payments as a provider of virtual credit cards and Bavel Pay by Voxel is the B2B payment channel capable of implementing a fully digital end-to-end payment process, achieving an efficient, frictionless and error-free process.

Pliant and Conferma have strategically partnered to expand the use of virtual cards for business travel payments, increasing access throughout Europe and enabling corporate customers to seamlessly connect and pay.

Commerzbank AG is expanding its credit card range for business use.

Company will use the funding to fuel expansion into the UK and other markets outside the EU.

Pliant’s Series A financing reaches €33 million upon securing an extension to its original €25 million financing making it the largest Series A in Germany in 2023. In addition, Pliant secured a €100 million debt facility to fuel its own EMI license in 25 countries and 11 currencies.

Berlin-based fintech Pliant secures E-Money license in Finland and becomes a Visa principal member to facilitate ambitious European expansion.

Pliant announces another significant milestone with the successful completion of its Series A financing round, securing $28 million in capital from existing and new investors.

Caroline Jenke has taken over the position of Chief Legal Officer and authorised signatory of the corporate credit card provider Pliant as of 1 March 2022 and is thus a member of the management. For the Klarna Group, Jenke accompanied the internationalisation process in more than a dozen European countries and created the legal basis for the licence-as-a-service offering for FinTecSystems.

Getting started with climate protection is a major challenge for companies that have many fixed processes. Creditreform has been supporting this entry into climate protection with its CrefoGreen team for almost two years. Now the group of companies is relying on Pliant earth and Cozero.

The corporate credit card startup Pliant is expanding to Austria, the first foreign market for the Berlin-based fintech. The target group consists especially of companies with high credit card spending, regardless of their number of employees. With its market entry, Pliant becomes the first credit card provider in Austria with fully digital card management, receipt collection and integration into accounting.

Only four months after announcing its first seed round, the Berlin-based corporate credit card provider Pliant closes with existing venture capitalists Alstin Capital, Main Incubator and Saber in the amount of €18 million.

Shortly after the market launch of Pliant, venture capitalists Alstin, Main Incubator, Saber as well as Seed+Speed invest 6.5 million dollars.

Climate protection instead of bonus miles - New Pliant earth credit card announced for climate-conscious companies: real sustainability made easy at no costs from July onwards.

Jens Quadbeck, former Google EMEA Lead for Sales Strategy & Operations and previously active in various sales roles in Germany and at the Dublin European headquarters, is now Chief Sales Officer at the Berlin-based corporate credit card specialist. He brings years of experience in building sales and distribution partner teams in European markets.

The new premium corporate credit card is tailored to the needs of German SMEs and companies with high turnover. Companies in Germany benefit from completely digital card management, seamless integration with accounting software, an unlimited cashback program and high spending limits.

Envie-nos um e-mail para press@getpliant.com e entraremos em contacto consigo de imediato.

O nosso kit de imprensa inclui os nossos logótipos, fotografias do nosso produto e fotografias do fundador e da direcção.

A nossa equipa está disponível de segunda-feira a sexta-feira das 9h às 17h para responder individualmente às suas perguntas.