Virtual credit card: Benefits, risks, and costs at a glance

Compared to other payment methods, virtual credit cards have numerous advantages. They're quick to create and issue, and you can use them instantly. To help you find the best virtual credit card for your business, we put together an extensive overview of the benefits, risks, and costs related to this digital payment method.

- What is a virtual credit card?

- How do virtual credit cards work?

- Apple Pay and Google Pay – add your virtual card to a digital wallet

- For what kind of companies are digital cards useful?

- Benefits of virtual credit cards

- How does management benefit from virtual credit cards?

- Why employees love digital cards

- Virtual credit cards integrate into your accounting

- Compare virtual credit card issuers

- What risks are associated with digital credit cards?

- How much does a virtual credit card cost?

- How to get a virtual credit card?

- Can you get a virtual credit card instantly?

- Here’s how you create virtual cards in the Pliant app

What is a virtual credit card?

A virtual credit card is just like a traditional credit card but it only exists digitally. The card number, name of the cardholder, and CVV code are all available digitally. This makes it easy to create new virtual cards as needed.

You can usually create new virtual cards in your banking app. Typically, virtual cards are available in large numbers and sometimes your plan might include even unlimited virtual cards.

Because virtual credit cards are fully digital, you can get one instantly. A physical card isn’t required so you don’t need to wait for the post to deliver it.

How do virtual credit cards work?

Virtual credit cards work like physical credit cards for online payments. You can use them to make purchases online or pay with your phone if your virtual card provider supports mobile wallets, such as Google Pay or Apple pay.

And you might be wondering: are virtual cards legal and safe?

Yes, they are perfectly legal and issued by legitimate card providers. They’re normal credit cards that just happen to be in digital form.

Virtual cards offer even greater security and speed compared to traditional credit and payment cards. They have the same security features, such as CVV code and 2-factor authentication.

One might argue that they’re even safer than plastic credit cards. Only existing online, they can’t be stolen from your wallet.

Apple Pay and Google Pay – add your virtual card to a digital wallet

Many virtual credit card issuers support digital wallet apps, such as Apple Pay and Google Pay, perhaps the most famous digital wallets.

When you connect your virtual card with Google Pay or Apple Pay, you can use your card to pay in-store with your phone. Your credit card stays always with you, without having to carry the physical card in your wallet.

📱Tip! Pliant supports Apple Pay in Germany and Austria. Connect your Pliant business credit card to your phone and use your virtual card anywhere you go.

For what kind of companies are digital cards useful?

Virtual credit cards are beneficial for all companies that have online transactions and want to streamline their subscription payments.

It’s not uncommon for a business to have several monthly SaaS payments. Virtual cards are particularly handy for these types of recurring online payments.

Depending on your needs, you can create multiple virtual cards for different purposes, projects, and merchants. As virtual cards are dedicated to certain expenses, it’s easier for management to understand and keep track of payments made by employees. This also makes accounting more efficient.

Benefits of virtual credit cards

Virtual credit cards are an essential part of a digital business credit card solution. Compared to purchasing on account or using conventional corporate credit cards, digital cards have numerous advantages.

The four main benefits are:

fast availability

better security

simplified accounting

full cost control.

Fast availability

Because virtual credit cards are digital, they’re extremely fast to issue to employees.

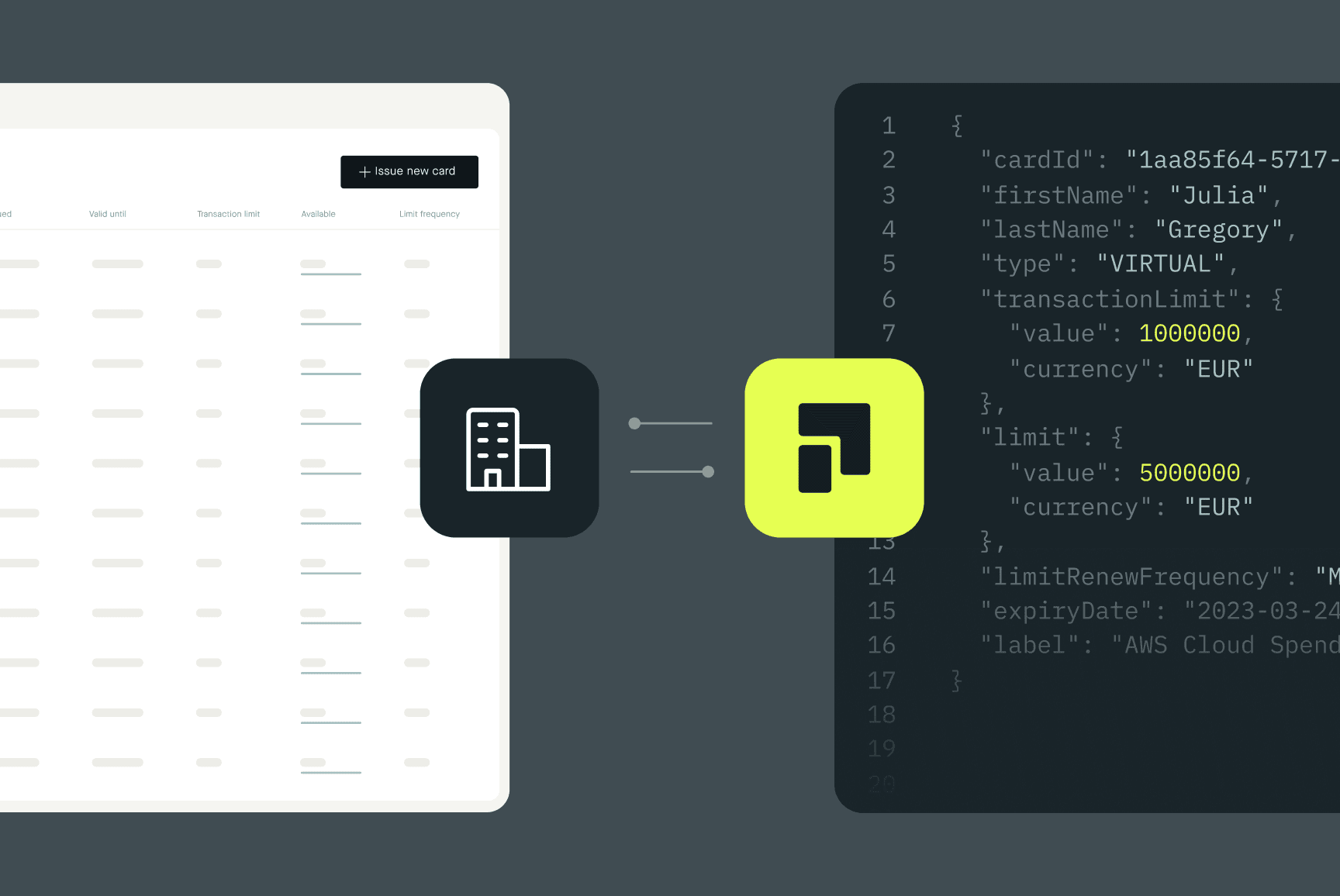

Companies can create and manage virtual credit cards directly in their card provider’s app. Admin users can set an individual spending limit for each card. There’s no need to order new cards from a bank.

Better security

If your card details get stolen, the affected card can be blocked immediately in the app. Delete the card and generate a new one in seconds. All other cards stay safe and unaffected.

Simplified accounting

Digital cards simplify accounting. Cardholders upload their receipts directly in the app, and all bookkeeping material is up-to-date and ready for accounting.

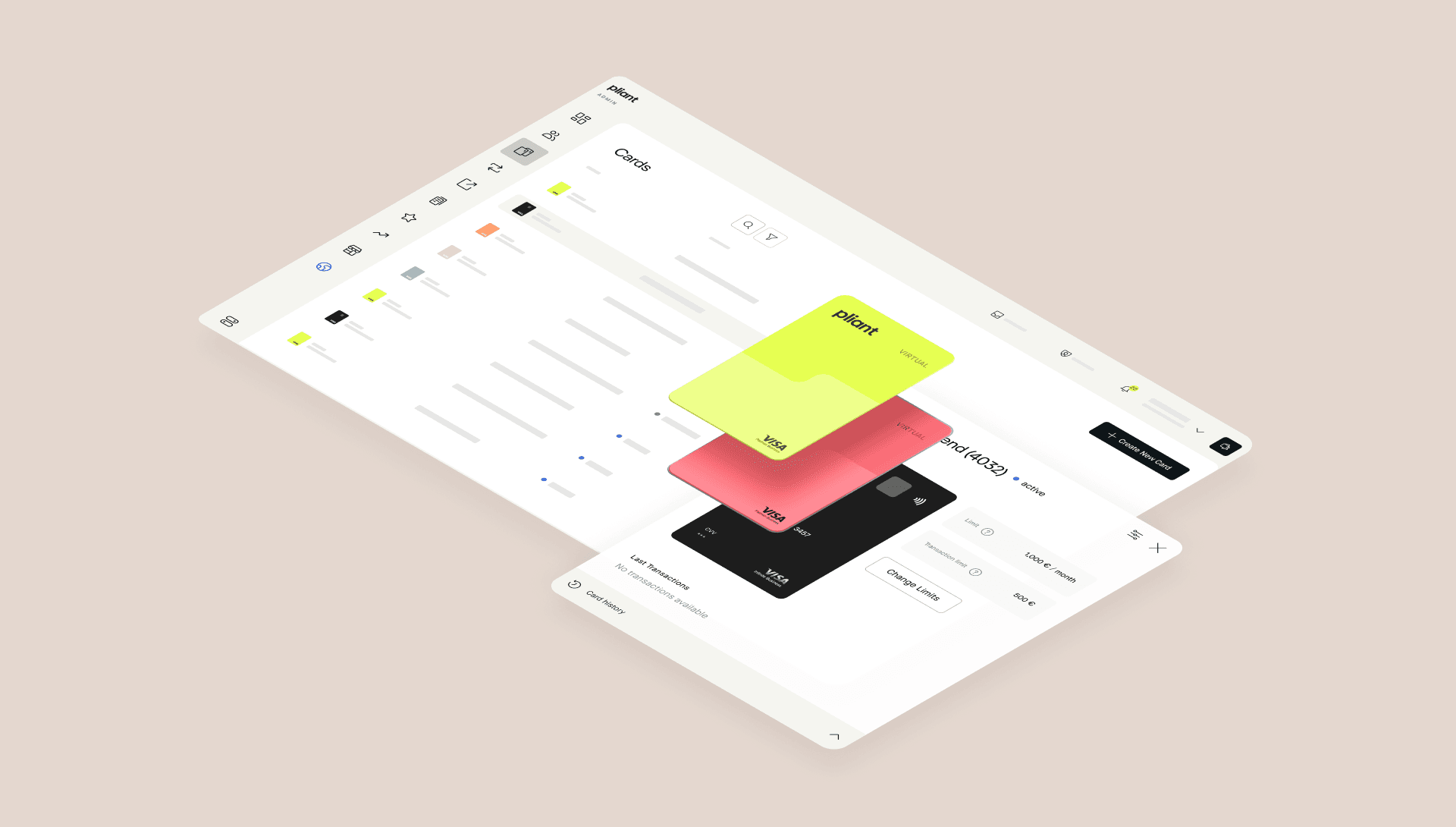

Full cost control

You have a full view and control over business expenses. You can manage your team’s cards and keep track of the transactions in the app. Ultimately, everyone involved in paying and managing business expenses benefits.

Next, let’s see how virtual credit cards make things easier for management, employees, and accounting.

How does management benefit from virtual credit cards?

Thanks to a digital expense solution and virtual credit cards, management has more control over all expenses in the company. Digitizing payment processes and spend control also saves valuable time.

In many companies, there’s only one physical card that is kept in the CEO's wallet or even in a safe.

Therefore, every transaction an employee makes must be carried out jointly with someone from management. From entering the card information to receiving the authentication code for the payment, the employee is dependent on their manager (or even the CEO).

At the end of the month, the finance team has to assign each transaction to an employee and collect receipts.

Virtual cards make expense management smoother

Virtual credit cards fundamentally change expense and card management.

Virtual cards can be created online for all employees with just a few clicks and they are ready for use instantly.

You can quickly block or delete cards in the event of misuse.

Unlike plastic cards, virtual cards won't get lost or stolen.

Virtual cards, together with a digital business credit card solution, give you the following advantages:

They increase the transparency of all transactions thanks to real-time reporting in the app.

They enable a range of controls to review expenses faster.

They are always personal, which means that each transaction can be assigned to an employee.

Payments are settled through the existing business account.

Virtual cards are available as charge credit cards with a credit limit.

💳 Tip! With Pliant, you can enjoy all the benefits of virtual cards. In addition to 5 virtual single-use credit cards, our Light plan includes up to 25 virtual cards and Live chat support. In our Standard and Custom plans, you have access to unlimited virtual cards.

Why employees love digital cards

Budget allocation can be a time-consuming process. Each expense must be approved in advance by a manager. But when an employee has a company credit card at hand, the process becomes much faster. Managers can control internal budget requests and approvals directly in the banking app.

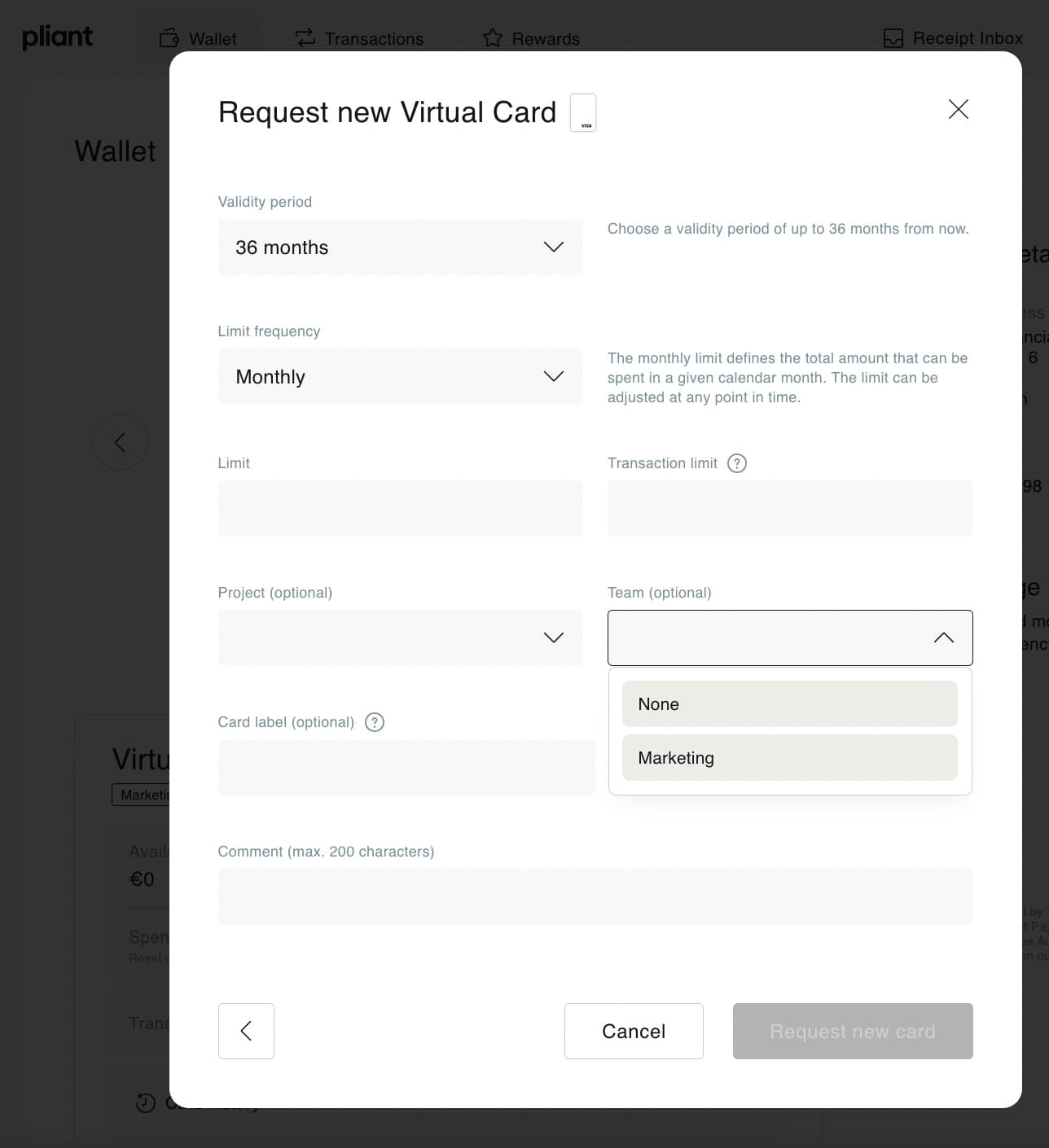

As an employee, you request a new virtual credit card from an admin user. You can suggest a validity period, spending limit, and transaction limit. If you want, you can select a project or a team and add a comment to your request. Once approved, the virtual credit card is instantly available.

Let’s take an example. You’ve been asked to organize the next Christmas party and you’ve been given a budget of 500 euros. Now, you can request a virtual card with a limit of 500 euros. You don’t have to pay any business expenses with your own money and don’t have to fill in expense reimbursement forms. Just submit all receipts in the app with a few clicks.

Virtual credit cards integrate into your accounting

Virtual business credit cards make accounting smoother. A modern digital credit card solution can solve many of the typical pitfalls in accounting. You no longer have to wait for a monthly statement to arrive in the mail – just log in to the app.

When your company digitizes receipt management, the whole accounting process becomes easier, thanks to:

automatic notifications of missing receipts

digital receipt capture – no need to sort receipts manually

real-time revision of submitted receipts

automation through integrations into accounting softwares.

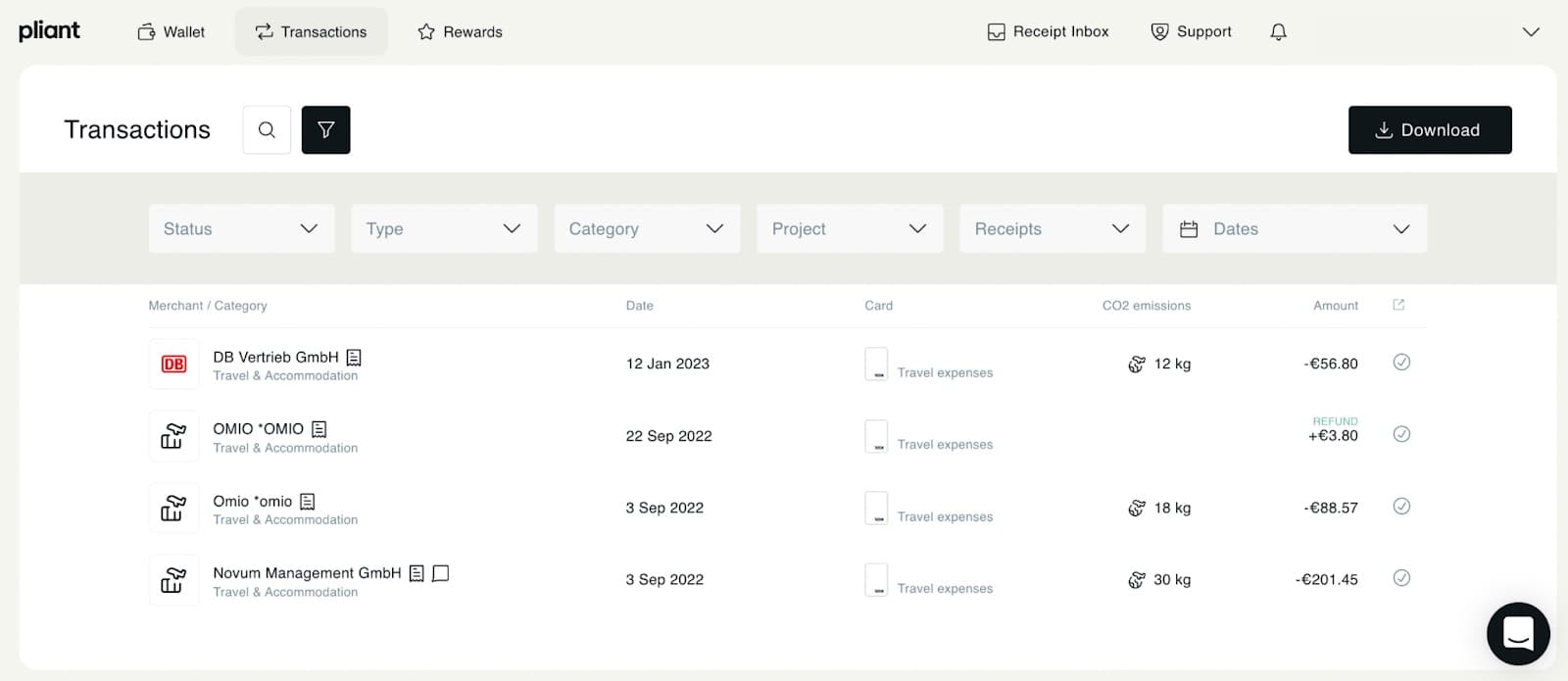

Here’s how you control even a large number of physical and virtual credit cards easily and efficiently:

all transactions are displayed in the Pliant dashboard

each transaction is matched to an employee's credit card

you get a better overview of all transactions thanks to various filters – filter payments, for example, by status, type, project, or date.

💡 Tip! In the Pliant app, you can see at any time which employee is responsible for a transaction and whether receipts are still missing. And the cherry on top: you can send all data to DATEV's accounting software or Circula's expense management system.

Compare virtual credit card issuers

Comparing virtual card issuers isn’t always straightforward. Often the differences between providers and cards aren’t apparent at a glance. That’s why we put together a simple list of criteria and features you should consider when looking for the right virtual credit card for your business.

How to find the best virtual credit card for your business

The best virtual credit card meets your business’s unique needs. Especially if you work in a large company with established processes, you might want to look into tailor-made solutions.

These questions will help you prep for your sales or demo call with a card provider:

How big a credit card limit do you need?

How high is your transaction volume?

What should your billing cycle be?

How many virtual credit cards do you need now and in the future?

What are the costs for each virtual credit card?

Are Visa or Mastercard widely accepted in your industry?

Checklist: 13 criteria for comparing virtual corporate cards

Once you know what your needs for a digital credit card are, the following criteria will help you compare credit card issuers.

Integration into your processes

Integration: can you integrate the card into the existing setup of your company?

Application: is it necessary to visit a bank branch?

Activation: how fast can you start using the virtual card?

Acceptance: where can you pay with the card?

Available cards: is the number of virtual credit cards limited?

Digital card management: how complex is it to manage the cards?

Accounting: do the cards integrate into your accounting system?

Stay on top of your budget

Billing type: does the card have a credit limit?

Costs: what are the fees per card?

Security: are there features that protect you against fraud?

Credit limit: how does the card provider determine your credit limit?

Employee expenses: can you manage, flexibly, your budgets and spending limits for the employees’ cards?

Cashback, benefits, and perks: what benefits does the card provider offer?

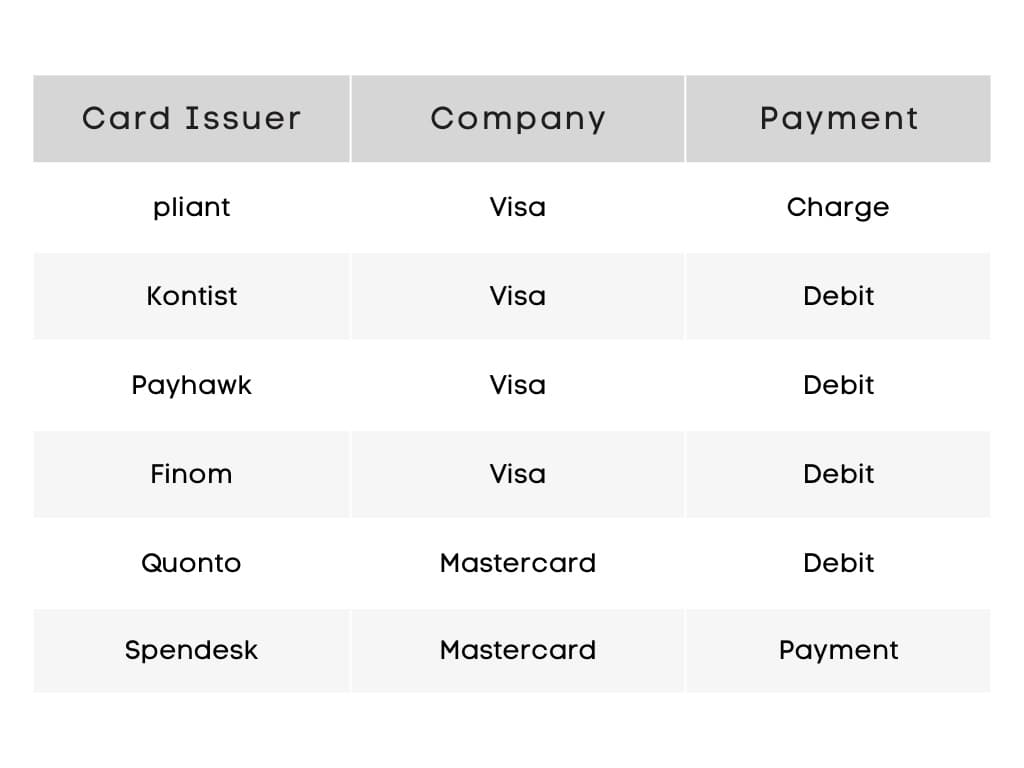

Virtual Visa and Mastercard in comparison

If you want a virtual business credit card that is accepted worldwide, Visa and Mastercard are good options.

They are accepted in over 200 countries. According to their websites, Mastercard is accepted at around 22 million and Visa at around 46 million sales points globally.

If you’re looking for a virtual credit card in Germany, Visa and Mastercard are very popular. They are widely accepted both in-store and online, as well as at ATMs.

Billing type – a key difference between virtual credit cards

Companies looking for virtual credit cards can choose between three different billing options: charge, debit, and prepaid. Revolving credit cards with a credit limit aren't yet available in Germany.

Charge card: The total sum of all transactions is charged from the business account at the end of the billing cycle. For the time between the transaction and billing, the credit card provider grants you an interest-free loan. But at the end of the billing cycle, the total amount must be paid off in full.

Debit card: All transactions are charged directly from the business account.

Prepaid credit card: Before the first payment, you must charge money to the card by depositing funds to the credit card account. If there aren’t enough funds in the account, you can’t use the card.

A charge card works much like a revolving credit card. Because the total amount of your transactions is only billed at the end of the billing cycle, a charge card adds short-term liquidity to your cash flow. The amount of your company’s credit limit depends on the credit check.

There’s one key difference between a revolving and a charge credit card. With a charge card, the total balance has to be paid off at the end of the billing cycle. With a revolving credit card, you can only pay a part of your credit card bill. The outstanding amount will accrue interest.

💳 Did you know? With Pliant, your company has one credit limit that is shared between all cards. While the total credit limit is shared, you can still set individual spending limits on your employees’ cards. This prevents the cards from being overdrawn.

A comparison of selected virtual credit card providers in Germany

To help you compare virtual credit cards in Germany, here’s a quick overview of card providers and the types of virtual cards they issue.

At Pliant, we offer flexible billing cycles. Your business account is debited monthly, every two weeks, every week, or if you wish, every day.

And because we issue Visa cards, you can rest assured that your cards, both physical and virtual ones, will be accepted worldwide.

Our virtual credit cards are just as effective as our physical cards. They have the same features, just digitally in the Pliant app.

This includes, for example, digital card management, full cost control through real-time reporting, seamless integration into your accounting software, high spending limits, and an unlimited cashback program.

If you’re looking for a virtual credit card for business, it’s smart to compare the providers. Using the 13 criteria, you can ask the right questions in your demo call with the card provider and choose the best virtual credit card for your business.

What risks are associated with digital credit cards?

Virtual credit cards meet the same security requirements as physical cards. Digital cards do not represent an increased risk. On the contrary: when the card only exists digitally, you can’t accidentally leave it on a bar counter and lose it.

When you create a virtual credit card, you set a spending limit for it. If the card is misused, you can block it immediately in the Pliant app or delete it.

Should one of your virtual cards end up in the wrong hands, your other virtual and physical cards are safe and unaffected. In the event of fraud, the risk is limited to the spending limit of the affected card.

Precautions against credit card fraud

As with any payment method, a credit card involves some risks too. That’s why it’s imperative to take precautions to prevent fraud.

According to security experts, it’s important to detect a fraudulent payment quickly and take action immediately.

With Pliant's credit cards, every time you make a transaction you receive a push notification on your phone confirming the payment. This way, you’ll be quickly alerted of any transaction that you don’t recognize and didn’t make.

The payment process is also secured by the 3D Secure standard from Verified by Visa. With this two-factor authentication (2FA), you need to enter a one-time passcode in addition to the credit card details. You’ll get the passcode via SMS, mobile app, or email.

And finally, a virtual credit card has a 3-digit security code, just like physical cards. As a Pliant customer, you’ll find the Card Verification Value (CVV) of your digital card in the app.

How much does a virtual credit card cost?

The costs of corporate credit cards vary greatly depending on the provider.

When comparing virtual credit cards, you should pay attention to these five fees:

Monthly fee: a fixed basic fee

User fee: a fixed fee per each active user

Card fee: a fixed fee for each card created, not per user

Costs for additional services: extra services may be charged separately

Foreign currency fees: transactions in a foreign currency usually incur exchange fees.

How to get a virtual credit card?

Depending on your card provider, you may be able to create virtual credit cards yourself in your banking app.

Virtual cards are based on digital card numbers (like the number you have on your plastic card). The number is generated immediately and so is the virtual credit card. You don’t need to formally apply for a card.

Can you get a virtual credit card instantly?

Yes, you can get a virtual card instantly. Once you’ve signed up for your banking app, you can create a virtual card and use it immediately.

If you’re a new customer and only signing up, you’ll first go through a credit check. Once you’re approved, you have access to virtual credit cards.

Here’s how you create virtual cards in the Pliant app

You can create a Pliant virtual credit card in seconds.

First, book a demo and learn how Pliant works – no strings attached.

You can apply for a Pliant card online, and onboarding is fully digital too.

Once the process is complete, you’ll have access to the Pliant app. With just a few clicks, you can invite your employees and manage their user rights.

You can decide individually for each employee what type of card you want to issue them.

When you issue a virtual credit card to your employee, they can use it instantly.

🤔 Something we didn’t cover about virtual business credit cards? Schedule a meeting and ask our experts.