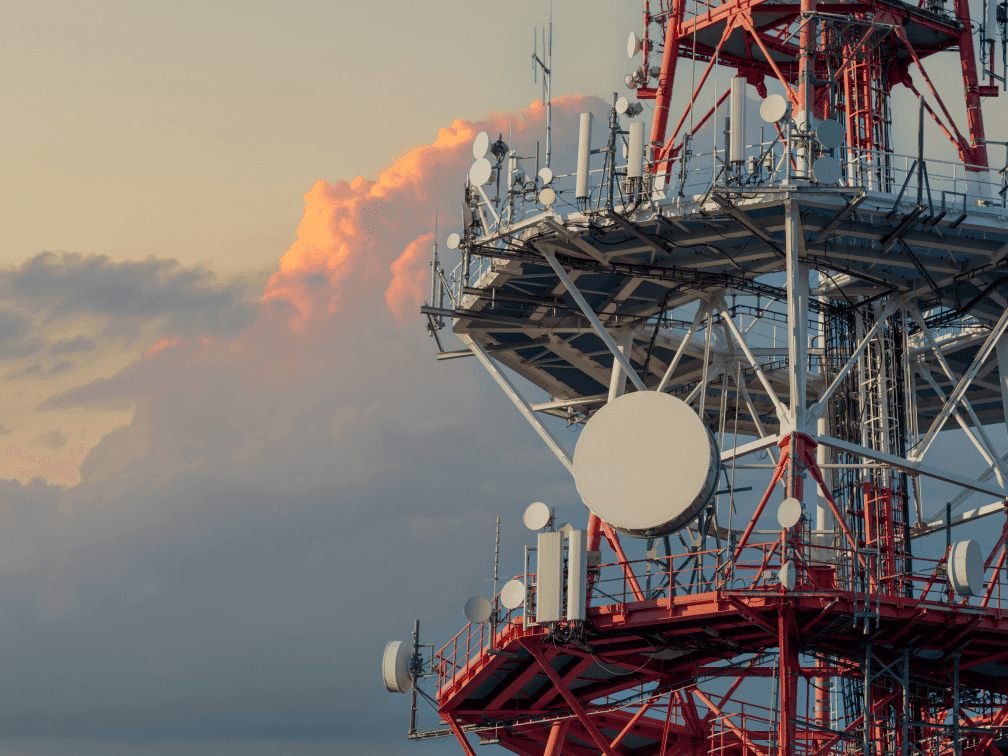

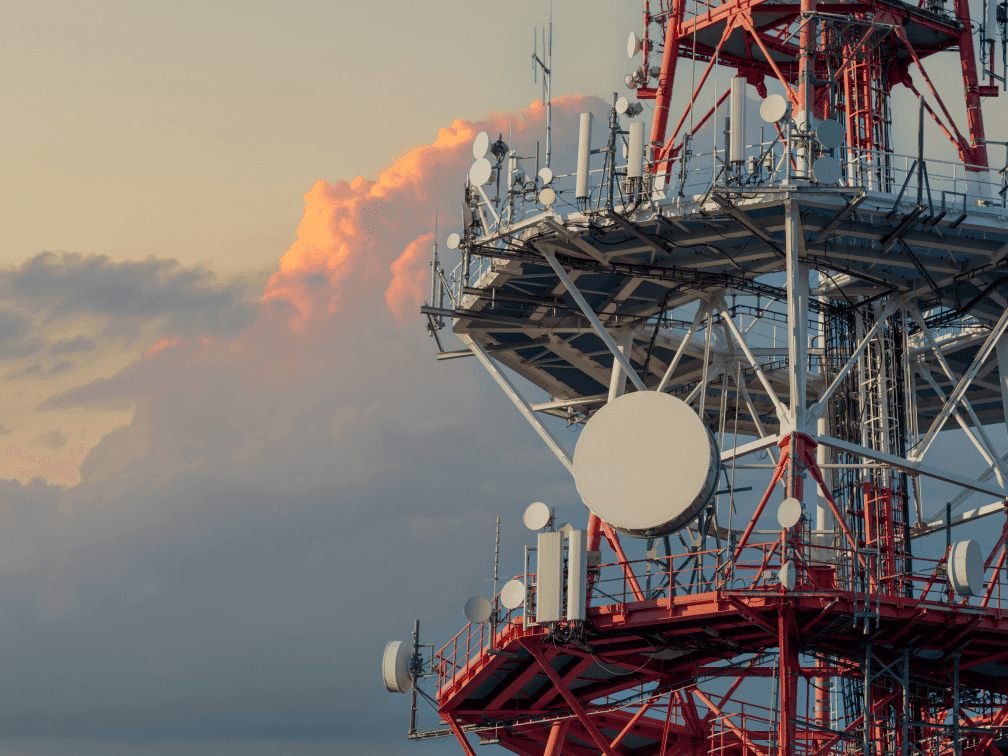

Deutsche Telekom

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

Maximilian Zielosko, CEO of BuchhaltungsButler, is working with co-founder Konrad and his team on a digital CFO. In an interview with Pliant, Zielosko shares his experience with our corporate credit card solution.

In the beginning, complicated procedures and analog accounting processes were frustrating. It took proper training to handle the accounting in a growing company without losing so much time. Maximilian and Konrad founded BuchhaltungsButler in Berlin in 2015 after seeing a huge need for automation. Since then, they have been working on a digital CFO that simplifies the financial accounting of companies as well as the coordination with their tax consultancy. BuchhaltungsButler is developing a cloud solution companies can use to process their business transactions in a time- and cost-saving way. Efficient accounting depends on processing receipts, which now benefit from artificial intelligence and automated pre-accounting.

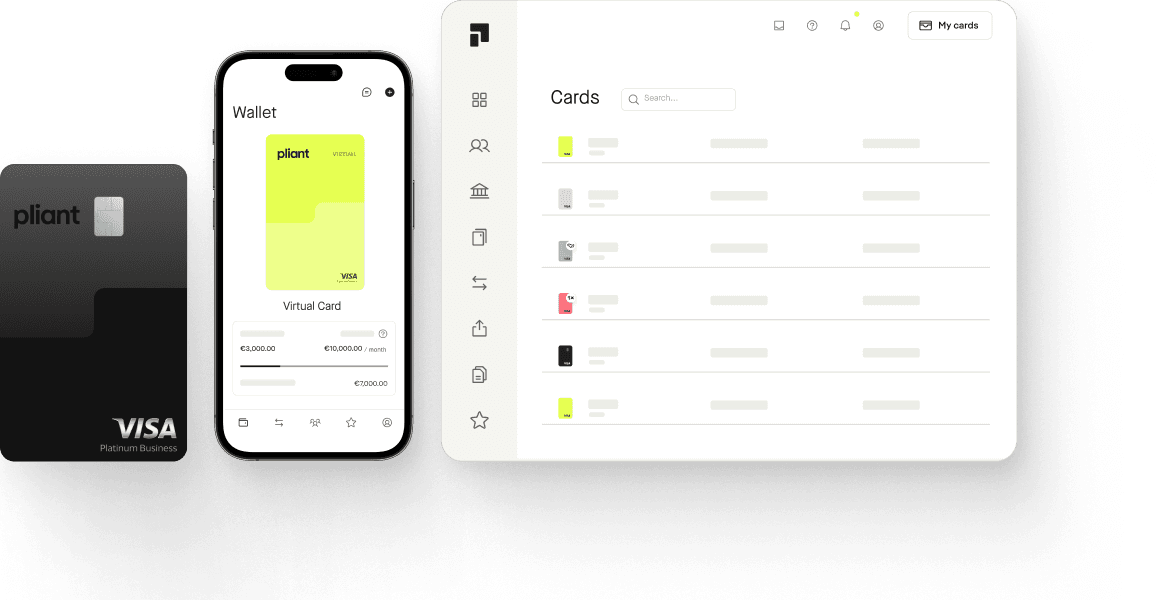

Cards for employees can be created, blocked, and deleted independently.

Faster transactions through time-saving card management.

Virtual corporate credit cards can be used immediately.

In 2019, Gründerszene included BuchhaltungsButler in its list of the 50 strongest growing companies. Today, more than 30 people work at the Berlin-based software company.

As the company grew, so did its payment processing needs. The functionality of the previous credit card solutions was no longer sufficient to keep track of everything. "Applying for a new company credit card and blocking the old one just to suspend a 19.99 Euro subscription was too much work for us in the past," recalls Maximilian Zielosko.

Instead of one corporate credit card, BuchhaltungsButler uses a mix of physical and virtual cards. According to Zielosko, ‘It is especially useful for us to be able to block cards and to create new cards at any time.’

Those who don’t go on business trips, receive a virtual credit card if needed. Card features such as limits or authorized payment categories can be changed for each credit card at any time. The Pliant dashboard instantly displays completed transactions for all cards.

"The payments are clearly sorted by employee. This is simply not possible if everything is done with only one card. So it creates transparency and convenience in day-to-day business."

Maximilian Zielosko's demands for efficiency and digital workflows in his own product are also applicable to his company's entire finance stack. With Pliant, BuchhaltungsButler has found another best-in-class solution that meets the needs of a growing startup.

"What makes Pliant attractive is the cashback system. In addition, it is very easy to create cards and to block them again when it is necessary to do so. One of the recurring problems we face is unauthorized charges and not being able to track down where they are coming from. This is now a thing of the past as I now have the ability to cancel the card and the problem is solved!"

BuchhaltungsButler and Pliant have been partners since July 2022. With the help of an automated document routing interface, users of both tools can easily export their incoming invoices from Pliant to the BuchhaltungsButler app.

“All of Deutsche Telekom’s requirements are met 100%.”

Ricky Singh-Grewal, Project Lead Smart Payments, Deutsche Telekom

"At product launch, 1,000 caregivers at Caritas Vienna started using our Pliant cards."

Patrick Reinfeld, CEO and Co-Founder of Pflegenavi

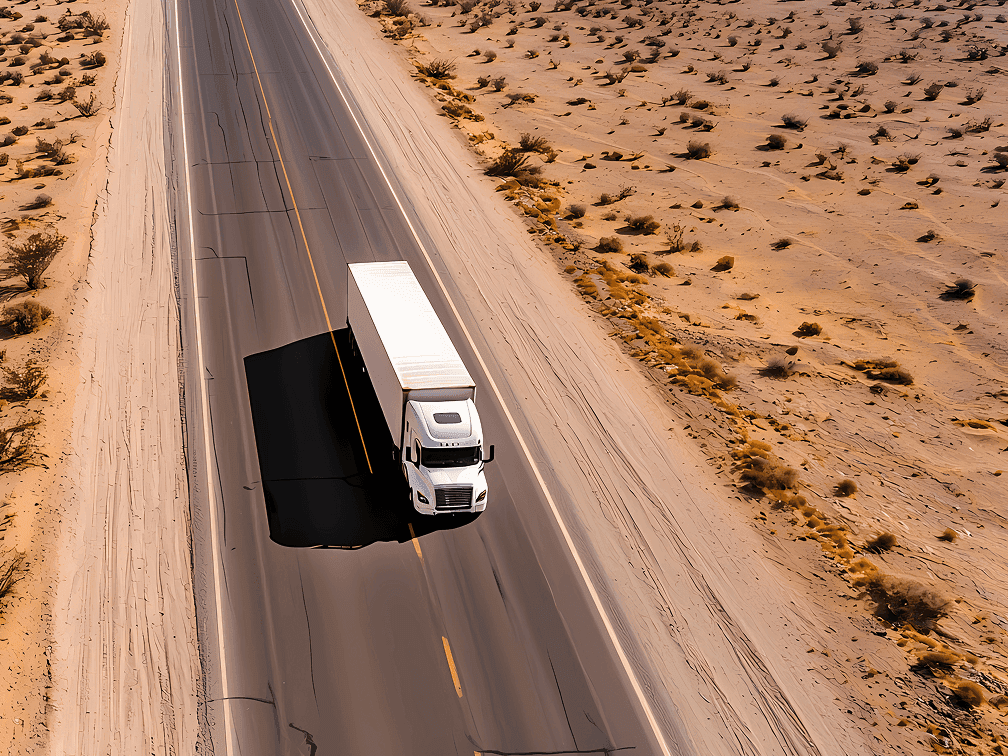

"Our fleet card was only possible thanks to Pliant’s flexible solution."

Adriano Rissbacher, Managing Director, RMC Service GmbH

"Circula will process €100 million in card spend this year"

Nikolai Skatchkov, CEO Circula

“Several thousand euros in cashback are a significant advantage for BLINKED.”

Jean-Gabriel Baron, CFO of the Jaws Group

"Pliant delivers a more efficient solution than building our own."

John Lindström, COO of Bezala

Our team is available every Monday to Friday from 9am to 5pm to answer your questions personally.