TMC-tailored virtual credit cards: Cashback at your fingertips

Travel Management Companies (TMCs) make business travel easy for their clients. A powerful modern corporate credit card solution ensures that TMCs’ internal processes and operations run equally smoothly.

- 1. Cashback improves TMCs’ margins

- 2. Use Pliant's API to streamline ticketing

- 3. Pliant is fast and easy to use

- 4. High credit limits keep payments reliable

- 5. Leverage Pliant's powerful integrations

- 6. Get started quickly

- 7. Pliant's virtual cards program open up new business opportunities for TMCs

- 8. Faster reconciliation and smoother monthly closing

- 9. Strong Customer Authentication (SCA) exemption

- 10. Broad acceptance by travel providers

- 11. Maximum efficiency with SUVs

Here’s how Pliant’s credit card solution enhances TMCs’ operations

1. Cashback improves TMCs’ margins

Competition is tight in the travel industry and this can lead to thin margins. To improve margins and profit, Pliant credit cards feature a generous cashback program that rewards high card spending. For every euro spent, your company receives a percentage back.

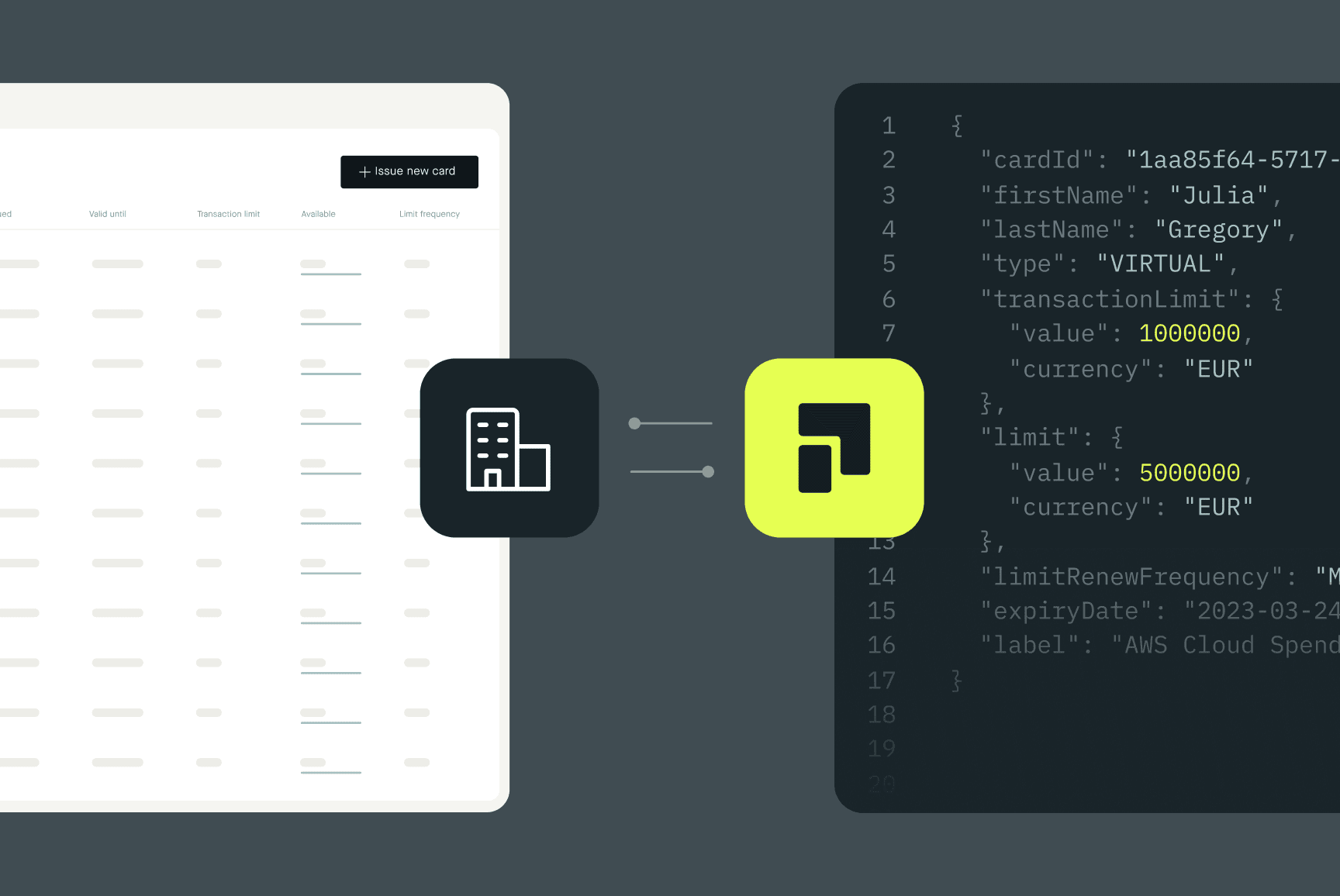

2. Use Pliant's API to streamline ticketing

TMCs can save time and reduce errors by automating the entire ticket purchasing process with our API.

With a few simple integrations, TMCs can seamlessly connect their back-office systems to Pliant for automated ticket purchases and instant payment reconciliation, streamlining operations and increasing efficiency.

3. Pliant is fast and easy to use

Pliant is 100% digital. In the Pliant app, you can manage card settings, create new cards, track expenses, and allocate budgets.

Create new virtual cards with a push of a button. Managers can issue virtual credit cards for their teams in a matter of seconds.

Save receipts instantly. Employees can store receipts digitally, saving the accounting team from collecting receipts at the end of the month.

4. High credit limits keep payments reliable

Because their clients often want to pay with an invoice, TMCs’ working capital can be tied up in long payment terms of customer invoices. Luckily, a corporate credit card with a high credit limit keeps cash flow running and sufficient funds always available. Pliant offers high credit lines that match your company’s spending needs.

What’s more, our payment terms are flexible. Choose how often you pay the credit card bill and free up the balance for new payments.

5. Leverage Pliant's powerful integrations

Pliant’s solution integrates seamlessly with TMCs’ existing technical setup. We offer several ready-made integrations to the most common accounting, invoice management, travel expense, and other financial solutions.

But if you have a custom setup, that’s no problem either. With our API, you can integrate Pliant directly into your back office systems. Fetch payment data automatically or issue virtual Pliant credit cards via API.

6. Get started quickly

Onboarding with Pliant is fast. This allows you to get started with your new credit cards quickly.

And once you’re onboarded, you can create and issue virtual cards instantly.

7. Pliant's virtual cards program open up new business opportunities for TMCs

TMCs can unlock new business opportunities with Pliant’s virtual cards program that’s tailored to the travel industry.

The dedicated virtual cards program allows TMCs to issue virtual cards automatically through the API. This way, a new virtual card can be created for each travel-related transaction. It all happens automatically, and the payment is instantly reconciled. Easy for the TMC and their end customers.

8. Faster reconciliation and smoother monthly closing

By using virtual cards, i.e. one card for each transaction, the process of reconciling expenses and closing monthly accounts becomes much faster. Virtual card transaction data is conveniently available in CSV format, with all details for easy tracking and accounting.

9. Strong Customer Authentication (SCA) exemption

The advantage of VCCs is that they are not required to be 3D Secure. This waiver ensures that VCC transactions are not blocked by authentication problems, making travel and other transactions more seamless and reliable.

10. Broad acceptance by travel providers

Pliant credit cards, including Virtual Credit Cards, are widely accepted by travel providers as a recognized and trusted form of payment.

11. Maximum efficiency with SUVs

Single Use Virtual Cards (SUVs) are ideal for travel purchases. They provide an extra layer of security because each booking is made with a separate card. By using SUVs, you can reduce the risk of fraudulent transactions to a minimum because each virtual card is limited to a single transaction at a time. If the information on one SUV is compromised, it won't affect other travel expenses.

You can learn more about the benefits of virtual cards for TMCs here.

Ready to make the switch to modern corporate credit cards? To learn more about Pliant and its features, book a demo with our team of experts.