With Pliant, you become your own digital bank, bypassing processes that would otherwise take weeks.

Modern corporate credit card for SMEs

Do you want to: - Reduce the workload of leadership with employee cards? - Simplify receipt capture for users and accounting? - No longer wait for the credit card statement? - Connect cards with your existing accounting solutions? Then Pliant offers the right credit card solution for you!

Rethink business credit cards

Whether online or on the travel, high limits and worldwide acceptance make all your purchases easier. Link the cards to your existing company account and your preferred accounting and financial solutions. In the Pliant app, you can independently create physical and virtual VISA® credit cards and customize them for any purpose thanks to advanced card functions.

Configure each card as needed

Assign limits for transactions, time periods and total spend to each card and instantly customize them to your team's needs.

Control even more card features, like your custom pin and whether cards can be used for certain payment categories, international transactions and more.

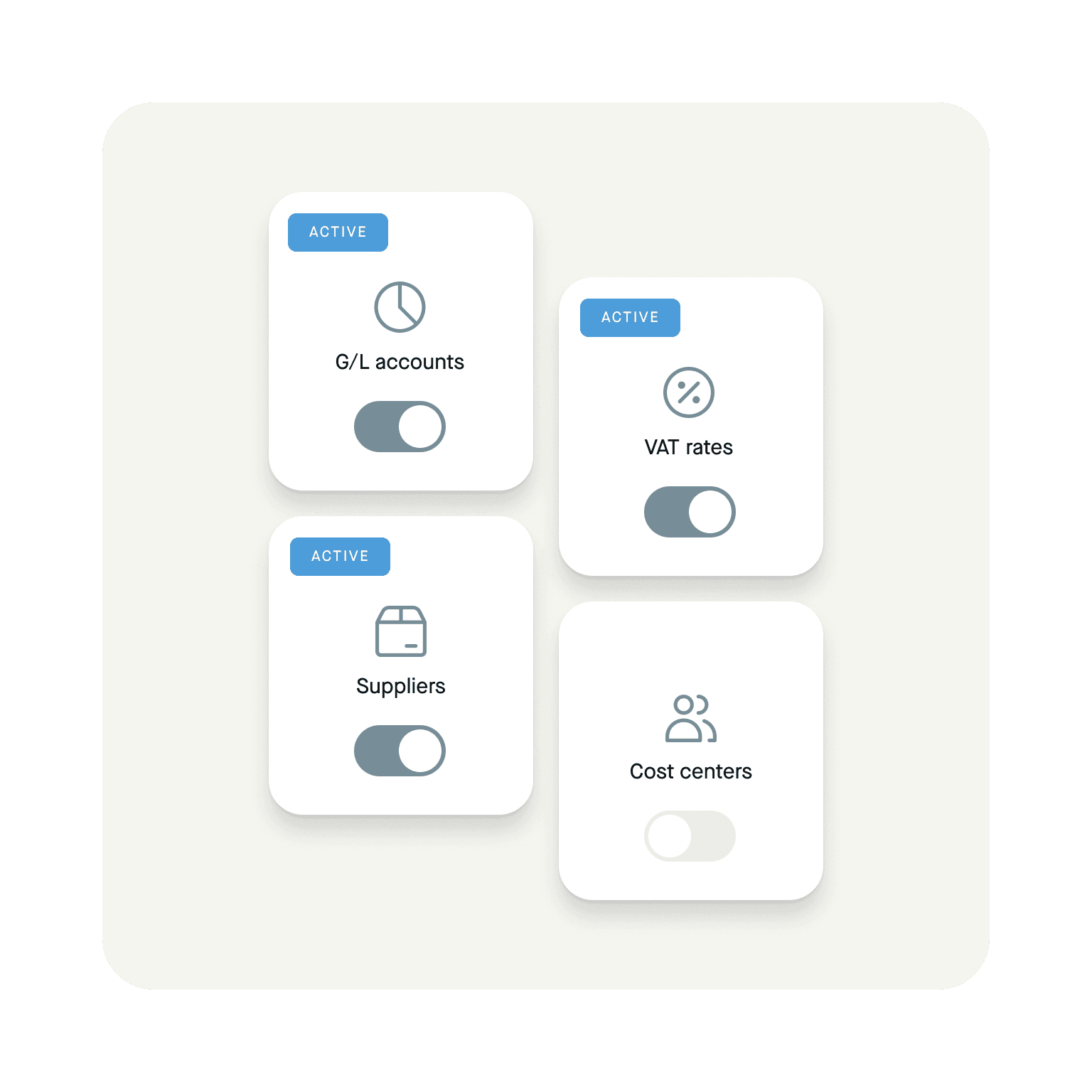

Automate preparatory accounting

Upload all your relevant accounting data like G/L accounts, VAT codes, creditors, as well as cost center data, and assign them to transactions with a few clicks or automate them entirely.

You can then transfer the data seamlessly to your existing accounting software, such as Datev or lexoffice, via CSV export or API integration.

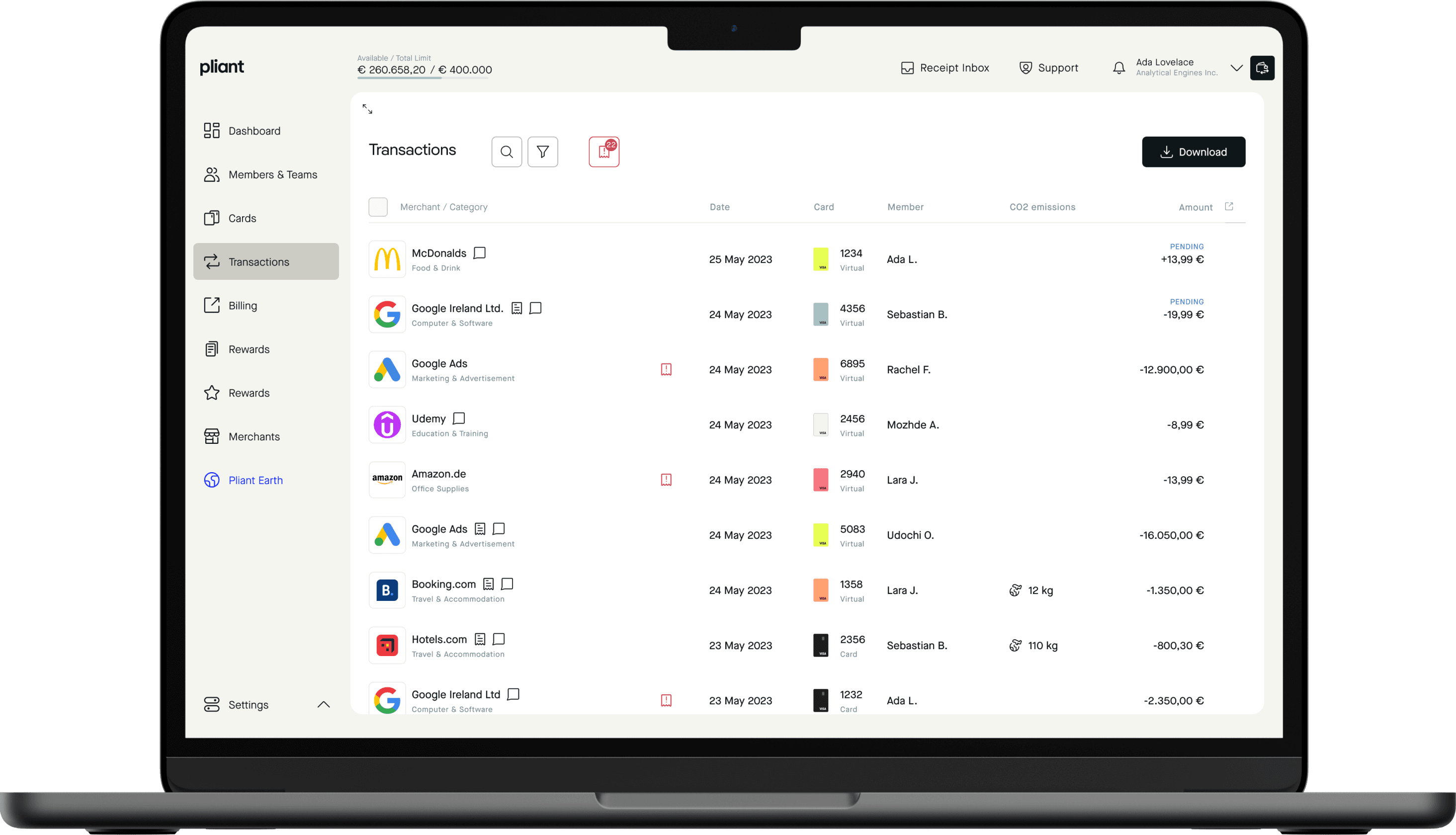

Track every transaction in a single dashboard

Missing spend controls add obstacles when tracking budgets and transactions. Use Pliant instead and track every card transaction in a single dashboard. Create project- and team-level card controls to better manage project budgets and track expenses. Digital approval and review workflows enable you to control costs more easily.

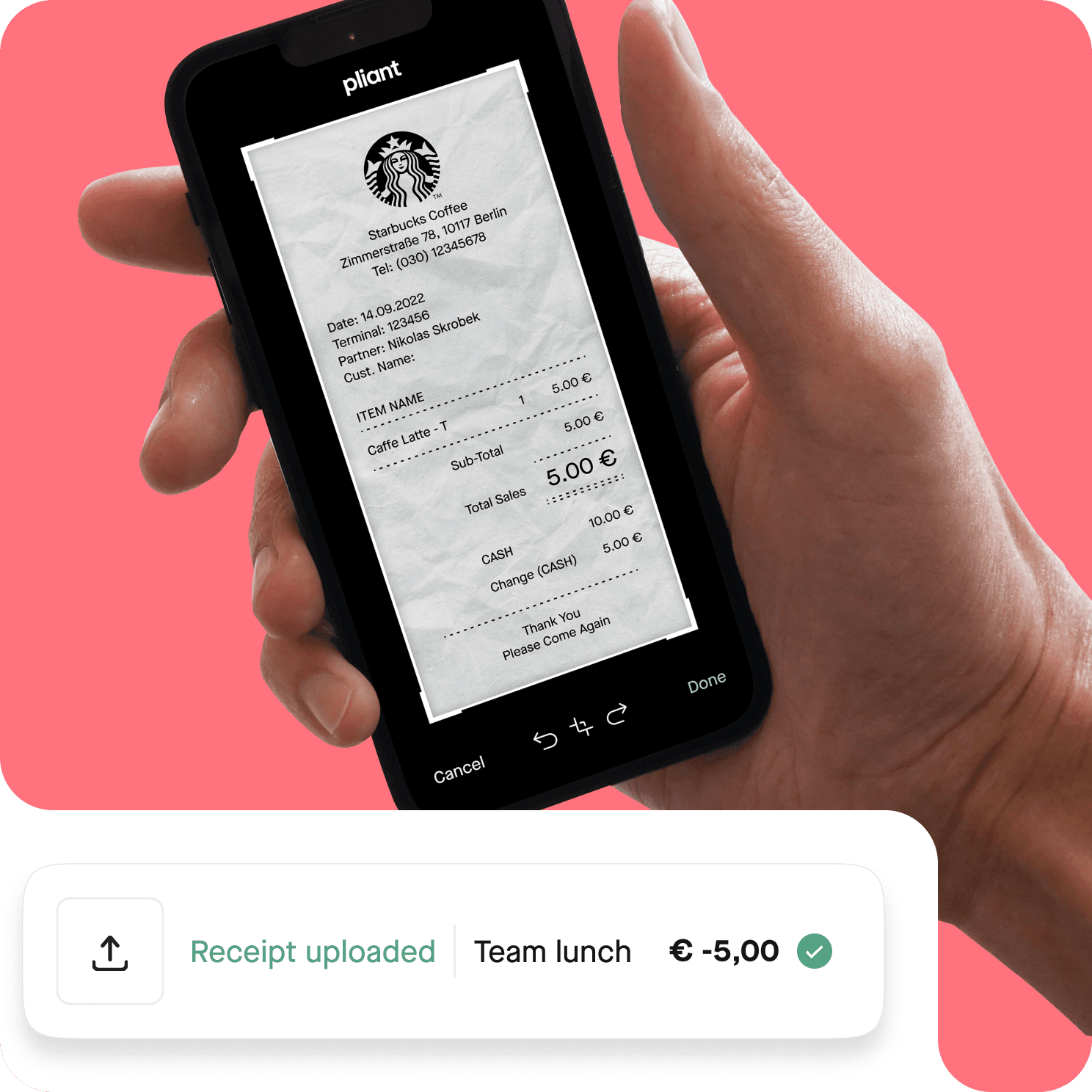

Submit receipts along the way or via email

The days of traditional receipt collection were cumbersome and involved a lot of paperwork for the traveler and the finance department. Submit every receipt in one step, whichever way you prefer. Take a picture on your phone, drag and drop in your browser, or forward an email to a dedicated receipt inbox that matches receipts to transactions using machine learning.

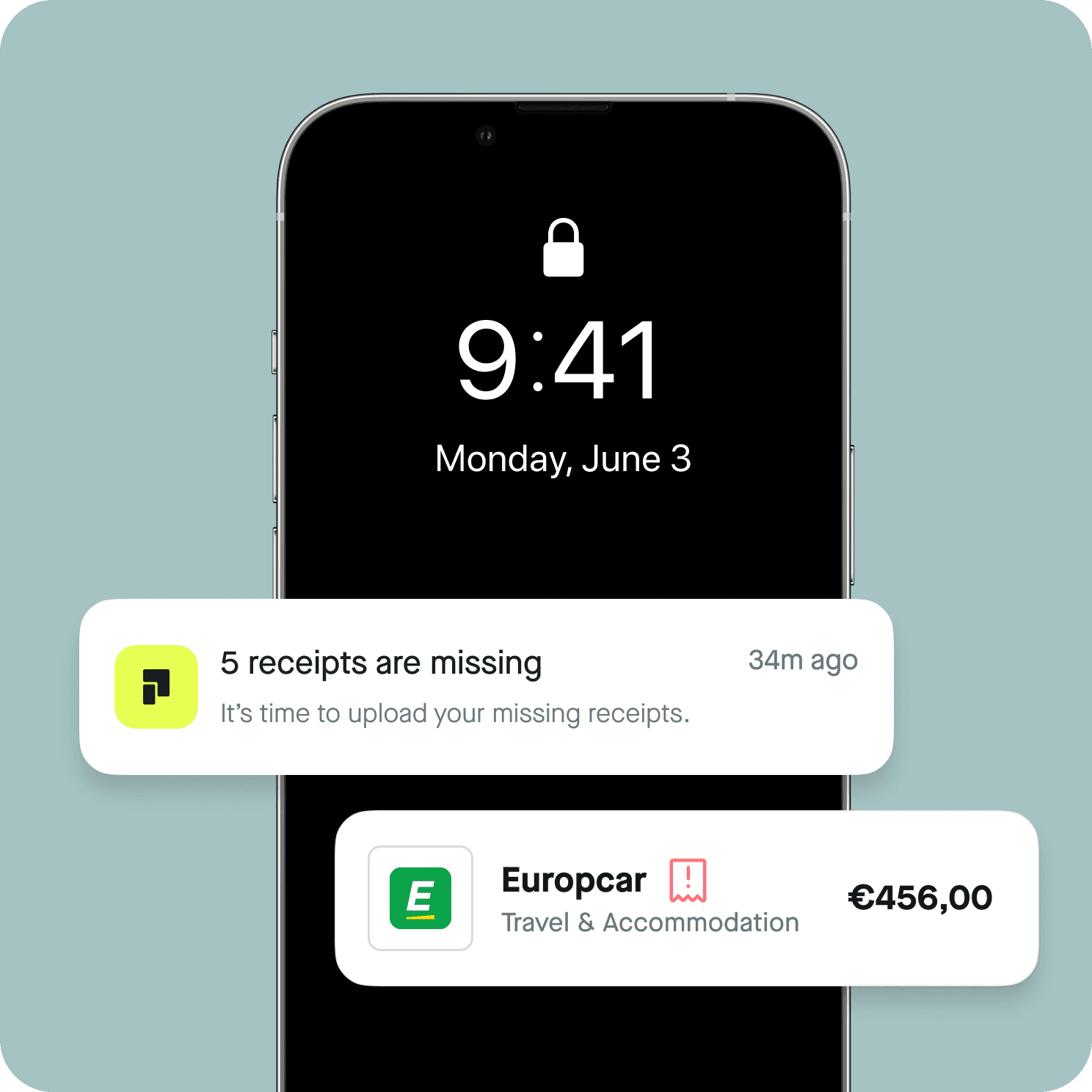

Track down missing receipts

Allowing employees to pay on their own can cause an increase in manual effort and the risk of errors for accounting. Pliant simplifies receipt collection and automates pre-accounting processes. Accountants can see missing receipts and automatically send out regular reminders to submit them.

From the paperwork of your bank to the digital credit card solution from Pliant

Optimize your finances with physical and virtual credit cards that adapt to your needs and maximize your savings. Future-proof your business growth with Pliant's advanced corporate cards.

| Pliant | Traditional credit cards | Debit cards | Wire transfer | |

|---|---|---|---|---|

| Digital receipt capture | yes | no | no | no |

| Automatic pre-accounting | yes | no | no | no |

| High limits | yes | no | no | no |

| Flexible payment cycles for increased liquidity | yes | yes | no | no |

| Fraud protection | yes | no | no | no |

| Real time budget controls & declined card notifications | yes | yes | yes | no |

| 0% foreign transaction fees | yes | no | no | no |

| Virtual cards with instant issuing | yes | no | yes | no |

How do you pay online and on the road with Pliant?

Benefit from our best-in-class solution in 4 simple steps.

Issue

virtual & physical cards with individual limits to your employees with a single tap.

Using

your card as payment method at the merchant.

Submit

your receipts in the Pliant app or via email.

Track

all your card spending in real time and effortlessly manage receipt collection and accounting tasks.

Why SMEs trust Pliant

The payments are clearly sorted by employee. This is simply not possible if everything is done with only one card. So it creates transparency and convenience in day-to-day business.

Requesting credit card statements and returning incorrectly completed travel or expense reports has improved significantly. There is nothing left lying around. Travel expenses are paid faster, and my team has all the information they need to make sure the process is tax compliant. Everyone knows where the receipts are at any given time and where they are being processed. Reconciliation becomes easier for the person who hands in the receipt and the person who later posts the receipt and makes the payment. Before, this was inconvenient for both parties and took a lot of time.

There has been an incredible amount of time savings since our implementation of Pliant. It used to take weeks to request new cards for my employees. Now it takes less than a minute to request and process.

Whether we are tracking travel expenses, collecting receipts, or integrating a credit card into our accounting system, Pliant adapts to our structures and needs. With Pliant, there is no need to migrate to new systems, as is the case with many of the mainstream banks' offerings.

Light

Pliant’s solution for businesses that make a lot of transactions but don’t need advanced features or integrations.

The benefits of Light:

- 1 standard card per user

- 25 virtual cards

- 5 single-use virtual cards per month

- Premium cards available upon request

- 1 standard integration

- Live chat support

All the benefits of Light, plus:

- Unlimited cashback*

- Unlimited virtual cards

- Unlimited single-use cards

- Premium cards available upon request

- Access to advanced features

- Unlimited integrations

- Insurance package**

- Support via email & phone

All the benefits of Standard, plus:

- Dedicated onboarding support & training

- Dedicated customer success manager

- Custom integrations

- Access to Pro API

* Depending on transaction volume ** Custom extra fee depending on plan terms & number of users