Travel Purchasing Card

Cards for the travel industry to optimize payments

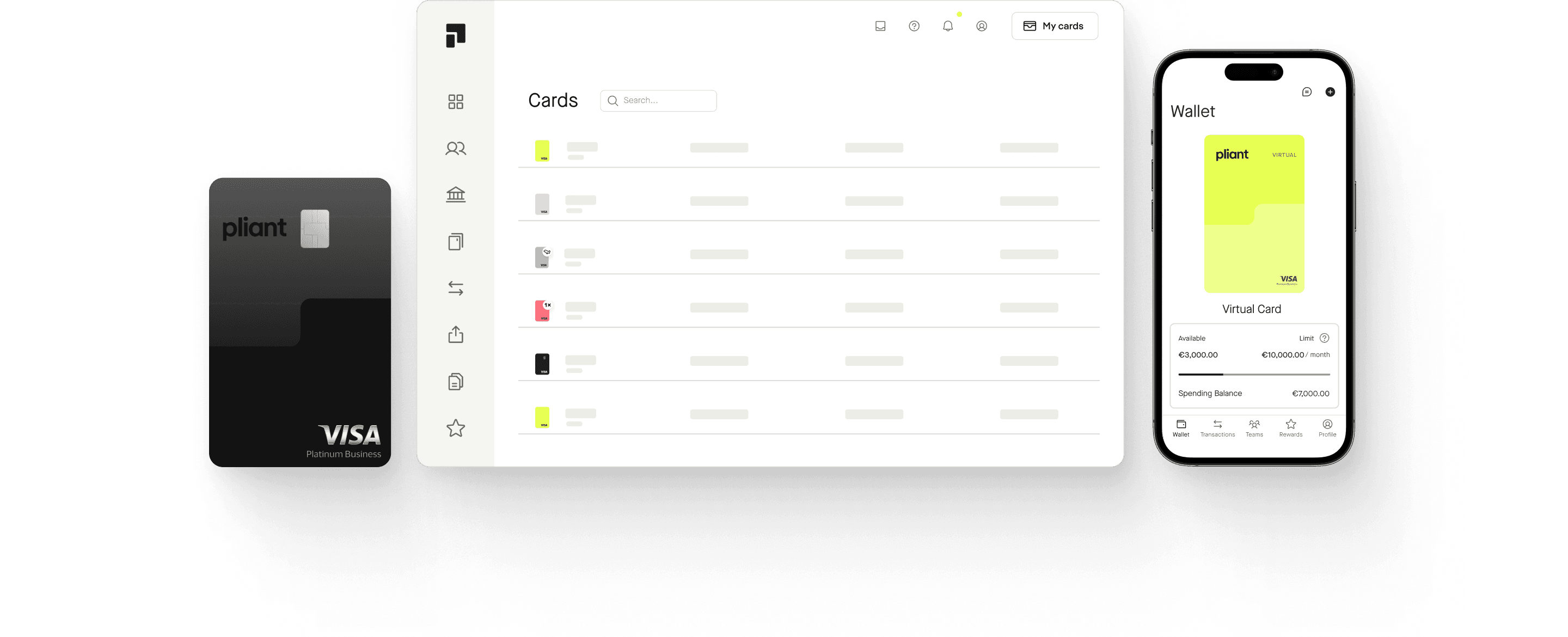

The Pliant Travel Purchasing Card (TPC) provides a secure way to manage travel payments. Issue virtual cards as needed and tailor payment workflows with our customizable API.

Streamlining payments for travel service providers

Travel agencies, especially Online Travel Agencies (OTAs), Travel Management Companies (TMCs), and other companies with high-volume travel purchasing needs for purchasing Travel services are leveraging Pliant TPCs to streamline their procurement processes and enhance profitability. By using Visa cards to procure supplies for clients, businesses can benefit from attractive rebates, reducing costs and increasing profit margins. Additionally, our flexible currency options and multi-currency accounts help travel companies save on international payments. Seamless automation and integration capabilities further smooth the procurement process, ensuring efficiency and financial control at every step.

Manage cash flow with real-time processing

Issue cards with limits that can exceed your total credit line. Pliant blocks the purchase amount at the time of the transaction rather than pre-loading funds, optimizing credit line usage. Each transaction is verified against card limits and available credit, streamlining financial operations.

Automated travel payments for high-volume issuance

Pliant TPCs are designed for high-volume, fully automated payments, ideal for travel businesses. Configured for secure transactions without 3DS challenges, they streamline operations with no need for manual intervention.

Maximize your savings

Unlock new revenue streams with attractive rebates, helping your business increase margins with every transaction. Take advantage of a cost-effective approach to currency interchange by opening multi-currency accounts to get billed in the same currency as your transactions.

Issue travel purchasing cards through our API

Use our flexible API to issue cards with customizable properties and restrictions. Enjoy instant issuance and activation, secure PCI-compliant PAN transmission—even for non-PCI-certified customers. Benefit from real-time reconciliation with transaction callbacks and custom reporting for smooth integration with your back-office systems.

Key features of the Pliant Travel Purchasing Card

Customizable validity periods

Set specific 'from' and 'to' dates for each card, aligning usage with travel dates.

Custom fields and labels

For example, create a new card for each booking and list the main passenger as the alternative cardholder for precise expense allocation.

Flexible card limits

Adjust spending limits according to your business requirements.

Automated controls

Manage transactions with automated controls for MCCs, merchants, and currencies.

Global acceptance

Use the card worldwide for seamless travel-related purchases.

Custom interchange fees

Set customized interchange fees aimed at high-volume customers in the travel industry.

FAQs

Pliant Travel Purchasing Cards are specialized financial tools designed to manage and streamline travel-related expenses for businesses and organizations. They offer flexibility, enhanced security, and global usability, making them ideal for travel agencies, OTAs, TMCs, and companies with frequent travel needs. These cards provide features such as customizable spending limits, real-time transaction monitoring, and global acceptance, while also incorporating advanced fraud protection measures to ensure secure and efficient management of travel expenses.

Our Travel Purchasing Cards (TPCs) are designed with advanced fraud protection measures to ensure your transactions remain secure. By being exempt from 3DS/SCA, we streamline your transaction process without compromising on security.

Our comprehensive fraud prevention features include:

Transaction Restrictions: Limit cards to travel-related transactions only, reducing the risk of misuse.

Customizable Limits: Set transaction limits according to your needs, enhancing control and preventing unexpected charges.

Merchant and Category Controls: Allow specific Merchant Category Codes (MCCs) and transaction categories to further tailor card usage and protect against unauthorized spending.

Merchant and Time Restrictions: Restrict cards to single or multiple merchants, and set specific dates and times for transactions, ensuring they are used only under defined conditions.

With these measures, you can travel confidently, knowing that your financial transactions are protected against fraud and misuse.

Corporations streamline their travel expenses by using our Visa credit card for payments. They can significantly reduce costs with seamless integration and automation with travel suppliers, accurate transaction coding for easy reconciliation, and efficient invoice management through payment apps.

Discover how rebates and FX savings further enhance financial efficiency of corporations.

Elevate your travel payment processes

Nasz zespół jest dostępny od poniedziałku do piątku w godzinach od 9:00 do 17:00, aby osobiście odpowiedzieć na Twoje pytania.