Travel Merchants of Record: Choosing the Right Virtual Credit Card (VCC) Platform Is Key to Your Success.

For business or leisure, there’s money to be made in the travel industry – but success in this highly competitive segment demands the right strategy and the right business structure. In recent years, the transition of travel companies – especially online travel agencies (OTAs) – to the Merchant of Record (MoR) model has been a notable shift of focus: enabling more control over cash flow and the potential for higher profitability.

In this blog post, we’ll explore how Virtual Credit Cards (VCCs) can be used by travel Merchants of Record, covering how your company can benefit from a more flexible way to pay for travel services. Whether your company already uses the model, or you’re considering a transition to become a travel Merchant of Record, read on to discover:

What is a Merchant of Record?

Why are Merchants of Record important in the travel industry?

Reasons why (and why not) to become a travel Merchant of Record

How Pliant helps travel Merchants of Record succeed:

Increasing margins

Increasing efficiency

Increasing foreign exchange effectiveness

Pliant: Your Credit Card Partner for the Travel Industry

At Pliant, we understand the challenges of finance in the travel industry, because we talk to business owners and CFOs about them every day. We’re here to help you succeed. Throughout a series of articles, we’re diving deep into the potential ways to increase margins, working capital, and efficiency: providing you with the inspiration and expertise to grow your business with Pliant.

Want to talk to us about it? Get in touch with a Pliant expert today for a free, non-binding demo.

What Is a Merchant of Record?

The simplest way to define a Merchant of Record is – in the words of Chargeback Gurus – when a consumer makes a payment transaction, the name that appears on their billing statement is that of the Merchant of Record.

In the most simple case, the company with a product to sell – be it a flight ticket, a pair of jeans, or a banana – will be its own Merchant of Record. In this case, the transaction is limited to the seller and the buyer.

However, being the Merchant of Record is a responsibility, and the bigger a business grows, the bigger that responsibility becomes. As well as actually accepting payments from customers, an MoR will take care of financial details like currency conversions and taxes. This is especially important for online businesses and digital platforms, who may not have the resources to process payments in-house.

As such, many suppliers, including those in the travel industry, will delegate the responsibility of being the Merchant of Record to a different company, for example the travel agency who sells the ticket. This has benefits for both parties:

The supplier can save resources on payments and customer service, enabling them to focus on operational efficiency.

The Merchant of Record can cover more parts of the payment process, and can (to an extent) influence the price that the end customer pays, giving them control over margins.

Why Are Merchants of Record Important in the Travel Industry?

If you run an online travel agency (OTA), there are two main ways in which you can facilitate the sale of tours while retaining a profit for your own company: the Agency (Pass-Through) Model and the Merchant of Record Model.

Using the agency model, you essentially act as the “middle man.” When your customer passes through your online travel agency, their payment will first go to the supplier, who will then pay out a percentage to your business. In this case, the airline, hotel, or bed bank will act as the Merchant of Record, and has a lot more control over when payments are made, including to your business.

On the other hand, with the Merchant of Record model, you will receive the cost of the booking from the customer directly, then pay the supplier the agreed cost of the package, maintaining your profit margin.

This is an important distinction, and there are several specificities to the travel industry that make the Merchant of Record model an increasingly important part of operations both for suppliers and online travel agencies.

Regulation. Customers in the international travel market are especially well protected against cancellations and delays, which makes the organizational effort of managing refunds and chargebacks an unavoidable reality. These can be painful for smaller hotels, which is why the reward of outsourcing the merchant function is high.

Internationalization. In an industry where global transactions are common, the MoR manages different currencies, addresses compliance issues, and navigates the complexities of financial regulations.

Price pressure. With customers more prepared than ever to shop around for good travel deals, outsourcing the merchant function gives the OTA greater autonomy over marketing and enables suppliers to benefit from their economies of scale.

Why Do Online Travel Agencies Want to Become Merchants of Record?

While becoming a Merchant of Record is a responsibility that could appear to be more effort than it’s worth, taking on the role can be extremely profitable for travel agencies – especially online travel agencies – as a form of vertical integration.

Among the most important aspects of the model is the ability to set the price for travel products like flights and hotels, in a way more similar to a tour operator or a bed bank, as well as to charge for extra services.

Essentially, OTAs switching to the Merchant of Record model will see the benefits from new revenue streams as outweighing the operational burden that becoming an MoR entails. In fact, by passing conversion costs, booking fees and the like onto end users without the need to pass a percentage onto the supplier, they can use these extra responsibilities to their advantage.

Example: Booking.com

One of the most publicized (and successful) transitions to the Merchant of Record model has occurred at Booking.com. The OTA giant is gradually changing the core of its business, and changing the outlook for the entire travel segment as a result.

According to Pablo Delgado at Mirai: Four out of ten (40%) Booking.com reservations in Q1/2022 were processed through the OTA’s payment platform, an 48% increment compared to the last year (Q1/2021 accounted for 27%) and twice as much as just four years ago (2018) when the number was 20%.

The report shows just how much extra scope for growth that Booking.com can achieve with the merchant model, and the reasons why it has the potential to define the online travel industry – for suppliers as well as competitor OTAs.

Why Travel Businesses Choose Not To Become Merchants of Record

Naturally, Booking.com benefits from its enormous size, and that specific example may not be the one that’s best for your business to follow. Smaller Online Travel Agencies (OTAs) may decide against becoming Merchants of Record (MoR) to mitigate resource constraints and operational challenges.

For these businesses, managing payment processing intricacies, complying with industry regulations, and handling the technical aspects of becoming an MoR can be overwhelming. Instead, they might opt for third-party payment solutions that specialize in these services.

VCCs: Challenges and Opportunities for Merchants of Record

With the Merchant of Record model, supplier payment generally occurs with a Virtual Credit Card (VCC) payment solution. VCCs are instrumental in the Merchant of Record (MoR) model because of their relative flexibility and security, with the potential to integrate card issuance systems into various types of booking systems.

Although card providers charge a transaction fee for their services, leveraging VCCs can help businesses keep their acquisition costs low: making the MoR model more effective. The fees are offset by the benefits of simplified payment processing, compliance management, and global transaction capabilities – as well as the potential for rebates (or “cashback”) on high-volume purchases.

Pliant and How Merchants of Record Can Use VCCs

1. Customer Purchase. The process begins when a customer makes a booking through the OTA. This will trigger the reservation of the flight or hotel room from the supplier. As the Merchant of Record, the OTA collects payment from the customer via their chosen payment portal.

2. OTA creates a VCC. The OTA uses a platform like Pliant to issue a virtual credit card, which helps them make a payment to the flight or hotel supplier or an intermediary like a bed bank. As each transaction has its own VCC number, it is easy for the OTA to track the transaction and match it with internal payment records. This also reduces the risk of fraud, as card usage can be limited to single transactions or transaction types.

3. OTA makes the payment to the supplier or intermediary. Using the VCC, the OTA completes the transaction. As no human interaction is involved, this is generally much more efficient than manual invoicing.

4. The OTA settles with the card provider. The OTA will then need to pay the balance on the issued VCCs, as well as the transaction charges, with the card provider. This can either be “pre-funded”, paid in advance, or settled via an invoice at agreed intervals.

VCCs for Merchants of Record: The Benefits

The key benefit of the VCC model is control. VCCs give travel merchants of record a lot of influence over the transaction flow and the resultant settlement intervals, which in turn allows them to adapt the system so that it results in greater profitability for the OTA.

Essentially, the success of the Merchant of Record model depends to a huge degree on the card provider you choose to handle your payments as a Merchant of Record. You will need to ensure that:

The payment platform and VCC issuance system is technically capable of handling the complexity and the volume of transactions you need to make, and has the potential to scale.

The card provider offers the optimal financial terms for you to make your Merchant of Record model a success.

The good news? Pliant is a market leader in both aspects, as you can find out below.

How Pliant Empowers Travel Merchants of Record with VCCs

Pliant Virtual Credit Cards can be integrated into the Merchant of Record model for flight and hotel bookings. By doing so, OTAs gain a streamlined, secure approach that enable them to scale their businesses and unlock unexplored revenue streams

Here are the top 3 ways that your business can benefit from Pliant.

1. More Payments. More Cashback. More Revenue.

They say you’ve got to spend money to make money, and that’s especially true when comparing the Merchant of Record (MoR) model with an agency structure.

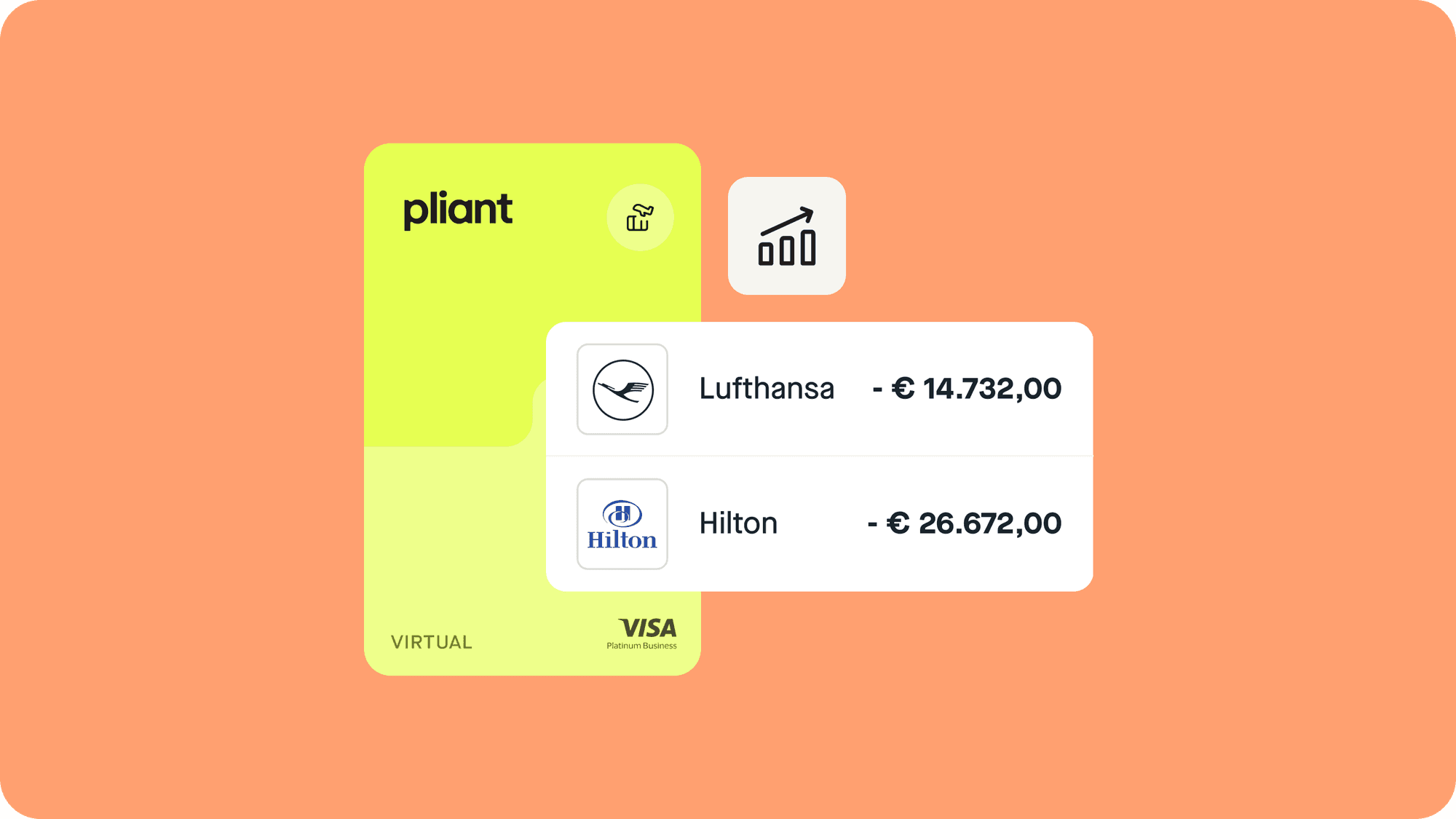

The reason for this is simple: cashback. As a Merchant of Record, even a moderately sized online travel company will make payments worth tens of thousands of dollars on a daily basis, owing to the size of the transactions made and the frequency they occur.

This means that getting even a small percentage of this revenue back as cashback can make a massive difference to your overall profitability, essentially increasing the margin on each product that you sell.

Data from Lendingtree suggests that the average cost of a domestic plane ticket was $381.55 in the first quarter of 2023. Even at 1% cashback, that means around $600 of extra revenue could be made per sold-out Boeing 737 – a low-effort and endlessly scalable source of revenue for your OTA.

Get Bigger Rebates: How Pliant Can Help You Succeed

Pliant's Virtual Credit Cards (VCCs) provide travel Merchants of Record with increased margin flexibility thanks to cashback incentives on large purchase volumes.

Likewise, Pliant VCCs offer the freedom of flexible billing cycles and high credit limits, reducing exposure to cancellations and optimizing cash flow management. This financial agility allows MoRs to maximize revenue and navigate the intricacies of the travel industry with confidence.

Find out more about ways to increase margins for your travel company.

2. Payments to Suppliers: Reduce Wastage with Integration.

One of the major drawbacks of the MoR model is the challenge of excessive paperwork. Manual payment processing for invoices and 3DS checks on credit card transactions can block scalability and increase support costs, wiping out the potential advantages of the system.

However by incorporating payment solutions into their existing systems via APIs, Merchants of Record can eliminate the errors and confusion of manual accounting processes. Automation reduces paperwork, enhances efficiency, and allows for seamless scalability.

Automate Payments: How Pliant Can Help You Succeed

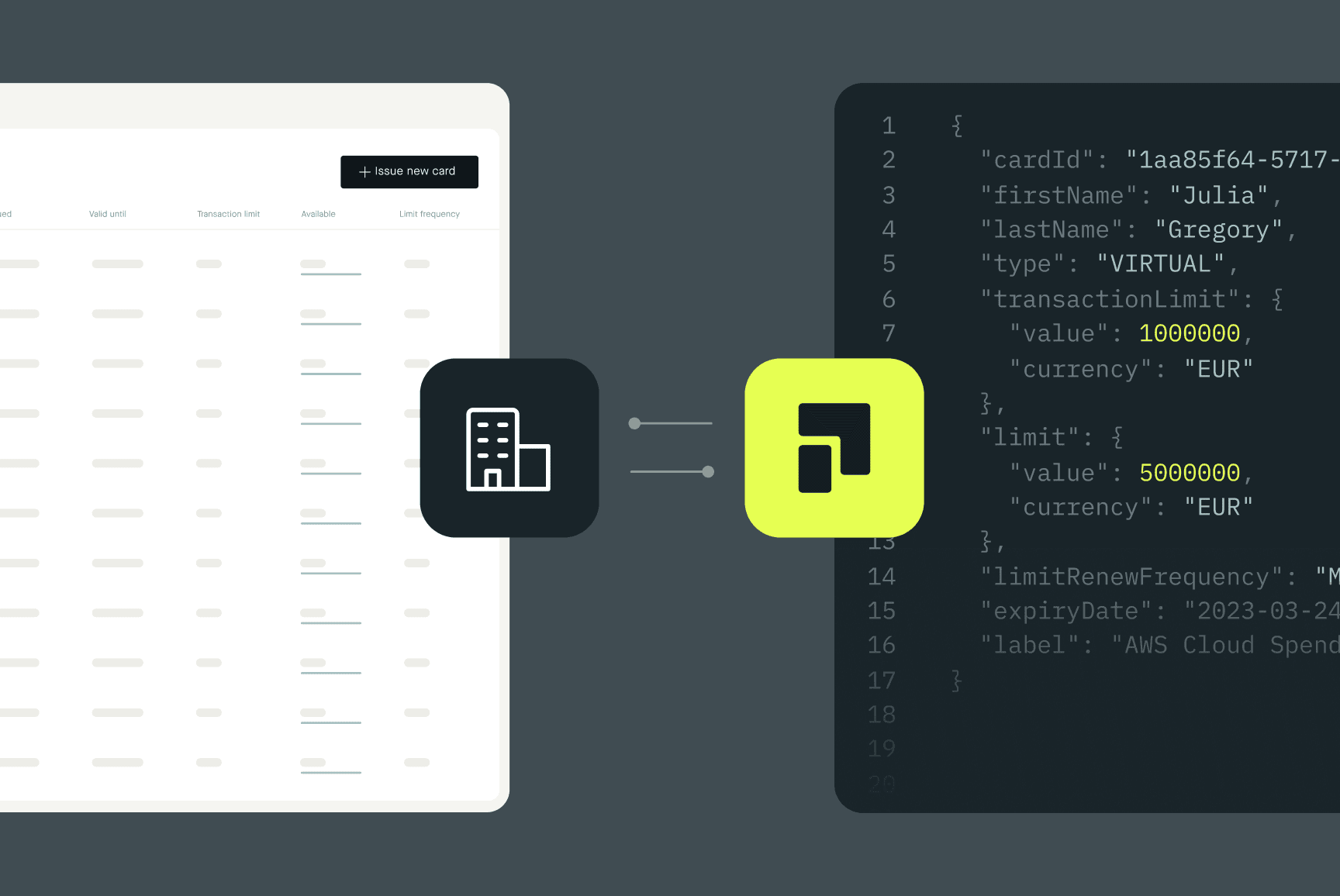

Pro API is central to the success of Merchants of Record worldwide. By plugging card issuance capabilities into your existing system, and providing the technology to automate payments to suppliers and the resultant reconciliation processes, your OTA can reduce its administrative costs while leveraging the advantages of VCCs.

Better yet, the Pliant Travel Purchasing Card is exempt from 3DS. This means that authentication time is saved, while security and efficiency are maintained.

Our API-driven approach streamlines financial transactions for MoRs, allowing them to allocate resources more efficiently and navigate the complexities of the travel industry with a secure, time-saving payment solution.

3. International Transactions

Especially for travel agents operating on an international scale, the Merchant of Record model can present serious challenges concerning foreign exchange fees. Your business may be affected by the fluctuating nature of exchange rates, which can lead to unexpected additional costs, impacting profit margins.

To mitigate these challenges, travel Merchants of Record should consider the impact of exchange fees while selecting a Virtual Credit Card (VCC) supplier. Choosing a platform with favorable currency exchange rates can minimize the impact of foreign exchange rates, while avoiding unnecessary fees is also key to optimizing profitability in a global marketplace.

Reduce Exchange Rate Costs: How Pliant Can Help You Succeed

Pliant's Virtual Credit Cards stand out for Merchants of Record by offering a superior solution with fair exchange fees and Forex rates.

This lessens the burden of additional costs associated with international transactions, ensuring that MoRs can optimize their profit margins. Pliant's commitment to transparent and favorable Forex rates provides MoRs with a cost-effective and efficient payment solution. The result: seamless global transactions without the financial burden of exchange fees.

Start Making Merchant of Record Work for You

Harnessing the power of the Merchant of Record model can help your business streamline financial operations and enhance customer experiences. Coupled with Pliant's Virtual Credit Card and Pro API solutions, it has never been easier for Merchants of Record to be successful in the travel industry.

If you’re a Merchant of Record, don't miss out on the Pliant advantage – start making it work for you today. Book your Pliant demo and learn how our solution can elevate your travel company.