Pliant & Voxel: Seamless B2B Travel Payments

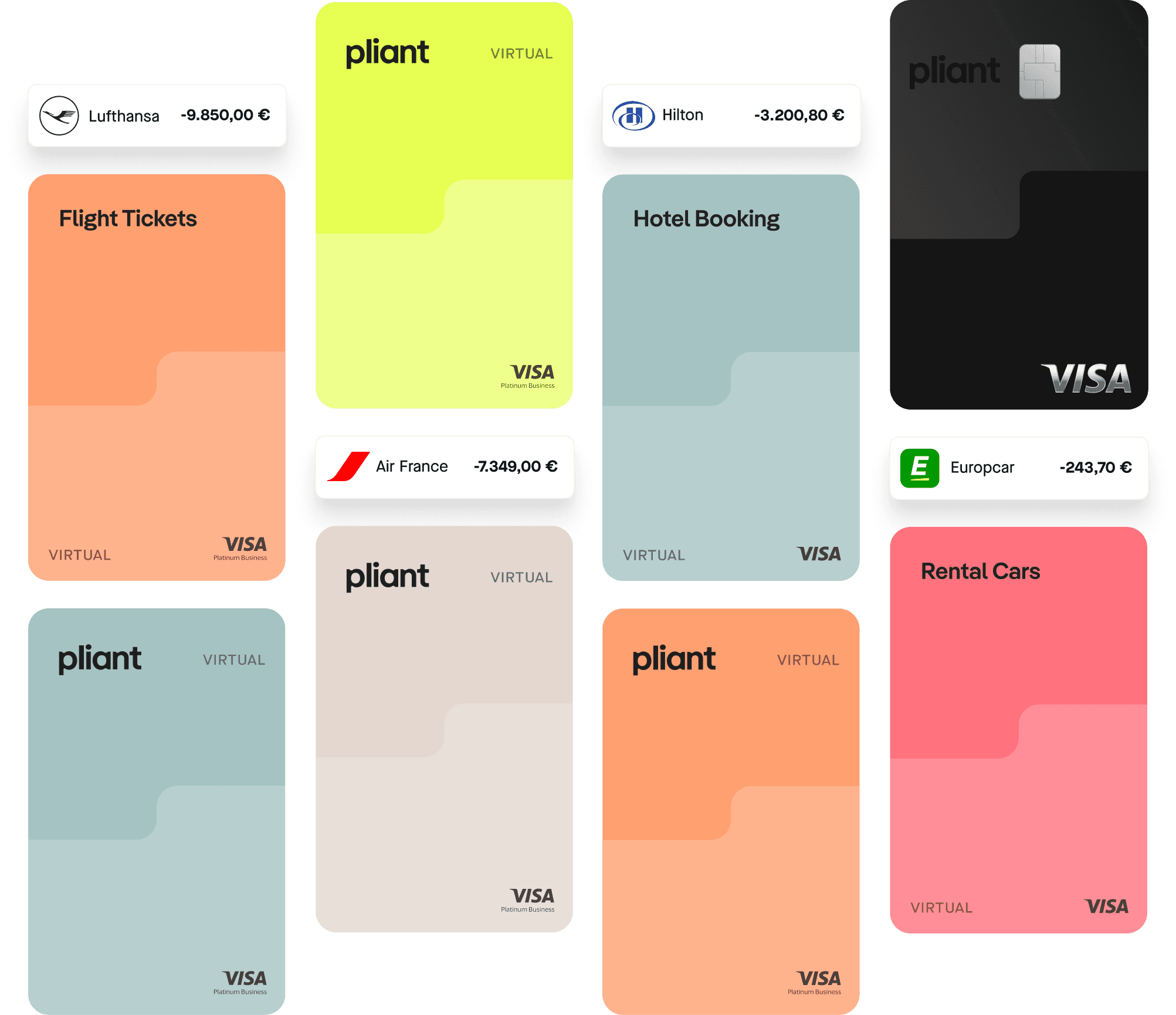

Experience the future of travel payments with Pliant’s virtual cards integrated into Voxel’s Bavel Pay. Automate, secure, and simplify your B2B payment processes with cutting-edge technology designed for the travel industry.

Over 3000 customers & partners trust Pliant, including:

Why Traditional Travel Payment Methods Fall Short:

Manual processes lead to errors

Traditional B2B payment methods are slow and prone to errors, increasing administrative burdens and disrupting cash flow management.

Lack of automation in payment and reconciliation

Manually reconciling payments adds inefficiencies to business processes, delaying financial reporting and heightening the risk of disputes with partners.

Security and compliance concerns

Many traditional B2B payment methods struggle to ensure full compliance with tax regulations and prevent fraud, which is critical in the global travel industry.

How Pliant & Voxel Streamline B2B Payments

Fully automated, end-to-end payment process

Pliant's integration with Bavel Pay provides businesses with a fully digital, end-to-end B2B payment process. Automate your payment flows, including reconciliation and VAT recovery, through Bavel Pay’s rules engine, optimizing each transaction in line with your business needs.

Seamless Integration with multiple platforms

With Bavel Pay’s single API connection, Pliant virtual cards can be used across multiple travel booking platforms. This ensures that all payment processes, from invoicing to currency exchange, are automated and consolidated on one platform, reducing operational costs and manual errors.

Enhanced security and compliance

By integrating with Bavel Pay, Pliant guarantees secure payment distribution, full compliance with PCI standards, and automatic reconciliation, ensuring your business is protected from fraud and non-payment risks.

Our previous virtual credit card system had several shortcomings. After getting familiar with Pliant, we found that practically all of them were covered and solved.

Jari IltanenOperations Controller of Elämys Group

Choose Pliant with confidence

E-money licensed

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

PCI DSS certified

Pliant is certified as a Payment Card Industry (PCI) Data Security Standard Service Provider – PCI DSS is the highest security standard in our industry.

ISO/IEC certified

Additionally, Pliant is certified to internationally recognized ISO/IEC 27001:2022 standards that define the requirements for information security management.

How Businesses Benefit from Pliant & Voxel Partnership

Travel Management Companies (TMCs)

TMCs can automate complex B2B payment flows using Pliant’s virtual cards and Bavel Pay’s platform, reducing errors and processing times while ensuring accurate reporting and compliance across global operations.

Hotels and Vendors

Hotels and other travel service providers can easily manage payments, reduce days sales outstanding (DSO), and improve cash flow by using Voxel’s automated reconciliation and collection services, which work seamlessly with Pliant’s virtual cards.

International Enterprises

For global companies dealing with multiple currencies and platforms, Pliant’s integration with Bavel Pay simplifies cross-border payments, automates currency conversions, and eliminates hidden fees, making international payments smoother and more transparent.

Pliant: made for your travel company

TMCs

Travel management companies (TMCs) are at the center of the business travel market: facilitating payments every day to airlines, hotels, car rental companies and more.

OTAs

Your online platform lives and breathes efficiency, and you need a platform that ensures full automation from day one. With Pliant, you can ensure seamless purchasing with VCCs, as well as a massive reduction of your payment support burden.

Tour operators

If you’re buying flights, hotel rooms and experiences in bulk, you need a payment solution that enables you to scale your operations effectively. Pliant’s flexible billing cycles mean that you plan for the long term with larger individual payments.

Bed banks

For bed banks, margins are the name of the game – and acquiring your inventory effectively is a huge step forward. Pliant’s payment platform for travel makes it simple to increase your margins with generous cashback offers on purchases.

FAQs

Pliant’s virtual credit cards integrate with Bavel Pay through a plug-and-play API connection, requiring no technical implementation. This makes it easy to start automating payments across multiple platforms.

Bavel Pay offers a fully automated end-to-end payment process, ensuring seamless reconciliation, reduced operational costs, and secure compliance with global payment standards—all while leveraging Pliant’s flexible virtual cards.

Yes, Pliant’s virtual cards can be used across all platforms integrated with Bavel Pay. This allows businesses to manage and automate payments regardless of their chosen travel management or booking system.

Pliant offers fast onboarding and seamless integration through its API. Most businesses can get up and running quickly, allowing them to start managing and automating travel payments without disruption.

Stay Ahead of Secure Corporate Payments with Our Virtual-Only Card Solution!

Subscribe to our newsletter and get the latest updates on secure, PSD2-compliant virtual card solutions designed for corporate payments. Learn how our virtual-only cards streamline bookings, reduce fraud.