Candis

“We diversified our revenue base and increased overall customer satisfaction.”

Christian Ritosek, CEO and Co-Founder of Candis

Launch your own fully-customisable credit card solution: White label & embedded options from Pliant your credit card solution to fit your needs: Choose between white-labelling our platform with your brand or fully embedding our features into your product for a seamless user journey.

Enhance your offering with digital credit cards: helping customers streamline their spending processes.

Jump straight into new markets with our innovative products: the perfect solution for more growth with less setup time.

Become an essential part of your customers’ lives: our solution embeds into vital workflows, fostering a deeper connection and brand loyalty.

Gain deeper insights into your customers' spending habits and generate valuable data for future business decisions.

"By offering an all-in-one solution for invoice management and credit card services, we're deepening our relationships with customers and increasing overall customer satisfaction. I couldn’t imagine Candis as the company as it is today without Pliant’s partnership." Christian Ritosek, CEO and Co-Founder of Candis

Read more about how companies have overcome their business problems with Pliant.

“We diversified our revenue base and increased overall customer satisfaction.”

Christian Ritosek, CEO and Co-Founder of Candis

"Pliant CaaS offers us the best technical functionality and the best service."

Bas Janssen, Head of Strategic Initiatives at Mobile Expense

"Pliant develops the card platform so we can focus on our customers.”

Marc Will, CEO of Intertours Reisen & Events GmbH

"In a few months, we added credit cards to our product range thanks to CaaS."

Bart-Jan Maatman, CFO of KlippaCustomize the card program according to your unique needs with a completely modular approach. We'll provide you with the building blocks, from the technology to the regulatory and compliance setup to the banking infrastructure, you need to launch a fully-fledged card proposition.

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

Pliant is certified as a Payment Card Industry (PCI) Data Security Standard Service Provider – PCI DSS is the highest security standard in our industry.

Additionally, Pliant is certified to internationally recognized ISO/IEC 27001:2022 standards that define the requirements for information security management.

Learn how Candis built their credit card solution and scaled it. Enter your email and get their full case study, along with other success stories straight to your inbox!

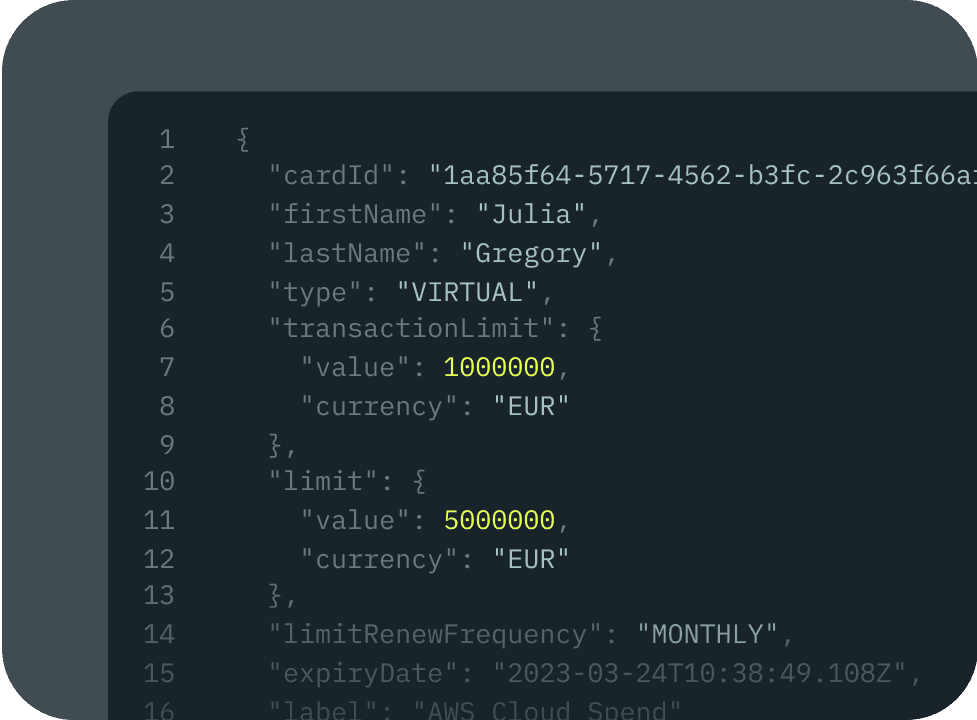

Create a custom card issuance flow with a variety of customizable settings for your specific use case.

Build all your reporting, analytics, and business logic on a massive amount of data to make informed decisions.

Use Pliant’s app interface and cards with your own branding, either as a standalone white-labeled solution or in combination with an embedded solution based on our CaaS APIs.

As a Pliant CaaS partner, you don't need to worry about compliance & risk – we cover it all for you.

We'll provide both technical and strategic support for you when implementing and running your card program, and we'll also support your customers directly.

State-of-the-art RESTful API to enhance your customer experience with credit card features.

What makes Pliant's white label and embeed solution unique is the level of support we offer. You can pick and choose layers depending on your needs — each provides maximum customization and efficiency:

Offers expert assistance throughout all project phases, including technical implementation and ongoing card issuance. Smooth operations and quick issue resolution.

Features user-friendly administrative and cardholder applications, equipped with real-time management capabilities for an intuitive user experience.

Boasts a state-of-the-art API infrastructure, facilitating easy and flexible product or application integration.

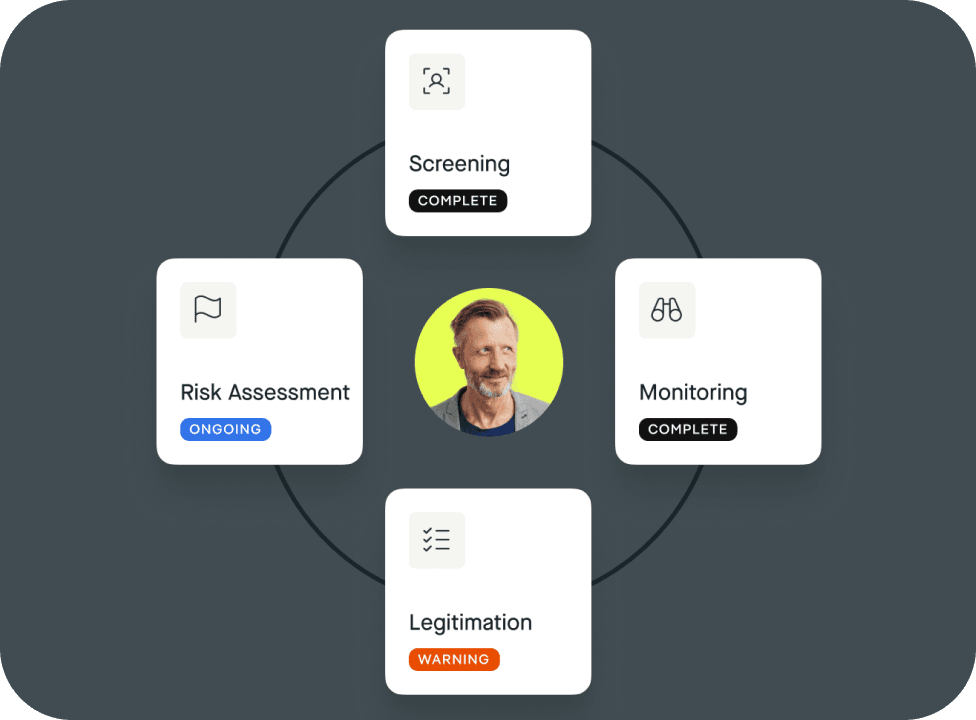

Ensures compliance with KYC/AML checks and provides continuous risk and compliance monitoring, essential for maintaining trust and legality.

Addresses all credit card requirements, simplifying the launch and management of card programs for businesses.

“I couldn’t imagine Candis as the company as it is today without Pliant’s partnership [..] Our transaction volume spent on our corporate cards has been doubling quarter over quarter for four quarters in a row. We now see the payoff, and it's been a game-changer." Christian Ritosek, CEO and Co-Founder of Candis

“In a few months, we added credit cards to our product range thanks to CaaS [..] We released a market-ready product within a few months. The collaboration between our development teams was really amazing. Big compliments!" Bart-Jan Maatman, CFO of Klippa

"Pliant handled the entire development of Intertours Pay in the background, while my team and I could focus on our customers and their requirements." Marc Will, CEO of Intertours Reisen & Events GmbH

Get access to our insider guide and discover the first steps to creating your very own credit card solution. Enter your email to start learning how the process works!

No, you can benefit from Pliant’s deeply rooted B2B credit card expertise when it comes to designing your ideal card solution. We provide you with the knowledge, tech capabilities, banking, and compliance infrastructure to launch your own solution.

We also offer our card management frontend that can be fully white labeled in addition to the REST-API infrastructure.

No, we will take care of KYC, credit risk assessment, and ongoing compliance and risk monitoring with our in-house team of experts.

You can offer Visa Premium Business Cards to your customers, which have highest worldwide acceptance and credit card benefits like no restrictions on acceptance from hotels, rental cars etc.

Yes, we can provide you with the underwriting and banking capabilities so you’re able to offer revolving credit lines to your customers.

Due to our plug-and-play setup you can launch your card program as quickly as five weeks.

No, you can leverage Pliant's existing license setup to offer adjacent financial services to your customers.

Yes, Pliant is certified as a PCI/DSS certified organization enforcing the highest security standards for data protection.

Contact us today to explore how Pliant's Cards-as-a-Service can transform your product. Let's discuss the possibilities and embark on the journey together.