Deutsche Telekom

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

Christian Ritosek is the CEO and Co-Founder of Candis. An invoice management software to digitalize and automate invoice processing operations, expandable with add-ons for expense management and enterprise content management tailored to DATEV and ERP system users. In this article, he discusses his experience with Cards-as-a-Service from Pliant and how they built their own credit card offering.

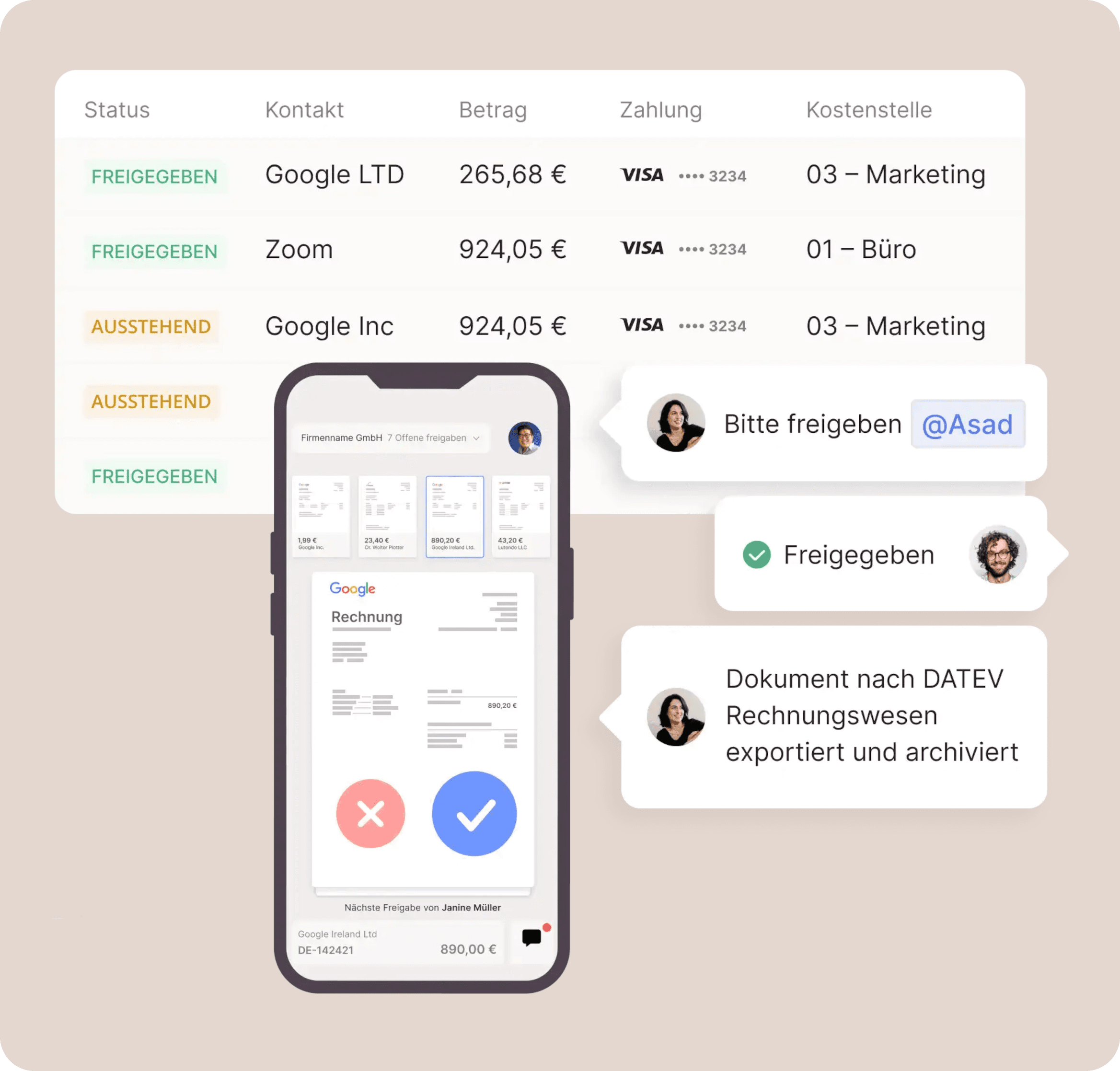

With the help of Candis, companies can manage, approve, export, and archive invoices in one cloud solution. With only a few clicks, you can easily automate manual financial tasks like receiving invoices or entering data. Candis also lets you set up custom rules for invoice approval. Once done, you can export your data to systems like DATEV, SAP Business, or Sage. In early 2023, Candis embedded Pliant's white-label credit card platform into its existing software and has since been adding new features.

How Pliant’s CaaS helped Candis double their transaction volume quarter-over-quarter.

Since its launch in 2015, Candis has been customer-centric with a mission to help accountants automate and simplify their daily tasks. “Candis is dedicated to simplifying invoice management and streamlining financial workflows”, says Christian Ritosek.

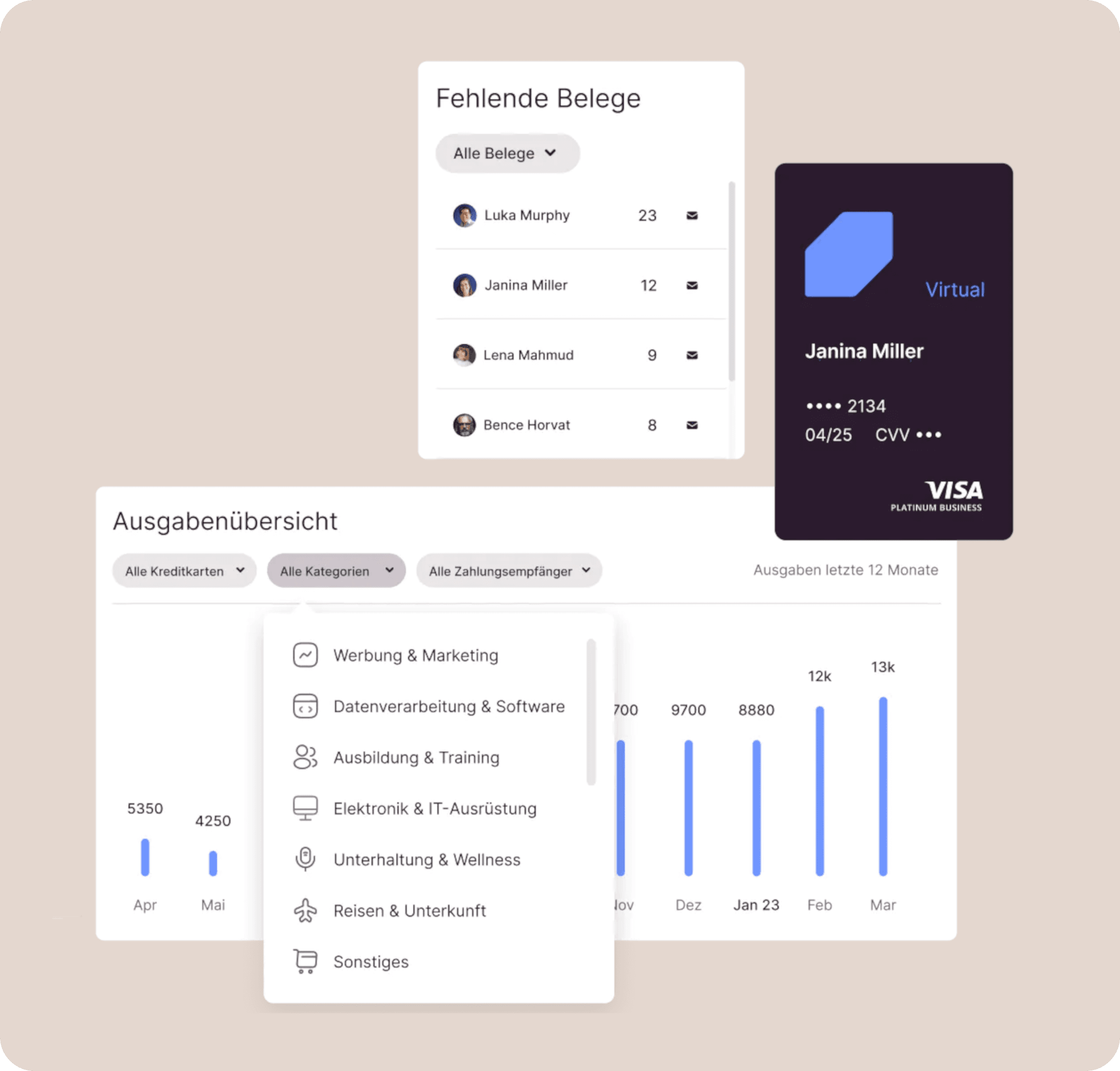

Even though Candis had success with their invoice management, they noticed that customers lacked an easy solution for expense management. Their cards from traditional banks could not be fully integrated into the finance stack.

Most clients did not have a flexible digital payment solution that could keep up with the requirements of the digital business world. After the digitization of invoice management, companies still had to collect receipts by hand, submit paper applications for new cards, and wait for the credit card statement in the mailbox.

This lack of transparency and flexibility provided Candis with the opportunity to help its customers manage their finances more efficiently and continue to improve their product offerings so they could grow their business.

At the beginning of 2023, Candis publicly introduced their Visa credit cards powered by Pliant. Before that customers could already connect Pliant and Candis via an API integration.

“Late 2021, I presented my board with a bold idea: Expanding our product portfolio to include corporate credit cards. It was a huge bet for us as a business, and a lot of company resources went into it – causing some sleepless nights, not only for me”, explains Christian Ritosek.

The new Candis Visa Credit Cards:

integrate seamlessly with the existing invoice management system, providing users with a comprehensive solution for managing their finances,

offer businesses greater control over their expenses, enabling real-time monitoring and budget management, and

help businesses optimize their cash flow and improve their overall financial health by providing flexible payment options and credit terms.

With Pliant CaaS and Candis advanced analytics and reporting tools, customers gain valuable insights into their spending patterns and can make data-driven decisions for growth and profitability.

For Candis, incorporating corporate credit cards into the product suite diversifies their revenue base and increases overall customer satisfaction.

"By offering an all-in-one solution for invoice management and credit card services, we're deepening our relationships with customers and increasing overall customer satisfaction. Our transaction volume spent on our corporate cards has been doubling quarter over quarter for four quarters in a row. We now see the payoff, and it's been a game-changer."

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

"At product launch, 1,000 caregivers at Caritas Vienna started using our Pliant cards."

Patrick Reinfeld, CEO and Co-Founder of Pflegenavi

"Our fleet card was only possible thanks to Pliant’s flexible solution."

Adriano Rissbacher, Managing Director, RMC Service GmbH

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.