Choose corporate credit cards optimized for enterprises

Managing payments across a corporation can be a daunting task. Every transaction needs to be handled efficiently, from complex payment processes to ensuring security and flexibility. Pliant is here to transform how your enterprise handles payments with our cutting-edge digital credit card solution.

Managing payments across a corporation can be a daunting task. Every transaction needs to be handled efficiently, from complex payment processes to ensuring security and flexibility. Pliant is here to transform how your enterprise handles payments with our cutting-edge digital credit card solution.

Streamline complex corporate payments

Corporations face complex payment processes. Pliant simplifies it all with a centralized control center for approvals, budgeting, real-time data, and enhanced security.

Simplify and unify your payment processes

Enhance financial flexibility and reduce costs

Streamline vendor and travel payments

Improve budget control and visibility

Upgrade security and compliance

Easily integrate Pliant into your systems

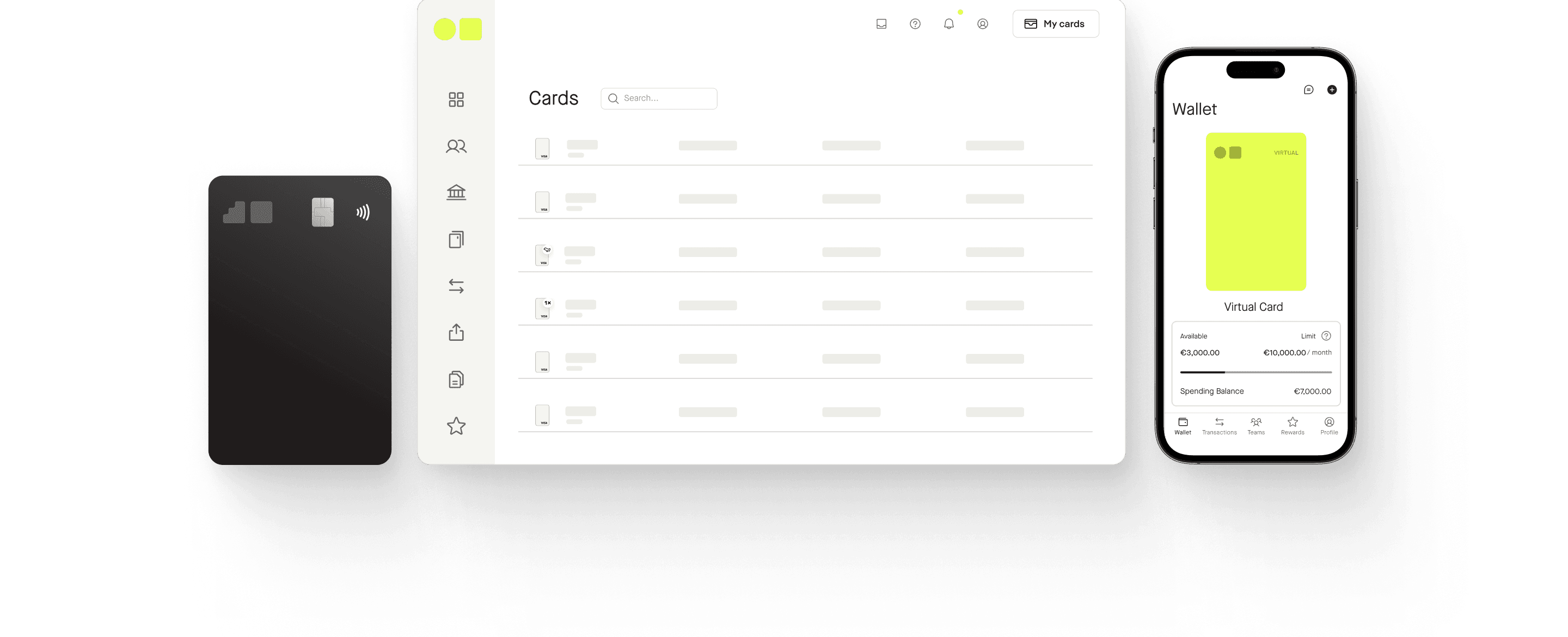

One control center to oversee all your credit cards

Approval workflows

Speed up approvals with pre-set permissions, allowing finance, leadership, and team managers to handle card requests and limit changes efficiently.

Team budgets

Monitor and manage team or company budgets automatically, with real-time alerts when approaching or exceeding limits.

Card-level controls

Fine-tune card capabilities, including payment categories, ATM usage, and foreign transactions, to match your organizational policies.

Real-time data

Stay up-to-date on every transaction, ensuring compliance with your spending policies and addressing declined or unauthorized charges.

Private card charging

Enable employees to refund private transactions directly to the company using their private card stored in the Pliant app.

Cards that move your business forward

Benefit from real VISA® credit cards with high limits, attractive cashback, and other premium perks like a comprehensive insurance package and worldwide airport lounge access.

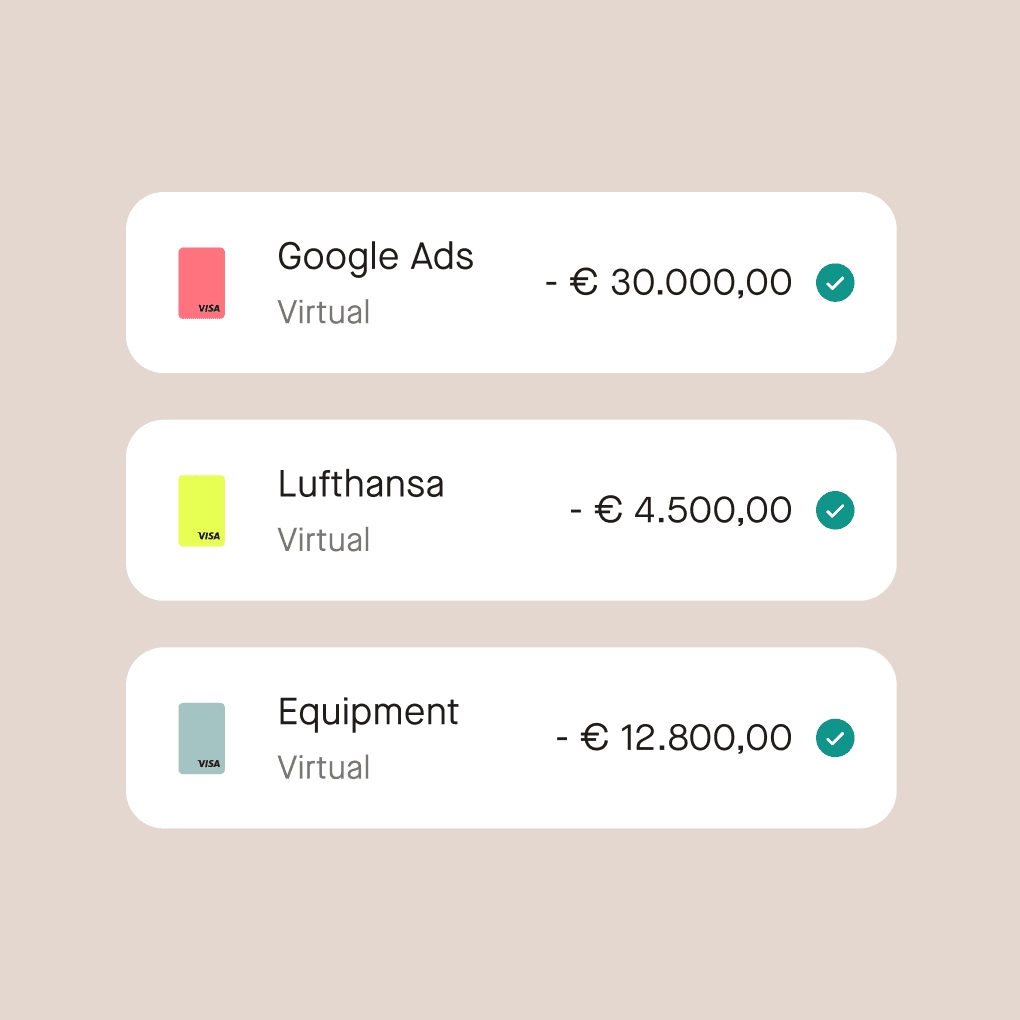

Dowiedz się więcejGet virtual cards with their own associated cost centers so every employee can get their card without filling out countless forms.

Dowiedz się więcejSimplify travel payments with a secure, efficient, and compliant card solution designed for business.

Dowiedz się więcej

Cards that move your business forward

Benefit from real VISA® credit cards with high limits, attractive cashback, and other premium perks like a comprehensive insurance package and worldwide airport lounge access.

Dowiedz się więcejOptimize local spending for worldwide operations

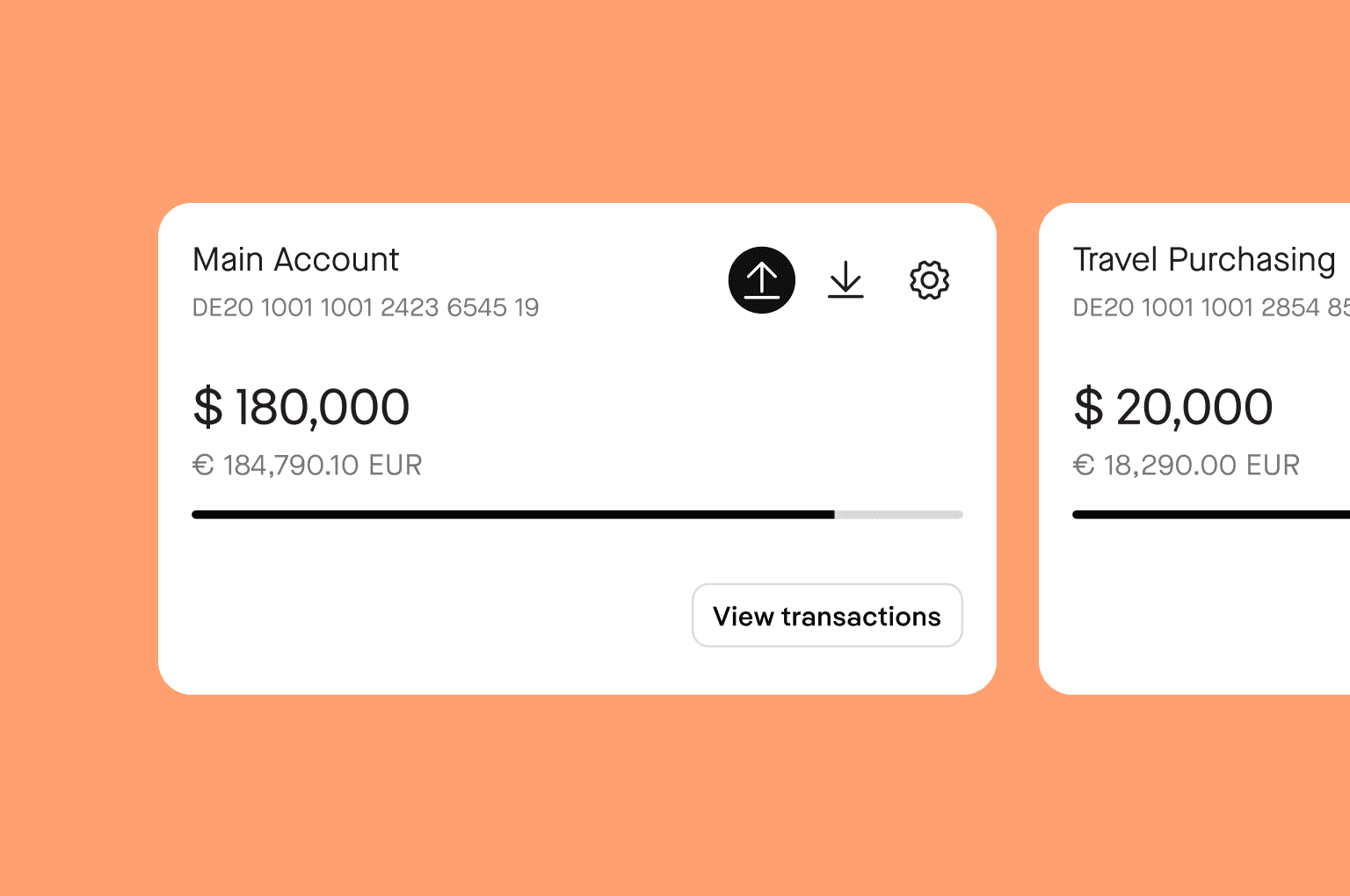

Multi-currency accounts

Make transactions in 11 currencies to avoid conversion costs and manage payments in your local currency, ensuring smooth operations across borders.

Worldwide card acceptance

Benefit from Visa's global network, offering unmatched acceptance and no restrictions for transactions with hotels, rental cars, and more.

Instant payment capabilities

Utilize flexible payment terms and high credit limits for efficient financial management and substantial transactions.

High-frequency card usage

Get unrestricted usage for all payments so you don’t need to worry about blocked card payments.

Multi-org control

Set up two different legal entities of the same company and switch immediately between them in the Pliant app.

Multi-account management

Manage multiple accounts with separate billing settings for different card groups, like branches of the same entity.

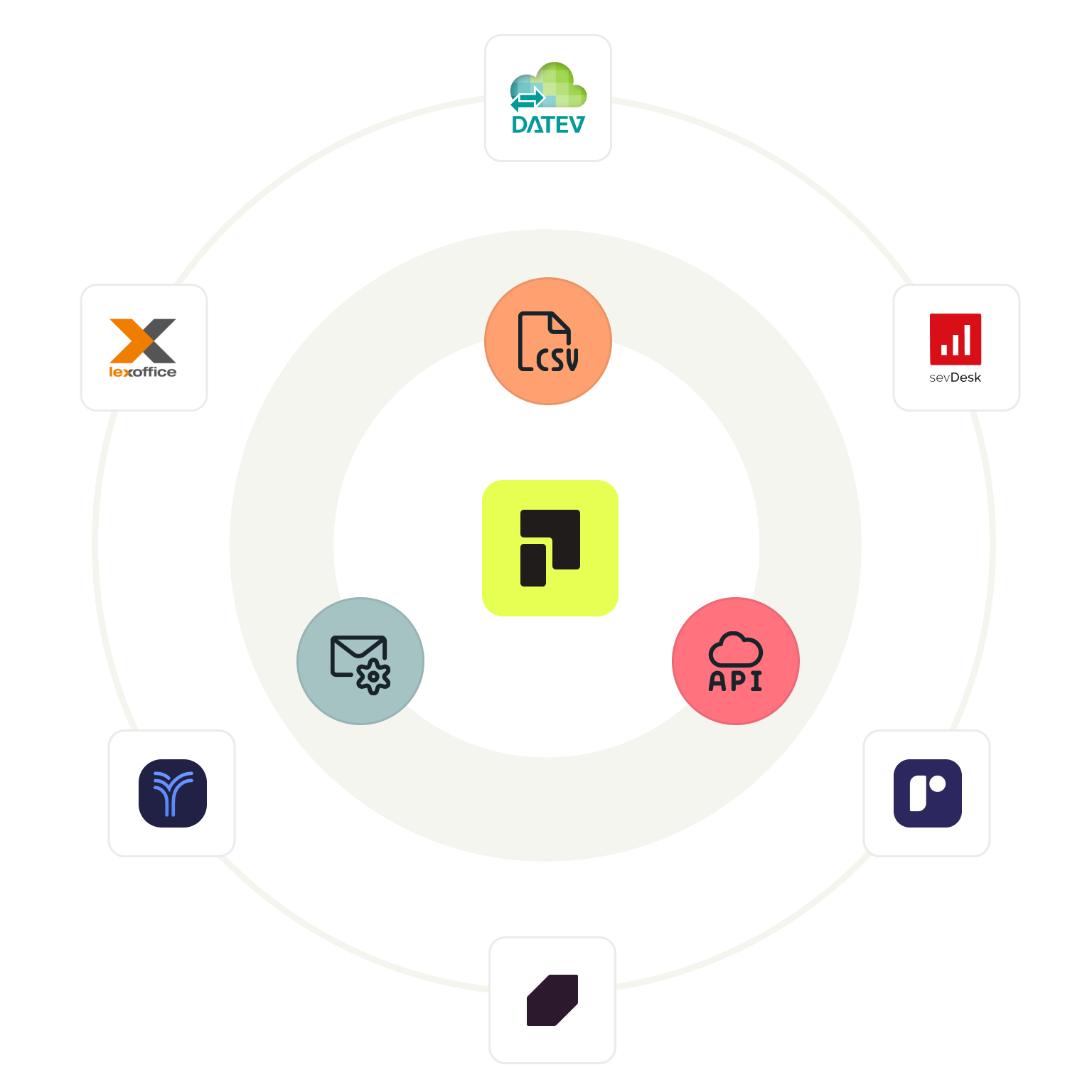

Tailor integrations and CSV Formats for maximum flexibility

Pliant offers many ready-to-use integrations, and for added flexibility, you can request a custom CSV export format tailored to your transaction and payment needs. Additionally, with Pro API, you can build custom integrations to streamline workflows, enrich data, and create tailored business rules for highest efficiency.

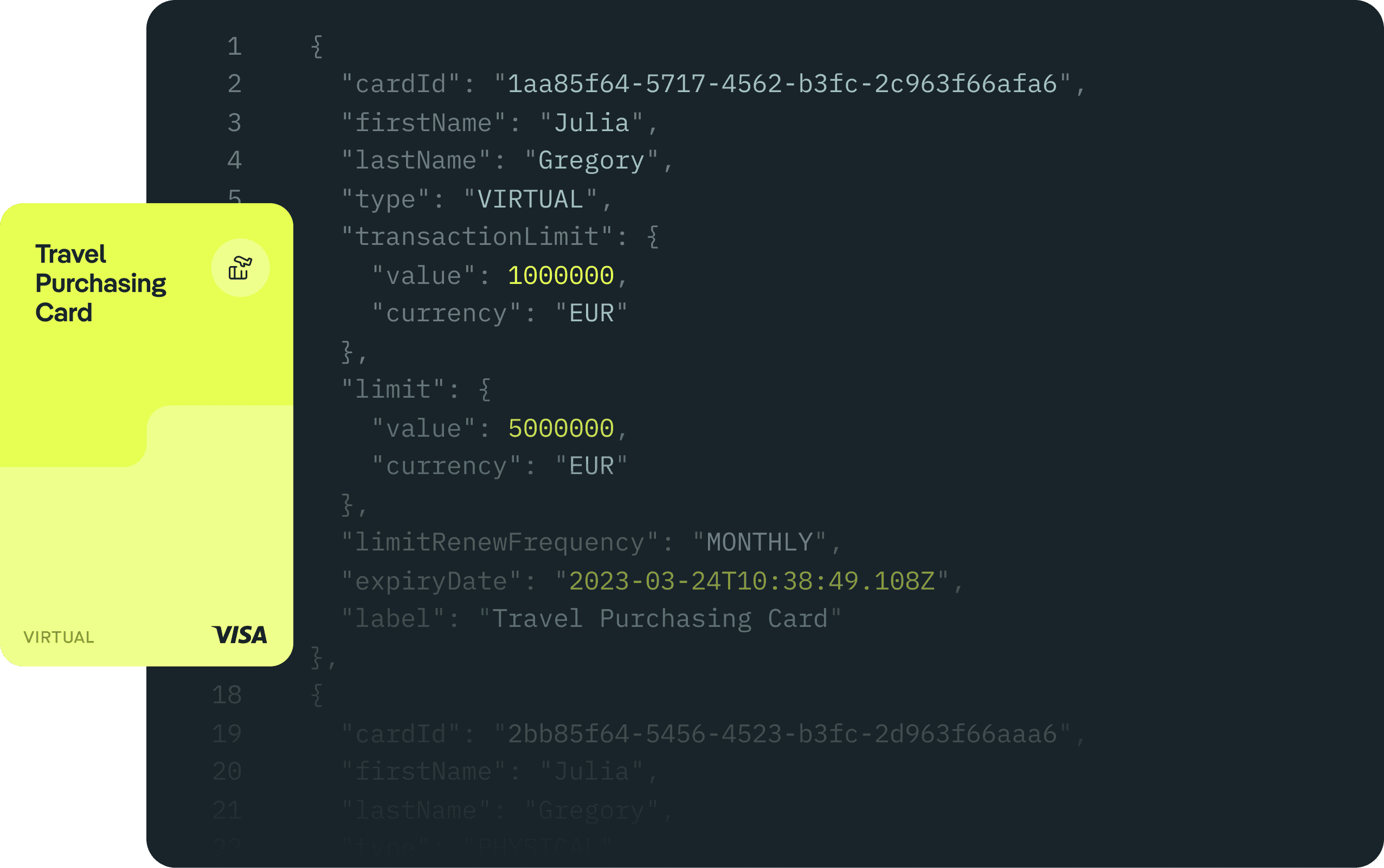

Plug it. Play it. Pay it. Meet Pliant Pro API.

Our easy-to-implement API enables you to:

Embed card issuance in your purchasing portals.

Build custom API integrations into your ERP system.

Use your Pliant VCCs alongside your traditional bank or credit card provider.

Trust Pliant to streamline your financial operations today

E-money licensed

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

PCI DSS & ISO/IEC certified

Pliant holds PCI DSS certification, the highest standard in payment security, and ISO/IEC 27001:2022 certification for information security management, ensuring top-tier protection and compliance.

Built-in security

Pliant enhances your financial security with 2-factor authentication on each credit card, safeguarding your transactions from unauthorized access and fraud.

FAQ

A corporate payment solution refers to tools and technologies that help businesses manage their financial transactions efficiently. For corporations, this includes managing credit card payments to vendors, handling employee expenses, and maintaining financial oversight with streamlined processes and enhanced security.

Corporations use various payment methods, including traditional credit cards, wire transfers, and manual invoicing. However, these methods can be inefficient and costly. The Payments Apps offered by Pliant provide a more flexible and efficient alternative to managing all the company’s card payments, with instant issuance, enhanced security, and comprehensive expense management features.

Pliant's Payment Apps offer several advantages for corporations, making financial management more efficient and secure. Key benefits include:

Enhanced Efficiency: Automate expense management and reduce administrative overhead.

Better Budget Control: Set and manage spending limits easily to prevent overspending.

Improved Financial Visibility: Access real-time insights into spending for more informed decision-making.

Strengthened Security: Protect transactions with advanced security features, including fraud detection and 2-factor authentication.

Simplified Integration: Seamlessly integrate with existing financial systems for a cohesive financial management experience.

Discover how Pliant can optimize your corporate payments

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.