Easy Market

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

Michel Wijnen is the Finance Manager of the Dutch travel agent The Travel Club. In this case study he talks about his experiences with the integration of Pliant and the BAS system from Fadiro.

The Travel Club works together with a network of 380 franchisees. These travel agents can be one person or franchises with multiple offices in a small region. They sell mostly travel packages from bigger tour operators to customers. But they also offer custom round trips for which they do the bookings with the Pliant cards.

Card requests: Enables creation of virtual credit cards directly within BAS

Bookings: Franchisees seamlessly use Pliant within BAS, saving time and effort.

Automation: Reconciliation with Pliant eliminates manual handling of credit card statements.

Travel purchase cards: Payment without 3DS for easy booking

Security and compliance: No need to copy and past credit card details outside of BAS

Before working with Pliant, The Travel Club faced several challenges in managing virtual cards within their operations. Michel Wijnen was looking for a solution that integrates virtual cards with Fadiro in the BAS system and offers the finance department seamless acceptance. “I have a background in travel and using virtual cards was a struggle in all businesses I worked in", says Wijnen.

The biggest challenge was the tedious reconciliation process, where the Travel Club spent a lot of time manually entering transaction data from a large number of card transactions.

With around 380 franchisees, ranging from individual representatives to regional branches, the need for an efficient payment method was obvious. The idea was to integrate card creation directly into BAS to reduce manual work.

At The Travel Club, Wijnen is responsible for optimising inefficient financial processes in the administration. With the help of the integration between Pliant and the BAS system, his team can now leave a lot of manual work behind and focus on other things.

A travel agent is able to create a single-use virtual credit card from a BAS travel file, adding the required card limit and transaction details. All the relevant card details to make the payment are shown without leaving BAS. A user does not have to copy and past credit card details between multiple applications.

“Our franchisees only use Pliant embedded inside of BAS thanks to the integration. A frequent user saves one minute per card. Just entering data in the BAS system is enough to get a new card. There is no need to create an account for them in Pliant. This makes it really efficient for our partners and our back office. The franchisees gave a lot of positive feedback and the word spread quickly, boosting the use of the system.”

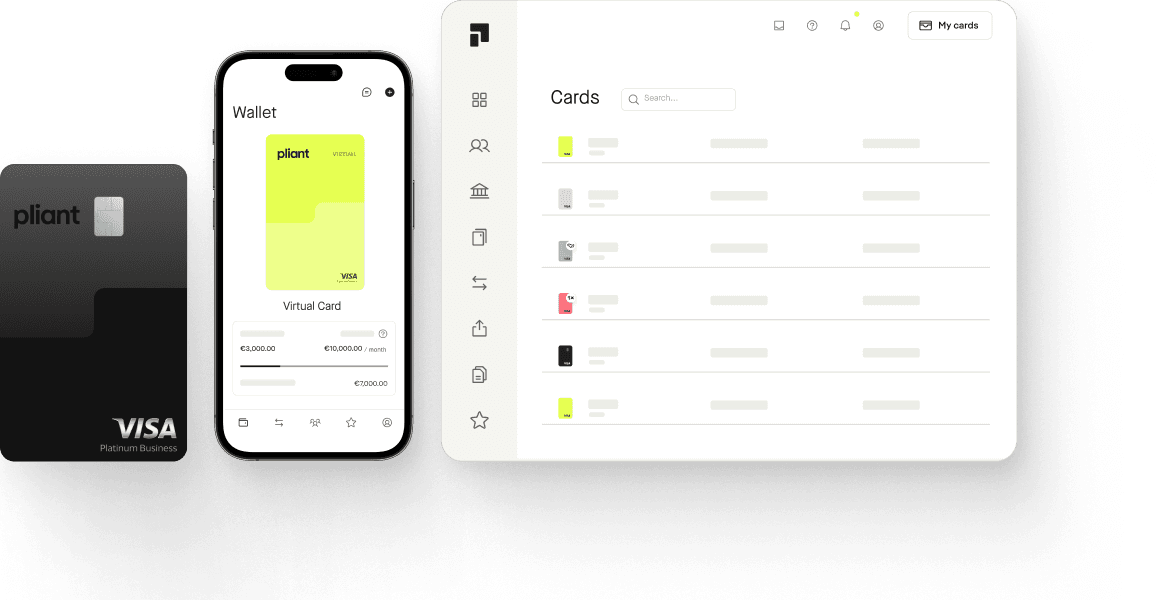

Wijnen also likes the UI of the Pliant apps: “For travel agents not using BAS, the card creation in the Pliant app is very intuitive. The app is state of the art.”

Since switching to Pliant, Wijnen and his finance team save 16 hours of manual work each week. The credit card statements go directly into the BAS system. With the integration, an automated key from the BAS system is assigned to the transactions when the reconciliation is done.

Before, The Travel Club needed the credit card statements to book them in the financial administration. "Now we receive them by email from Pliant, but we don't have to do anything with them. The reconciliation with Pliant is fully automated. That saves time", says Wijnen.

For them, the integration also means less training for partners in the use of multiple systems and less IT effort for the maintenance of multiple applications.

“I had been looking for a VCC that could be integrated into the BAS system for years. Then Pliant called. Now my finance team saves 16 hours each week of just typing numbers in the finance administration to do the reconciliation. The 5 minutes our franchisees spend reading the documentation on how to create a card is paid back with the first booking thanks to the increased efficiency.”

“With Pliant Pro API, we automate 1000s of daily transactions.”

Fiorino Cellucci, CFO at Easy Market

“Only with CaaS was a complete integration quickly achievable.”

Alexander Kintzi, CRO Scopevisio AG

“Pliant Pro API is a key asset to our travel booking platforms.”

Diego Furlani, Founding Partner at Salabam Solutions

"Thanks to Pliant, we save up to 10 hours per month on billing alone.”

Peter Wundsam, Managing Partner of Forvis Mazars in Austria

"Pliant CaaS offers us the best technical functionality and the best service."

Bas Janssen, Head of Strategic Initiatives at Mobile Expense

“We trust Pliant to digitize our credit card system.”

Merelle Ahlman, Finance Administrator at VincitNasz zespół jest dostępny od poniedziałku do piątku w godzinach od 9:00 do 17:00, aby osobiście odpowiedzieć na Twoje pytania.