What should a business travel report include?

Your business trip is over, and now it’s time to draft up a travel report. Why does your manager ask for a business trip report? And what should a good report include? Scroll down to learn everything you need to know about how to write a travel report.

What is a business trip report?

A business trip report, or business travel report, is a document about a business trip, usually written for a manager. It’s like a memo of the trip, its purpose, learnings, and outcomes.

The meaning of a business trip report is to give an overview of the trip and justify the expenses.

With a travel report, you tell your manager (or other relevant people in the company) what your trip was about: purpose, goals, achievements, learnings, and recommendations. The purpose of a business trip can be, for example, to solidify business partnerships, prospect for new clients, or learn about the latest industry trends.

A business trip report also justifies the investment the company makes. If your employer sends you on a business trip and pays for the costs, how will it benefit from your travel?

What should a travel report include?

There isn’t one set format for a travel report. You can check if your company has a template for reporting business trips or if there are some conventions or requirements the report should follow. If not, you can find a simple business trip report template in this article.

Unless you work in a traditional industry, a travel report doesn’t have to be too formal. Your manager probably doesn't want to scan through a 20-page report.

It’s okay to keep the report brief and concise. You can skip the table of contents and executive summary and focus on the goals, outcomes, and learnings of the trip – the part that matters the most.

A simple outline for a business trip report

If you want to keep your travel report short and sweet, you can follow this simple structure.

Basics: Your name, participants (your colleagues), travel period, and destination.

Purpose of trip: Why did you go on this trip? What were the goals?

Overview: What events did you attend? Who did you meet? What learnings did you gain?

Summary and Conclusions: A brief summary of the trip and recommendations or action points.

Expenses: You can list your expenses here or deliver your expense claim separately.

Attachments: If you claim expenses, attach receipts and invoices as proof of travel costs.

Claim travel expenses with an expense report

If you’ve paid travel expenses from your own pocket, you can claim expense reimbursement from your employer. Depending on your company’s conventions, you can either attach the expense claim to the report or deliver it separately.

More and more companies use digital tools to manage travel expenses, which means that you don’t need to claim back travel costs with a paper document (and not even with a PDF). For example, Pliant features an integration to Circula, a software designed to streamline and automate claiming and managing travel costs and allowances.

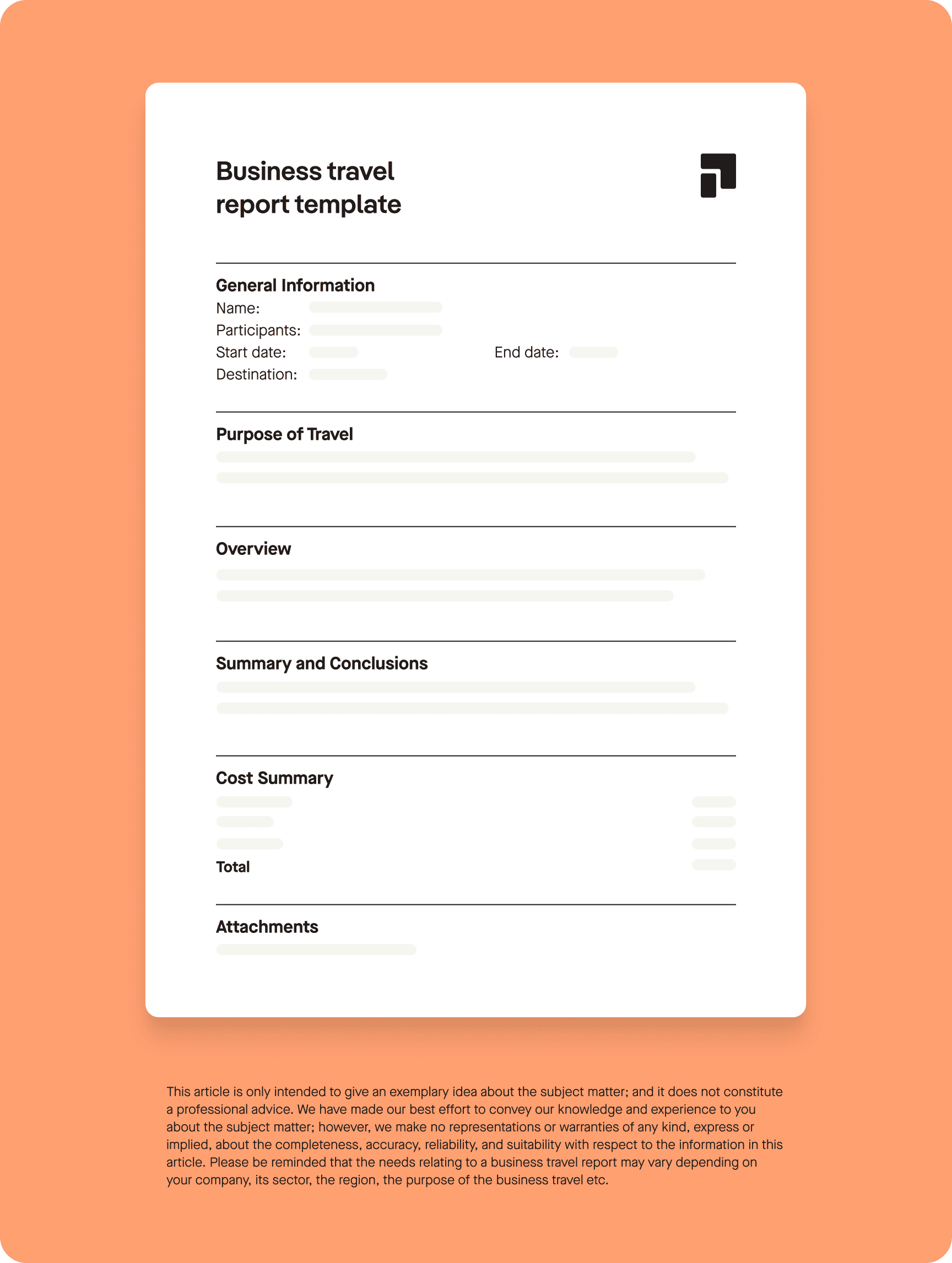

Use a business travel report template

If your company doesn’t have a fixed structure for a business travel report and you’re not sure how to go about it, here’s a template to help you get started.

You can use this template to summarize your trip and its expenses in a simple and easy-to-skim format.

Bear in mind that this isn’t an official travel report template – if there is such a thing. Feel free to edit and customize it for your needs. You can skip or add sections that you see useful. If you want to highlight something particular, add new sections, like Goals or Learnings.

How to write a travel report?

Following the structure of the template above, here’s how you write a travel report.

Start with the basics

First things first. In addition to your own name, mention any colleagues that were with you on the trip. Include the travel period and destination.

Focus on the benefits for the company

The body is the most important part of your report. You can use a structure that works best for you, but if you’re not sure what to include, here are some ideas.

You can start with the purpose. Why did you go on this trip? What were the goals? This could be, for example, to keep up with the industry trends at a conference.

Provide an overview of the trip. Who did you meet? What events did you attend? What did you learn? This is your chance to shine. Stress how the trip was beneficial for the company. Not only did you pick up new skills at a seminar, but now you can put them to use in your work for the company. You’ll want to show how sending you on this trip was a good investment.

Close with a summary and conclusions. Write a summary and revisit the key points, like your learnings, how the goals were met (or why they weren’t), and recommendations and an action plan for the next steps.

Attach a cost summary and receipts (if necessary)

Depending on your company’s travel expense policy, you can attach a cost summary of your reimbursable expenses and relevant attachments to the travel report. Attachments include receipts and invoices as proof of incurred expenses during the trip.

If you deliver an expense claim with an app or in another way established in your workplace, you don’t have to include it in the travel report.

What is an example of business travel?

There are many types of business travel, ranging from conferences to trade shows to visiting international branches of the same company.

What qualifies as business travel in the eyes of the tax office varies from country to country. But usually, there’s some kind of requirement for temporary travel for work purposes.

Examples of business travel include:

Conferences and seminars

Trade shows and fairs

Travel to meet business partners, like suppliers or clients

Internal visits and meetings at different locations

Company retreats and events

Not every type of business travel requires a travel report. If you’re traveling to a company retreat or summer party to unwind and bond with your colleagues, you can skip the report.

When does a business trip require a travel report?

Whether a business trip report is required depends on the organization and its travel policy. A travel report isn’t always necessary, so it’s best to ask your manager.

But if you claim reimbursement for business-related travel expenses, you do need to submit an expense report and receipts. This is usually required by the tax office to provide a clear audit trail of why your employer is making a (tax-exempt) payment to you. But this doesn’t mean you have to write a report on the whole trip.

Depending on the policy of your company, you might either submit an expense claim with an app or software or in another fashion that is established in your organization.

In summary

Business travel report policies vary from company to company. While a travel expense claim may be required by the tax office, a business trip report is usually just used for internal purposes.

In some companies or industries, lengthy reports may be the norm. But just the same, there may not be a culture of writing travel reports at all. When in doubt, ask your manager.