What is a black credit card?

Black credit cards differ from other payment cards in more ways than just by their unique color. These luxurious elite cards come with exclusive benefits and numerous extra amenities. Read on to learn what requirements you have to meet to qualify for a black credit card – and is it worth the hype?

A quick overview of black credit cards

Black credit cards are premium cards with high credit limits and exclusive benefits.

To qualify for a black credit card, a customer must have a good credit rating and a high spending volume.

American Express Centurion® Card, World Elite Mastercard® and Visa Infinite® are the best-known black credit cards from the major credit card providers.

On top of the black credit cards designed for private customers, there are also premium business credit cards available.

What is a black credit card?

A black credit card is a premium credit card with special benefits, such as comprehensive insurance packages and access to airport lounges or concierge services.

The card design is always black and plain – exuding luxury. Premium cards offered by major credit card companies include American Express Centurion Card, Mastercard World Elite and Visa Infinite. Because of their high-end additional services, they are popular among business customers and the wealthier private users.

A black credit card is generally viewed as a sign of status and wealth. The most expensive credit card in the world, Sberbank’s Visa Infinite Card, costs a whopping $100,000. Just to manufacture the card is said to cost $65,000. The diamond-encrusted card is made of gold and issued by the Kazakhstan branch of Sberbank.

Although the black color is associated with the most exclusive credit cards, it is not unique to them. The black design is not protected and is now used by card issuers for regular cards as well.

What credit card colors are available?

In addition to black credit cards and the standard classic credit cards (without a specific color), you can usually find credit cards also in gold and platinum.

In many European countries, Visa offers four different types of credit cards. Their names and availability may vary by country.

The exact terms and conditions are always determined by the card issuer, but here’s a general overview.

Classic. Many customers receive this Visa card free of charge when they open a bank account. It is accepted worldwide both online and in-store, as well as at ATMs.

Gold. The Gold card provides even more flexibility, for example, through a higher credit limit. What’s more, customers often receive insurance benefits and discounts at selected retailers.

Platinum. Customers with a high transaction volume have access to the Platinum card and benefit from even more extensive additional services.

Infinite. This is the black Visa card and it comes with the most exclusive services. These include a personal concierge service and access to airport lounges.

The credit card tiers depend always on the card provider. This means that you can’t necessarily compare the cards very easily.

But a good rule of thumb: the card in the highest tier is usually the black credit card.

Who qualifies for a black credit card?

There are no uniform qualification rules. Instead, the black card requirements depend on the card provider.

But generally speaking, customers with a good credit rating and a high spending volume are usually eligible for a black credit card.

With some card providers, you can apply for the card once you reach a minimum spending threshold. Other credit card providers, on the other hand, offer the premium card by invitation only.

Who is the premium credit card suitable for?

Black credit cards are best suited for private and business customers who want more flexibility to their finances and who travel a lot.

One advantage of a premium credit card is its high credit limit. Unlike with a debit card connected to your current account, the amount you spend is only billed at the end of the billing period – not directly charged from your account.

Frequent travelers in particular will benefit from the extensive insurance packages. Premium cards usually come with extra safety, such as international health, luggage or car rental insurance.

And of course, they make air travel more comfortable. Access to airport lounges all over the world is certainly a plus.

How much does a black credit card cost?

The exact cost of a black credit card is determined by the issuing company and it depends on the additional services offered.

When choosing a premium card, pay attention to the following fees and costs:

Monthly fees. Fixed fees are usually charged either monthly or annually.

Service fees. Withdrawals and payments are usually free but additional services might be charged separately. You can find all fees in the card provider's fee schedule.

Foreign currency fees. Some providers charge surcharges for paying in a foreign currency.

But don’t worry if a black credit card doesn’t fit your budget. Some card providers also offer free cards with a smaller range of services.

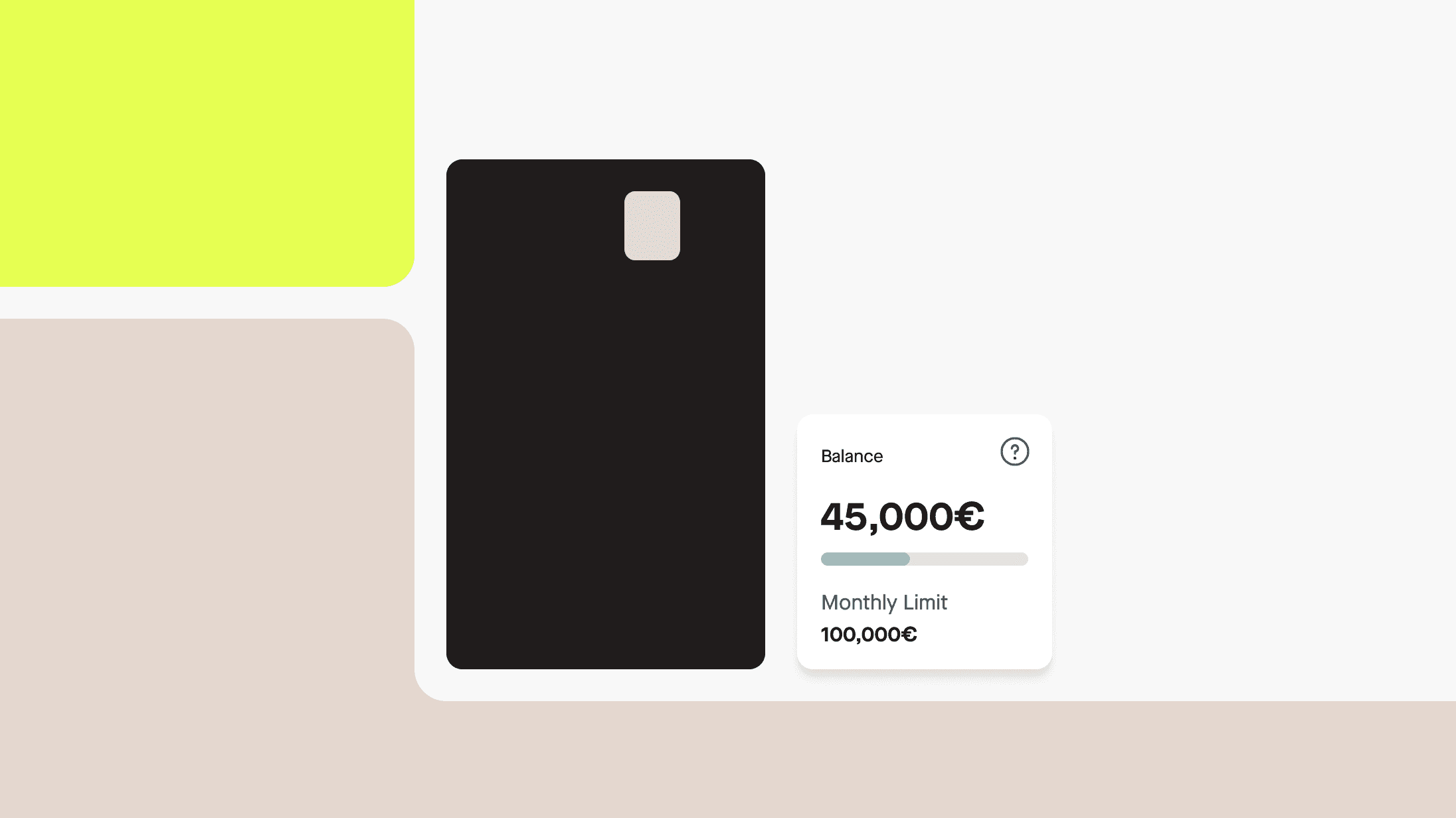

What is the credit limit of a black credit card?

The card issuer makes the credit decision based on their individual assessment so there’s no one preset credit limit automatically applied to all black cards. But it’s safe to say that credit limits available for these premium cards can be very high, easily going up to tens of thousands of euros (or even more).

The credit limit may also depend on the card type: whether the card is a credit card or a so-called charge card.

With a credit card, you don’t have to pay your total balance at once but the unpaid part will accrue interest. With a charge card, you have to pay off the whole bill at the end of the billing period.

Visa Infinite vs. AMEX Centurion vs. Mastercard World Elite

Visa, Mastercard and American Express are the world's largest credit card companies and all three offer black credit cards. Here’s a quick overview of the best-known premium cards on the market.

Visa Infinite

With this Visa card in your pocket, you are covered by a comprehensive travel insurance package and have access to airport lounges worldwide. A 24/7 concierge service adds a touch of extra luxury. Personal assistance is always just a phone call away.

Mastercard World Elite

With the World Elite Mastercard, you get various insurance benefits and extra security against threats like identity theft. Cardholders also enjoy special discounts from selected partners.

Like most premium cards, the black Mastercard grants you access to airport lounges and exclusive events around the world.

American Express Centurion Card

The black AMEX card is only available by personal invitation from the credit card provider.

It is the most exclusive card from American Express. Only a small number of customers have access to the Centurion card. There are plenty of rumors about the qualification requirements and admission process but AMEX doesn’t disclose details about it.

The Centurion card comes with numerous extra amenities, such as a priority pass for airport lounges, concierge service, and exclusive offers from their partner network.

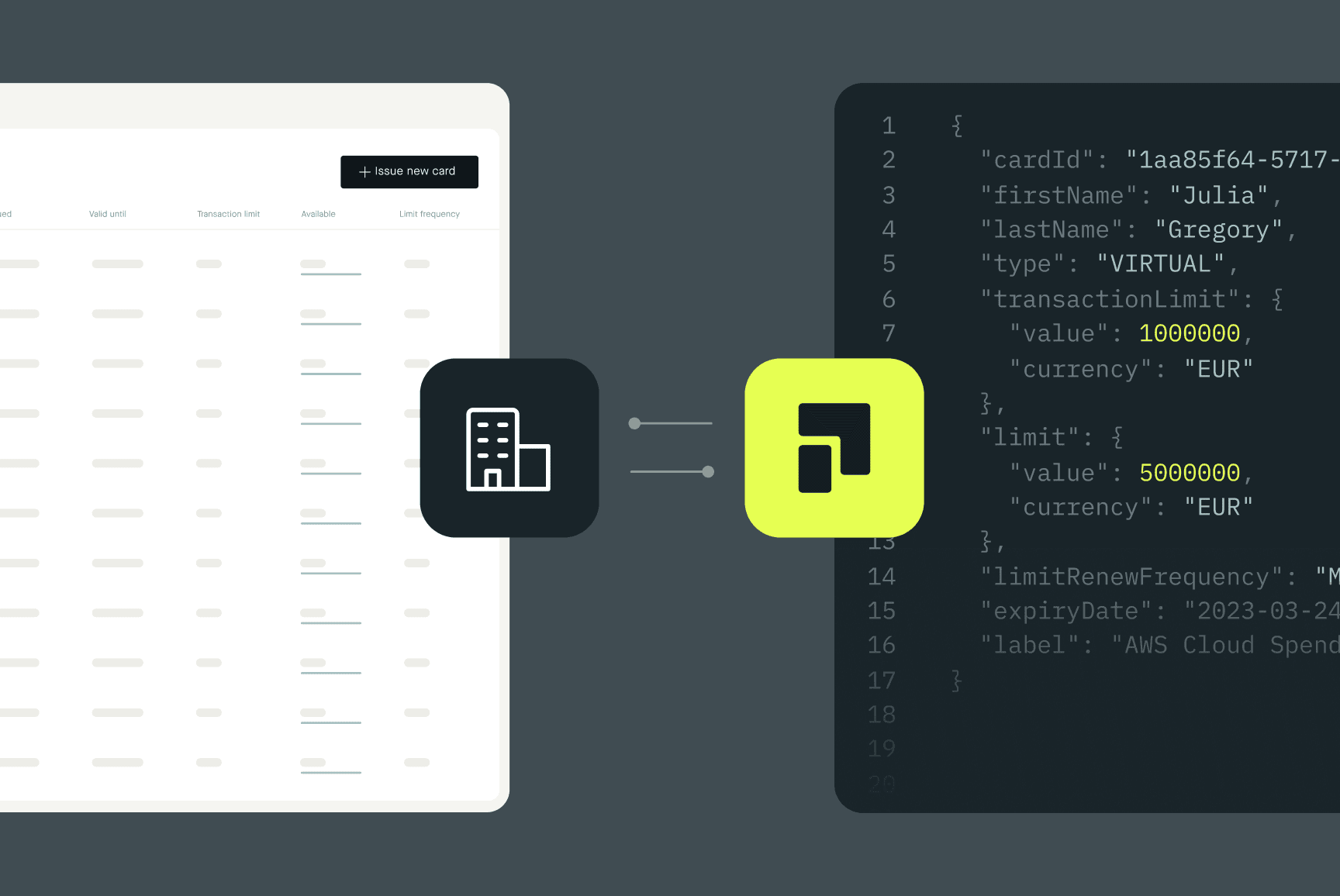

Pliant Visa Infinite Business: The premium corporate credit card

At Pliant, you can choose the black Pliant Visa Infinite Business card. If you don’t need an exclusive premium card, you can opt for the free Pliant Visa Platinum Business credit card.

Pliant's black card is ideal for small and medium-sized businesses (SMBs) and corporate customers with good credit ratings and high spending.

Special card benefits include, in addition to high limits and cashback, digital card and receipt management and seamless integrations with your accounting software. Extensive emergency services, access to airport lounges and an insurance package are also included.

And what does it cost? Check our Pricing page!

💳 Want to learn more about Pliant credit cards? Book a demo here.

Summary: What is the point of a black credit card?

It goes without saying that the ultra-luxurious black credit cards that cost thousands of euros – probably not worth it for the average consumer. And not even available to the average consumer. But if you’re not short on cash, travel a lot and enjoy the finer things in life, premium cards do come with unmatched perks and benefits.

Perhaps the more relevant question is: are the more affordable premium cards worth it?

Especially for an avid traveler, a premium card can come in handy. They might not reach the comfort level of the American Express Centurion Card, but there are alternatives that offer extra value at a more affordable price level.

And the premium business credit cards are particularly beneficial to companies where business travel is frequent. The employees will appreciate the extra comfort of airport lounge access while comprehensive insurance packages make travel safe.