Pliant is excited to join ITB Berlin 2025

As a leading provider of flexible B2B credit card solutions, we’ll showcase how our innovative payment technology streamlines travel payments, enhances cash flow, and simplifies expense management for travel businesses. Meet us at ITB 2025 to explore how Pliant is shaping the future of seamless and efficient travel payments.

Meet the Pliant team

Ivar van Herpen

Ivar van Herpen is a payments expert with deep experience in corporate travel solutions, now driving partnerships at Pliant. At ITB 2025, he’s the go-to person for discussing smarter travel payments, virtual cards, and how to optimise B2B spend. Stop by to explore how Pliant can streamline payments for your business!

Severin Gerstenkorn

Severin Gerstenkorn is Pliant’s New Markets Manager, specializing in expanding innovative payment solutions into new regions. At ITB 2025, he’s eager to discuss market expansion strategies, the integration of Pliant’s flexible credit card solutions into diverse business environments, and how these can enhance your company’s financial operations.

Carlotta Dal Pozzo

Carlotta Dal Pozzo leads Pliant’s growth in Italy, building key partnerships with Cisalpina, Easy Market, and Salabam. At ITB 2025, she’s the go-to person for discussing strategic collaborations and how Pliant’s payment solutions can streamline travel payments.

Pliant : fait pour votre entreprise de voyage

TMCs

Travel management companies (TMCs) are at the center of the business travel market: facilitating payments every day to airlines, hotels, car rental companies and more.

OTAs

Your online platform lives and breathes efficiency, and you need a platform that ensures full automation from day one. With Pliant, you can ensure seamless purchasing with VCCs, as well as a massive reduction of your payment support burden.

Tour operators

If you’re buying flights, hotel rooms and experiences in bulk, you need a payment solution that enables you to scale your operations effectively. Pliant’s flexible billing cycles mean that you plan for the long term with larger individual payments.

Bed banks

For bed banks, margins are the name of the game – and acquiring your inventory effectively is a huge step forward. Pliant’s payment platform for travel makes it simple to increase your margins with generous cashback offers on purchases.

Over 3000 customers & partners trust Pliant, including:

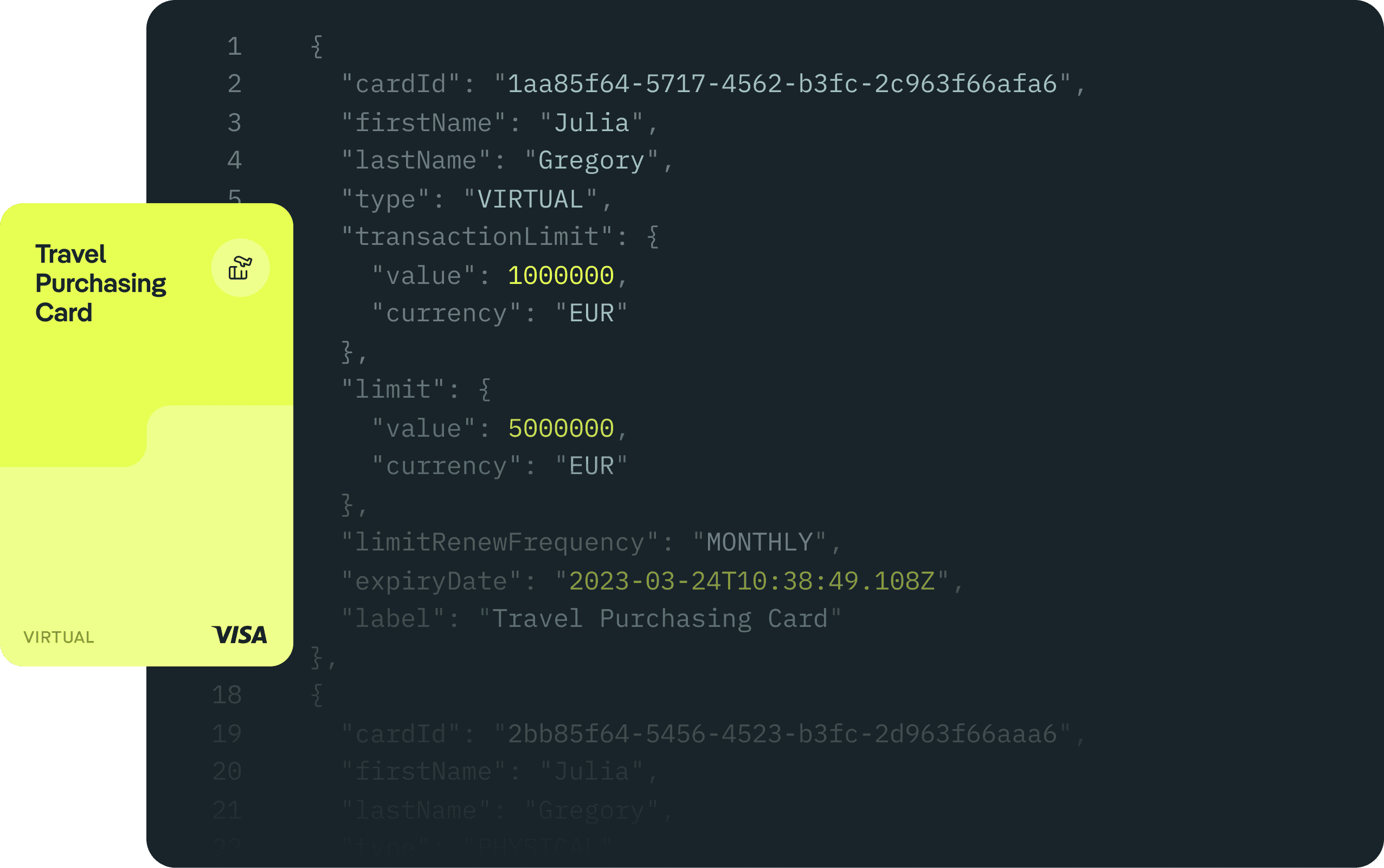

With Pliant Pro API, we can automate thousands of daily transactions, streamlining everything from card creation to reconciliation. This capability allows us to integrate more partners into our systems and has transformed our cash flow management.

Fiorino CellucciCFO at Easy Market

Based on our experience, Pliant cards have an almost perfect acceptance rate, so we haven’t heard any complaints about failed transactions.

Diego FurlaniCOO Salabam Solutions

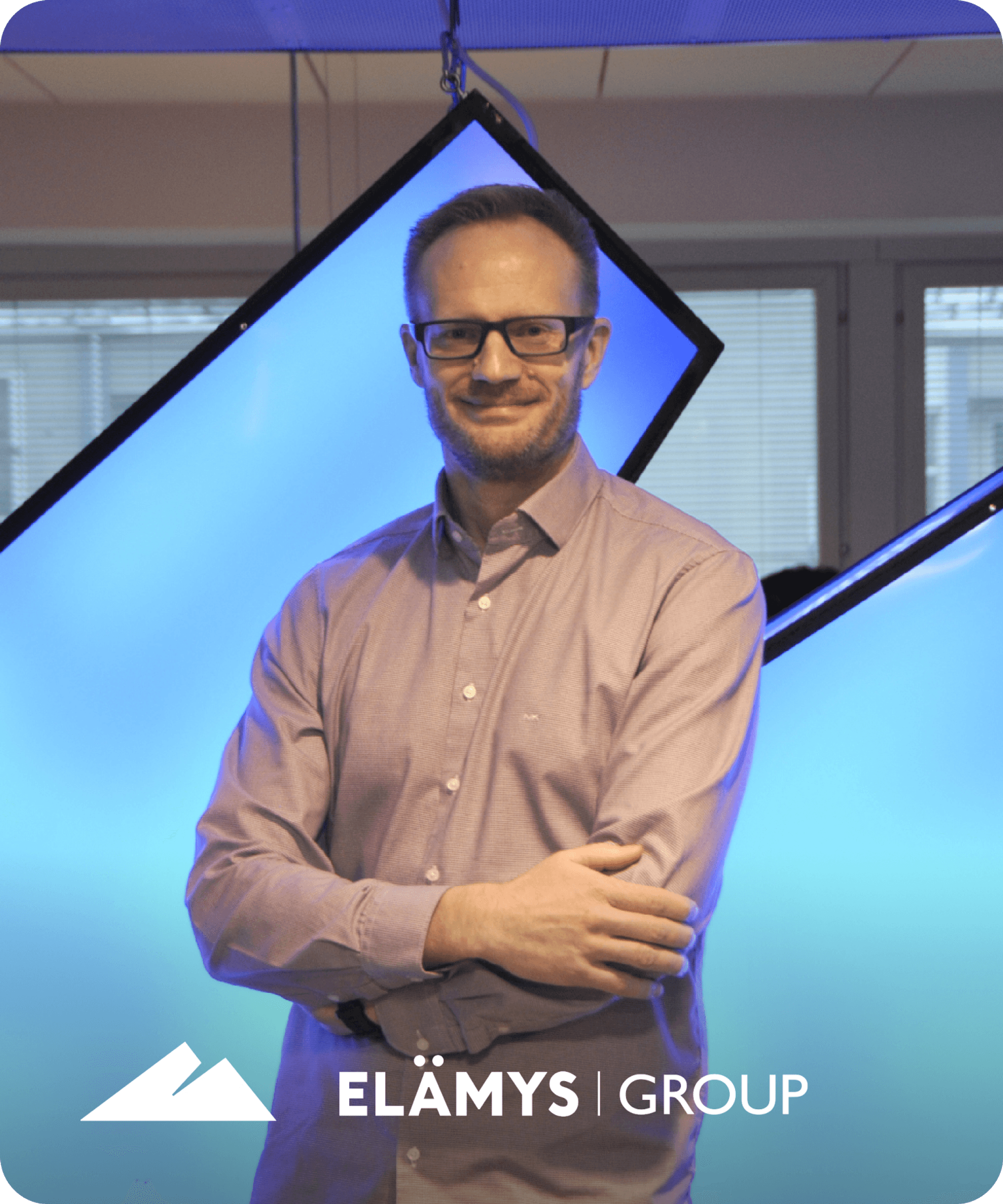

Notre ancien système de cartes de crédit virtuelles présentait plusieurs lacunes. Après nous être familiarisés avec Pliant, nous avons découvert que pratiquement tous les problèmes étaient corrigés et résolus.

Jari IltanenContrôleur des opérations d’Elämys Group

Branchez-le. Utilisez-le. Payez-le. Découvrez Pliant Pro API.

Notre API facile à implémenter vous permet de :

Automate bulk processes for travel purchasing

Issue new virtual credit cards (VCCs) for each travel purchase, reducing risk and simplifying accounting workflows

Use your Pliant VCCs alongside your traditional bank or credit card provider