Increase your reselling margins with credit cards

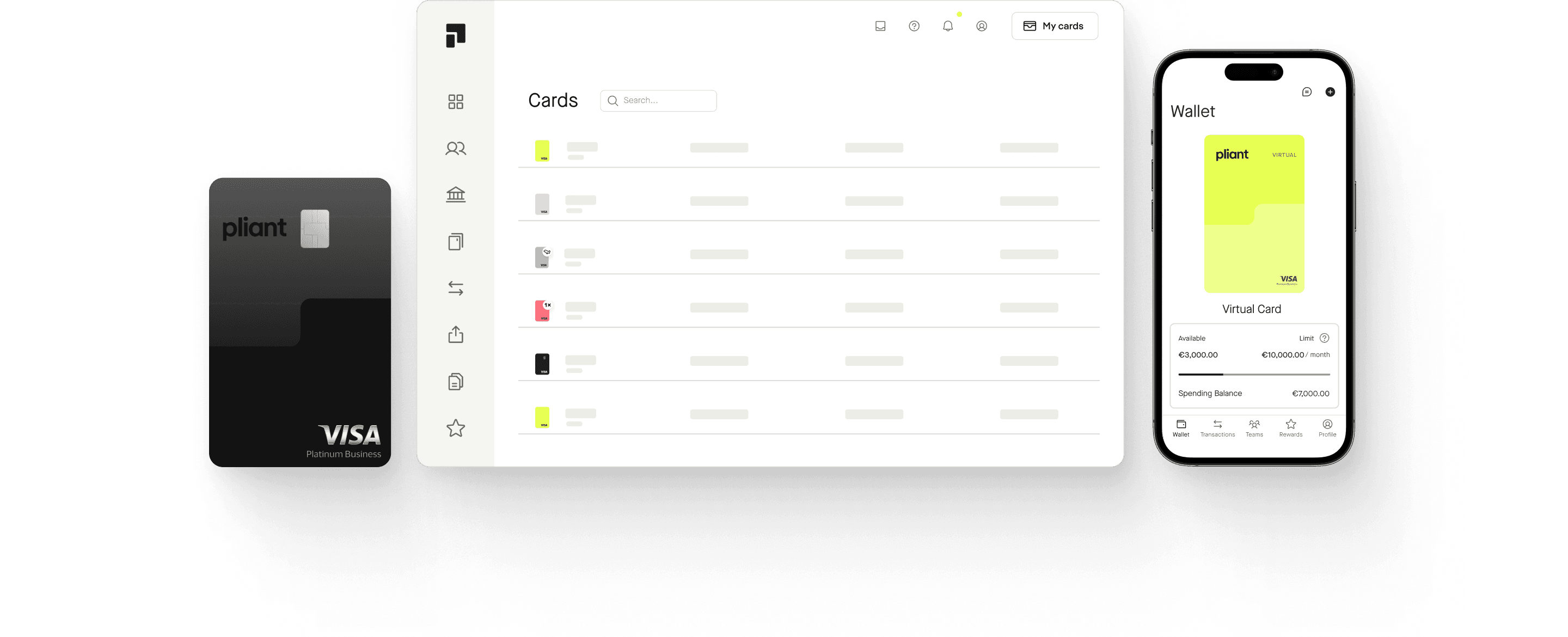

Managing finances as a reseller comes with unique challenges, from handling large transactions to navigating multi-currency payments. Pliant’s digital credit card solution is designed to streamline operations, enhance financial flexibility, and reduce the complexities of international transactions.

Managing finances as a reseller comes with unique challenges, from handling large transactions to navigating multi-currency payments. Pliant’s digital credit card solution is designed to streamline operations, enhance financial flexibility, and reduce the complexities of international transactions.

Overcome financial challenges as a reseller.

Declined transactions and fluctuating exchange rates pose significant challenges for resellers, disrupting operations. Pliant’s digital credit card solution helps avoid fees, streamline payments, and boost margins.

Instantly issue cards for quick purchases

Make payments in bulk

Avoid conversion fees & hedging

Process large transactions seamlessly

Track spending in real-time

Automate payment processes with Pro API

Do billing in US-Dollars with multi-currency accounts

Avoid expensive FX surcharges and mitigate the risks of volatile FX markets by managing payments in the local currency. Make transactions in 11 currencies like US-Dollars or Euros, reducing conversion costs and managing payments efficiently across borders.

Predictable prices

Simplify currency forecasting and budgeting by managing multiple currencies within one platform.

Cost-efficient international payments

Avoid high foreign exchange (FX) surcharges with cards in the local currency.

No hedging required

Mitigate exchange rate risks and eliminate complex hedging strategies by billing in US-Dollars and 10 additional currencies.

Cards that move your business forward.

More than just for travel. Visa’s most exclusive card handles large transactions with high velocity.

Dowiedz się więcejInstantly issue a card for each transaction or customer for easy matchmaking without filling out countless forms.

Dowiedz się więcejEnhance fraud protection and simplify expense management, ensuring a secure and efficient payment experience.

Dowiedz się więcej

Cards that move your business forward.

More than just for travel. Visa’s most exclusive card handles large transactions with high velocity.

Dowiedz się więcejNo more declined transactions with Pliant cards.

High-velocity cards

Each card can handle up to 30,000 transactions per day, supporting high-volume payment needs.

Flexible credit lines

Access up to €5M in credit, with 24-hour risk assessments available for short-term limit changes.

High single transaction limits

Process transactions up to $1.5M without restrictions, ensuring you can handle large payments seamlessly.

Whitelisting of merchants

Customize and manage merchant whitelists to control where your cards can be used, enhancing security and compliance.

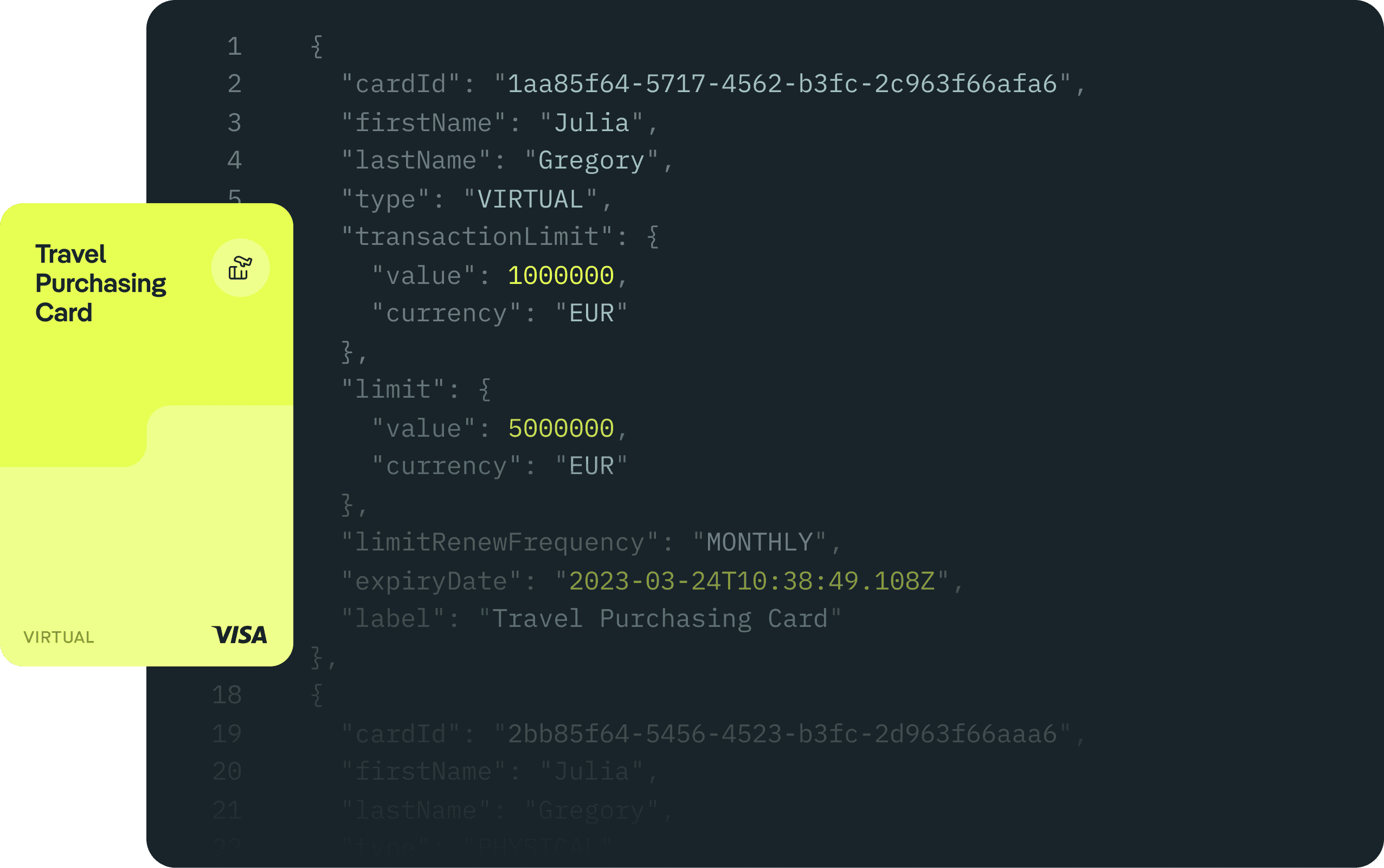

Plug it. Play it. Pay it. Meet Pliant Pro API.

Our easy-to-implement API enables you to:

Embed card issuance in your purchasing portals.

Build custom API integrations into your ERP system.

Use your Pliant VCCs alongside your traditional bank or credit card provider.

Fast onboarding and implementation

Most customers complete onboarding within two weeks. Get started quickly with efficient KYC and credit checks, supported by our dedicated tech team.

Submit

initial details via email

Sign up

on our platform and agree to the T&Cs

Complete

KYC and risk assessments

Start

using your cards and platform features.

Fast onboarding and implementation

Most customers complete onboarding within two weeks. Get started quickly with efficient KYC and credit checks, supported by our dedicated tech team.

Submit initial details via email.

Sign up on our platform and agree to the T&Cs.

Complete KYC and risk assessments.

Start using your cards and platform features.

Jesteśmy do Twojej dyspozycji.

Nasz zespół jest dostępny od poniedziałku do piątku w godzinach od 9:00 do 17:00, aby osobiście odpowiedzieć na Twoje pytania.