Virtual Credit Cards for Employees: What You Need to Know

A modern virtual card solution for employees is secure, transparent, and saves time for management, employees, and accountants through streamlined digital processes.

- Common issues with traditional corporate cards for employees

- When are virtual cards useful?

- Why one corporate credit card for the CEO isn’t enough

- Benefits of virtual cards for employees

- 3 alternatives to corporate credit cards and their drawbacks

- Which employee should get a virtual card?

- Effective expense control with employee roles and permissions

- Accelerate your payment processes with the Pliant Payment Apps

- Key considerations for virtual cards for multiple employees

Common issues with traditional corporate cards for employees

Pliant’s executives and finance managers often share similar issues during initial consultations:

Hard-to-trace expenses can lead to fraud, or at the very least, long processing times, frustrating both employees and the accounting department.

Credit card details tend to circulate throughout the company, no matter how careful you are. Unauthorized payments, such as subscriptions to services like LinkedIn, can be difficult to track.

Companies often purchase from a variety of online stores and use numerous online services, especially cloud-based tools, SaaS, and online advertising. These expenses, often paid by multiple employees using credit cards, create challenges when a single card is used by several employees, as each transaction must be manually attributed to the appropriate individual or department.

Purchases on corporate credit cards often occur before receipts are available, but gathering original receipts is essential for tax deductions and audits, a process that can be tedious.

Customers report that they generally prefer employee cards for payments, as they simplify and expedite processes compared to invoicing. However, the drawbacks of traditional corporate credit cards often lead companies to restrict their use as much as possible.

For this reason, many companies are searching for modern credit card solutions for employees and procurement teams, to ease the burden on management and simplify receipt handling for users and accounting.

In this article, we’ll answer key questions.

When are virtual cards useful?

A virtual credit card for employees is a recognized payment method for advertising costs and subscription payments. It enables quick and secure transactions, and offers convenience for employees, accounting, and management, with charges drawn directly from the business account. Thanks to Apple Pay and Google Pay, they can also be used to pay for business trips.

Without access to a corporate card, employees must cover business expenses upfront, which becomes an unreasonable burden, especially for large expenses like hotel stays and flights.

Handling many small expenses also takes up significant time in accounting, as manually entering minor transactions into accounting software can be very time-consuming.

Why one corporate credit card for the CEO isn’t enough

If your company only has one corporate credit card shared among employees, internal processes can become slow and insecure. Each payment requires verbal approval, meaning the employee must first check with a supervisor and then inform accounting of the purchase.

Transactions are only possible if both the card and the company phone used to receive the authorization code (TAN) are available. At the end of the month, accounting must match payments to the correct employee and collect receipts.

"You can’t keep payments organized by employee when everything is run through one card. It creates a lack of transparency and convenience in day-to-day business operations."

Benefits of virtual cards for employees

By integrating a digital business credit card solution into your payment processes and issuing individual corporate credit cards to your employees, your company can enjoy several advantages:

Transparency & control

Imagine one of your employees is on a business trip and checks into a hotel. The client project takes longer than expected, and they need to stay two additional nights. However, their credit card limit has been reached. What options do you and your employee have in this situation?

With Pliant’s digital business credit card solution, your employee can request a limit increase directly in the app. Once approved, the higher limit is immediately available, and you can reverse the change just as easily later. There's no need to contact Pliant, as long as the company's overall credit limit hasn’t been exceeded.

Illustration: Employees submit limit increase requests directly through the app to an admin. (Image: Pliant)

Time savings

Digitizing payment processes using corporate credit cards saves both time and money. Every transaction-related process becomes faster and more convenient. Instead of filing formal requests and waiting for monthly summaries to arrive by mail, all stakeholders benefit from fully digital card and receipt management.

Employee satisfaction

From the employee’s perspective, a digital business credit card solution eliminates many frustrating processes, such as lengthy approval chains and fronting business expenses. Having to pay out of pocket and then handle expense reports can be highly frustrating for employees.

No credit check for employees

When applying for a corporate credit card for an employee, their personal credit score does not matter. Even with a negative credit score, employees can receive a personalized credit card, as the company—not the individual—is responsible for payments. To mitigate risk, companies should request a current credit report and establish a usage agreement with employees for the corporate card.

3 alternatives to corporate credit cards and their drawbacks

In the past, many companies allowed employees to use personal credit cards or bank accounts for business expenses. Today, this practice presents significant drawbacks for everyone involved. Employees assume unnecessary risks, and companies face complications when private and business expenses become entangled.

1. Employees use their personal credit cards for business expenses

In this scenario, the employee uses their personal credit card for business purchases, such as travel, and is reimbursed at the end of the month. Ideally, the employee’s account is reimbursed in time to cover the credit card bill. However, the employee still assumes liability, risks a negative impact on their credit score, and depends on timely reimbursement from the employer. If delays occur, the employee faces late fees, further increasing their risk.

Additionally, the reimbursement process is administratively complex, burdening both employees and accounting departments.

2. Corporate card transactions processed through employee bank accounts

Since 2016, EU regulations have mandated that corporate credit card transactions must be charged directly to the company’s business account and used only for business purposes. Personal accounts are not permitted. Companies must establish an agreement with the card issuer, linking the business account to all transactions.

If business travel expenses are charged to a corporate card but processed through a personal account, it creates several issues. The European Union prohibits this practice to ensure employees aren’t held personally liable and to protect their personal data. A clear separation of business expenses and personal accounts is essential.

3. Travel office cards for multiple employees

A travel office card, or company card, is a physical or virtual credit card primarily used for business travel expenses. These cards are not issued to a specific employee and do not allow cash withdrawals or in-person payments.

The procurement department or travel office typically holds the card, which is issued in the company’s name rather than an individual’s. It can be used for B2B transactions like hotel reservations, rental cars, or online purchases.

However, to cover additional travel expenses, employees will still need a corporate card or be reimbursed for personal payments.

If your company doesn’t have a dedicated procurement department and your employees are responsible for their payments, a travel office card isn’t a viable option.

Which employee should get a virtual card?

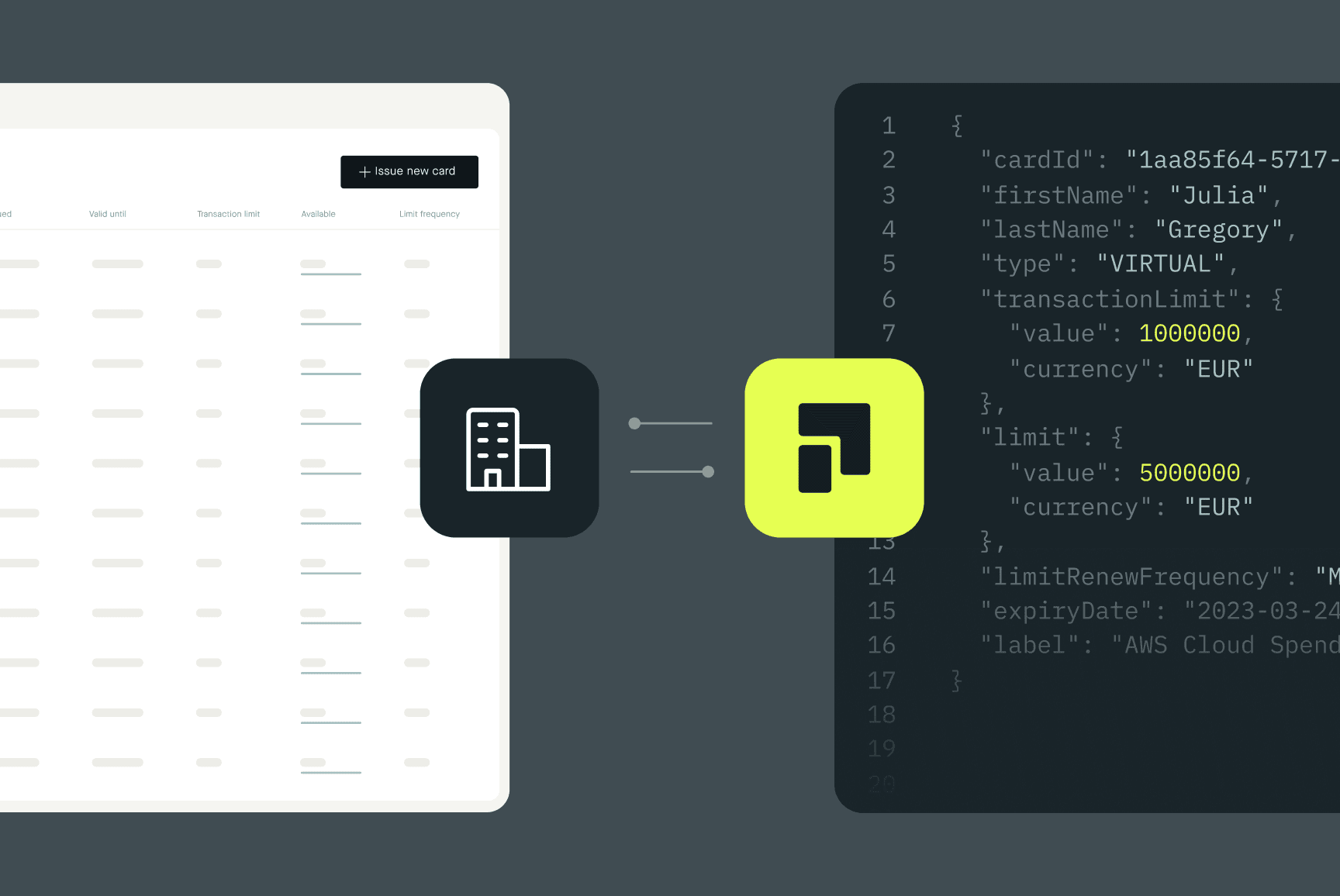

Theoretically, you can use the Pliant app to issue virtual credit cards to employees without any additional paperwork. Invite employees through the app and issue them a virtual card for immediate use, or request a physical card.

You can choose from the following card options based on your company’s needs:

Physical Cards: Pliant offers the Pliant VISA Platinum Business Card as the standard option, or the VISA Infinite Card for higher-end needs.

Virtual Cards: Create virtual cards in the Pliant app for immediate use, with no activation required. Employees can have multiple digital cards for different purposes, projects, or vendors.

Single-Use Virtual Cards: These cards are deactivated after a successful payment, ensuring the card details cannot be reused.

"Since we started using Pliant, we’ve saved an incredible amount of time. New employee card applications, which used to take weeks, now take less than a minute."

Effective expense control with employee roles and permissions

Not all employees should have full access to all card transactions. Pliant offers both an admin app and a simplified card user app, providing employees access only to their cards.

Pliant allows you to assign roles like owner, admin, accountant, card user, or team manager, to control who can access which functions of your company’s account.

Accelerate your payment processes with the Pliant Payment Apps

By using Pliant corporate credit cards for multiple employees as part of the digital credit card solution, many processes can be sped up through the Pliant App:

Budget Request: Employees can request a new credit card, suggesting rules such as monthly or transaction limits. A card label and comment field facilitate internal communication.

Approval: An admin is automatically notified of the request and can immediately create a new card or adjust the rules. All settings for both physical and virtual cards can be modified at any time in the app.

Transaction: A virtual credit card is instantly available to the employee, while a physical card may take a few days to arrive. With their personalized card, the employee makes payments within the predefined rules and usage agreement.

Receipt Capture: Employees upload the necessary receipts directly in the app

,(for example, by taking a quick photo at a restaurant,) t which is then linked to the payment.Monitoring: Accounting has access to all expense data directly in the app. They can see transactions in real-time and monitor them. Digitalizing these processes automates tedious tasks like sorting receipts or chasing colleagues for missing ones.

"The need to ask for credit card receipts or return incorrectly filled-out travel expense reports has greatly improved. Nothing is left behind. Travel expenses are reimbursed faster, and my team has all the information they need for secure tax assessments of transactions. Everyone knows where the receipts are and their status. The coordination is easier for both the person submitting the receipt and the one processing it for payment. This used to cause a lot of frustration and cost us a lot of time on both sides."

By introducing Pliant, Mr. Sander and his six-person team have saved 25% of their time due to faster receipt checks and fewer follow-ups. Read the doctari group's full experience report here.

Key considerations for virtual cards for multiple employees

Before issuing a credit card to individual employees, the following three points should be addressed:

Establish security mechanisms

Like any other payment method, corporate credit cards for employees come with certain risks. Be aware of these risks in advance. Ensure that all security features of the digital business credit card solution are used to detect misuse by third parties or even employees in time. Effective security mechanisms include:

3D-Secure and PSD2

Individual limits for each card

Real-time transparency over all transactions

Assignment of roles with individual rights for supervisors, employees, and accountants

Automatic notifications for various processes

Card blocking directly in the app

The goal of these features is for all parties to always have an overview of all transactions made with the cards and be able to take independent action if needed.

Limit liability

A framework agreement between the company and the credit card provider is established for the use of corporate credit cards, which also clarifies liability. In the event of damage caused by unauthorized use, the company is liable, not the employee. If credit card information is stolen and all security mechanisms are bypassed, the risk is limited to the affected employee's credit card limit.

Write down a usage agreement

A written usage agreement is recommended when issuing corporate credit cards to employees. This should clearly outline what the credit cards can be used for and which expenses are prohibited. This way, you are legally covered, and the liability for individual expenses is clarified.

Exclude private use

A common question arises: Can an employee use a corporate credit card for personal purposes? The answer is a clear no. The card should only be used for business-related expenses. Private payments have no place in a company’s financial records. Also, keep in mind that the company is liable for every transaction. For this reason, no payment should be accepted without receipt verification.

Define internal processes for exceptions

Despite all agreements, unwanted transactions can occur, for example, if an employee accidentally uses their corporate credit card instead of a personal one. For such exceptions, your company should have clear internal agreements in place. Swapping cards can cause accounting issues. If the employee acts deliberately, it may result in immediate termination of employment.

By adopting Pliant’s corporate credit card solution, businesses can empower employees to make faster, more efficient purchasing decisions while maintaining control and oversight over all company expenses. This not only saves time and money but also helps companies stay agile in an increasingly competitive marketplace.