Secure, SEPA-Compliant B2B Payment Solution

Empower your business with a SEPA B2B solution that simplifies cross-border payments in the Eurozone, reduces FX fees, and accelerates reconciliation. Pliant provides flexible credit limits and seamless integration with your existing financial workflows, ensuring both compliance and efficiency.

Over 3000 customers & partners trust Pliant, including:

Why Traditional Methods Fail for SEPA B2B

Manual reconciliation slows operations

Manual reconciliation creates inefficiencies, delaying monthly closings and financial reporting. Traditional B2B payment methods are error-prone, especially with high volumes of cross-border transactions, which require complex matching processes.

Hidden costs in cross-border transactions

Many B2B payment solutions come with high FX fees, impacting margins. Traditional providers often lack multi-currency billing, leading to costly conversions and unexpected charges, especially in international transactions.

Lack of real-time control and visibility

Limited visibility into payments hinders cash flow management. Without real-time insights, businesses face difficulties in tracking transaction statuses and managing financial forecasts, affecting both liquidity and decision-making.

Slow onboarding and Integration with existing systems

Traditional payment providers often have inflexible APIs, making it difficult for businesses to implement new payment processes or switch providers. Lengthy onboarding processes can lead to delays and lost opportunities, especially for fast-growing businesses.

How Our Solution Addresses Your Needs:

Automate SEPA B2B payments

Pliant automates complex B2B transactions, making reconciliation faster and more accurate. With our virtual card technology, each payment comes with complete data, streamlining back-office operations and reducing manual workload.

Lower FX fees with multi-currency billing

Pliant’s multi-currency accounts allow for seamless SEPA transactions without high conversion costs. By billing in multiple currencies, we help you reduce FX fees and optimize cash flow, enhancing cross-border efficiency.

Real-time visibility and control

Gain full control over your SEPA B2B payments with real-time insights via Pliant’s dashboard. Track transaction histories, monitor payment statuses, and manage credit limits with ease, empowering you to make informed financial decisions.

Fast onboarding and seamless API integration

Pliant offers a modern, flexible API that enables quick integration with your existing systems. Onboarding is fast, allowing you to start using SEPA B2B payments with minimal disruption to your business. This flexibility supports various use cases, ensuring that even complex workflows are easily managed.

Our previous virtual credit card system had several shortcomings. After getting familiar with Pliant, we found that practically all of them were covered and solved.

Jari IltanenOperations Controller of Elämys Group

Choose Pliant with confidence

E-money licensed

In the EU, Pliant is an e-money (EMI) licensed company and a Visa Principal Member – both licenses allow Pliant to issue cards using its own regulatory setup and directly process payments from customers using Visa credit cards.

PCI DSS certified

Pliant is certified as a Payment Card Industry (PCI) Data Security Standard Service Provider – PCI DSS is the highest security standard in our industry.

ISO/IEC certified

Additionally, Pliant is certified to internationally recognized ISO/IEC 27001:2022 standards that define the requirements for information security management.

Real-World Benefits of Pliant's B2B Payments Solution:

Simplifying Cross-Border B2B Payments

Streamline your cross-border payments across the Eurozone with Pliant’s SEPA B2B solution. Our platform ensures fast, secure, and compliant transactions, reducing payment delays and improving vendor relationships.

Optimized Payment Processes for Multi-Vendor Payments

Handle payments for multiple European vendors effortlessly using Pliant’s automated reconciliation and disbursement features. With complete transaction traceability and reduced errors, you can ensure accurate and timely payments.

Scaling for Subscription-Based Services

For businesses with recurring payments, Pliant’s SEPA B2B solution automates subscription billing and reduces the risk of payment failures. Our system ensures seamless recurring transactions while providing full visibility into each cycle.

FAQs

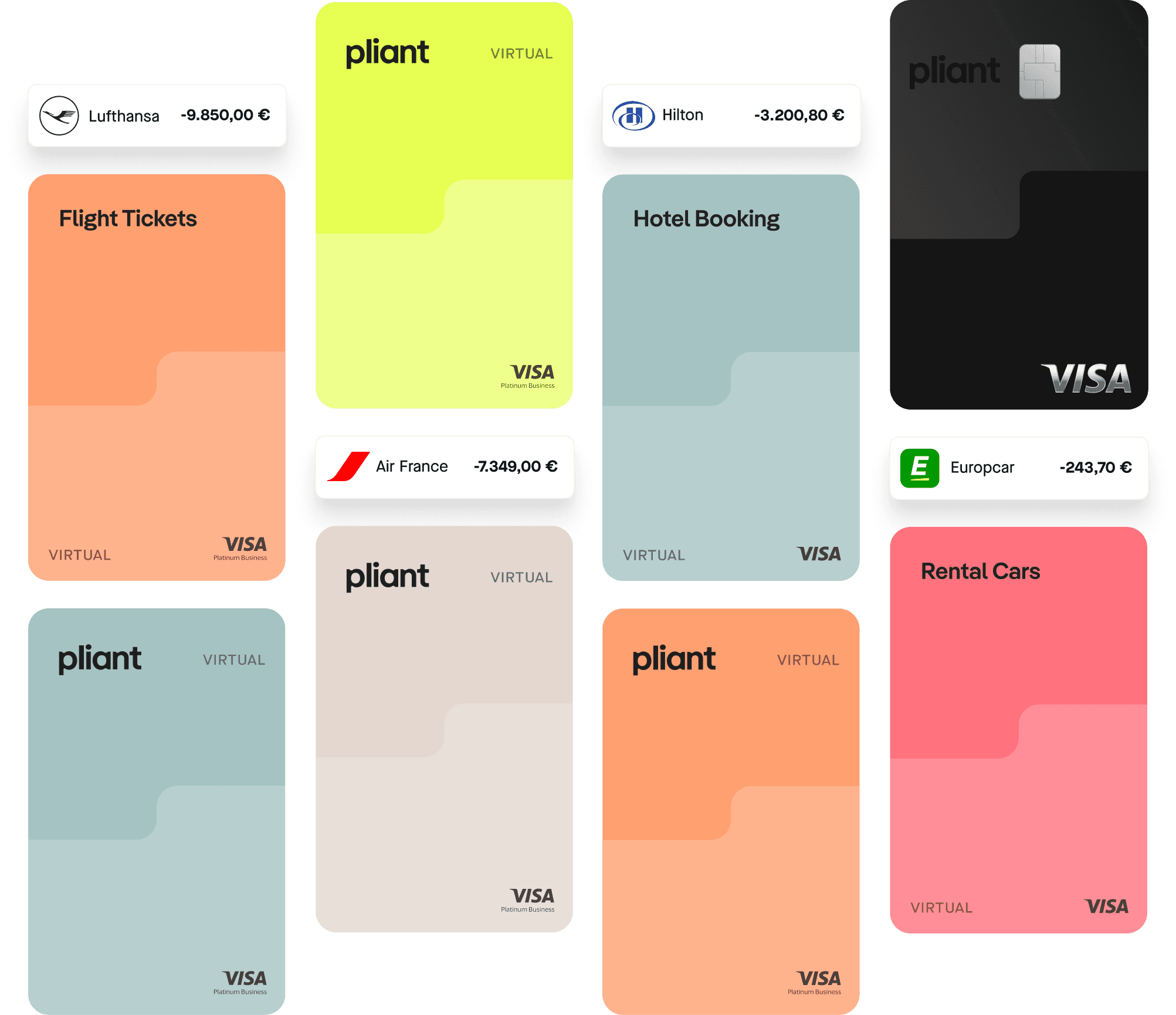

Although it’s sometimes used to describe a way for end users to purchase travel, we use the term “travel payment solution” to describe tools that enable companies within the travel industry to purchase inventory – such as flight tickets, hotel reservations and car rentals – from one another.

Travel companies use different payment methods, each varying in flexibility and efficiency. Some methods, such as IATA BSP, automate transactions and data exchange between agencies and airlines, although IATA charges a commission for those.

For non-IATA providers, manual invoicing and wire transfers are commonly used. However, these present challenges like slow processing times and high fees for international payments. Virtual Credit Cards (VCC), including those offered by the Pliant travel payment solution, offer more flexibility, allowing quick issuance and streamlining reconciliation processes.

Virtual Credit Cards (VCCs) provide significant advantages for travel companies. Firstly, they contribute to higher margins through cashback programs, enabling businesses to maximize returns on their expenditures.

Secondly, VCCs offer increased access to operating capital, thanks to high credit limits and flexible repayment options offered by the Pliant travel payment solution.

Additionally, the potential for automation is enhanced with tools like Pliant Pro API, streamlining processes and reducing manual effort, ultimately improving operational efficiency for travel companies.

Stay Ahead of Secure Corporate Payments with Our Virtual-Only Card Solution!

Subscribe to our newsletter and get the latest updates on secure, PSD2-compliant virtual card solutions designed for travel agencies and corporate payments. Learn how our virtual-only cards streamline bookings, reduce fraud, and simplify payments with airlines, hotels, and more.