Solving marketing agencies’ woes with the right digital payment solution

Marketing agencies have been instrumental in the way businesses approach advertising and promotions. Their expertise in creating compelling multichannel campaigns has helped companies of all sizes and industries reach their audiences and grow their customer bases. But despite the significant value they bring, marketing firms often encounter their own obstacles when it comes to managing their operations.

One of the most pressing issues is the difficulty of managing payments and expenses, particularly when it comes to collecting receipts, staying within credit limits, and ensuring flexibility in their financial operations.

Traditional physical credit cards can be cumbersome to use in these contexts and often fail to provide the flexibility and functionality needed to manage complex financial transactions.

And regardless of their area of expertise or service offering, marketing agencies have one thing in common: the need for a modern payment solution that will streamline their operations with minimal effort and maximum profit.

Fortunately, virtual credit cards provide a solution to these challenges and simplify payments for marketing agencies.

In this article, we'll show you how marketing agencies are using virtual credit cards to increase revenue and streamline operations with ease.

Why do marketing agencies need to adopt Virtual Credit Cards (VCCs) to remain competitive?

It's important for marketing agencies to stay on top of the latest payment technologies, such as virtual credit cards, to avoid falling behind competitors who have already adopted these innovative payment solutions. Doing so is critical to meeting the needs of both their clients as well as their own staff.

Some of these benefits are:

High payment frequency: Virtual credit cards offer marketing agencies the benefit of high payment frequency, which means that they can make payments on a more frequent basis when compared to traditional credit cards. It can also help you manage your cash flow and keep your vendor/partner relationships strong.

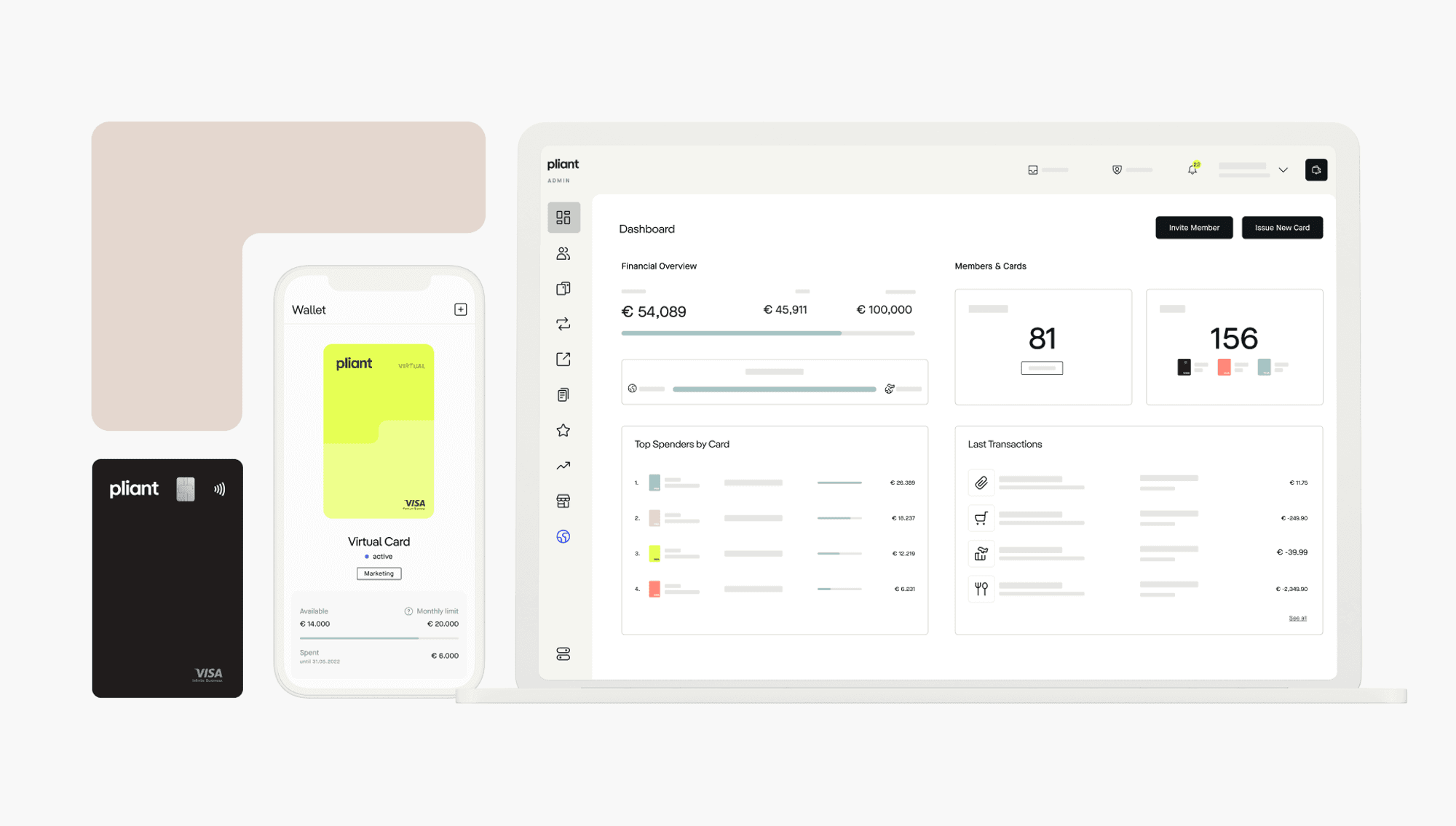

Real-time reporting: With instant access to transaction data, marketing agencies can monitor their spending in real time, accurately track expenses, and gain valuable insight into their financial performance through the use of virtual credit cards.

Downloadable transaction histories: Marketing agencies can easily access and download detailed records of their card transactions, which can be useful for offline analysis, integration with accounting systems, or sharing with stakeholders.

Card limits: This feature provides enhanced control and security for marketing agencies that manage multiple cards for different employees or departments. By assigning limits to each card, agencies can prevent overspending, manage budgets more effectively, and reduce the risk of unauthorized or excessive charges.

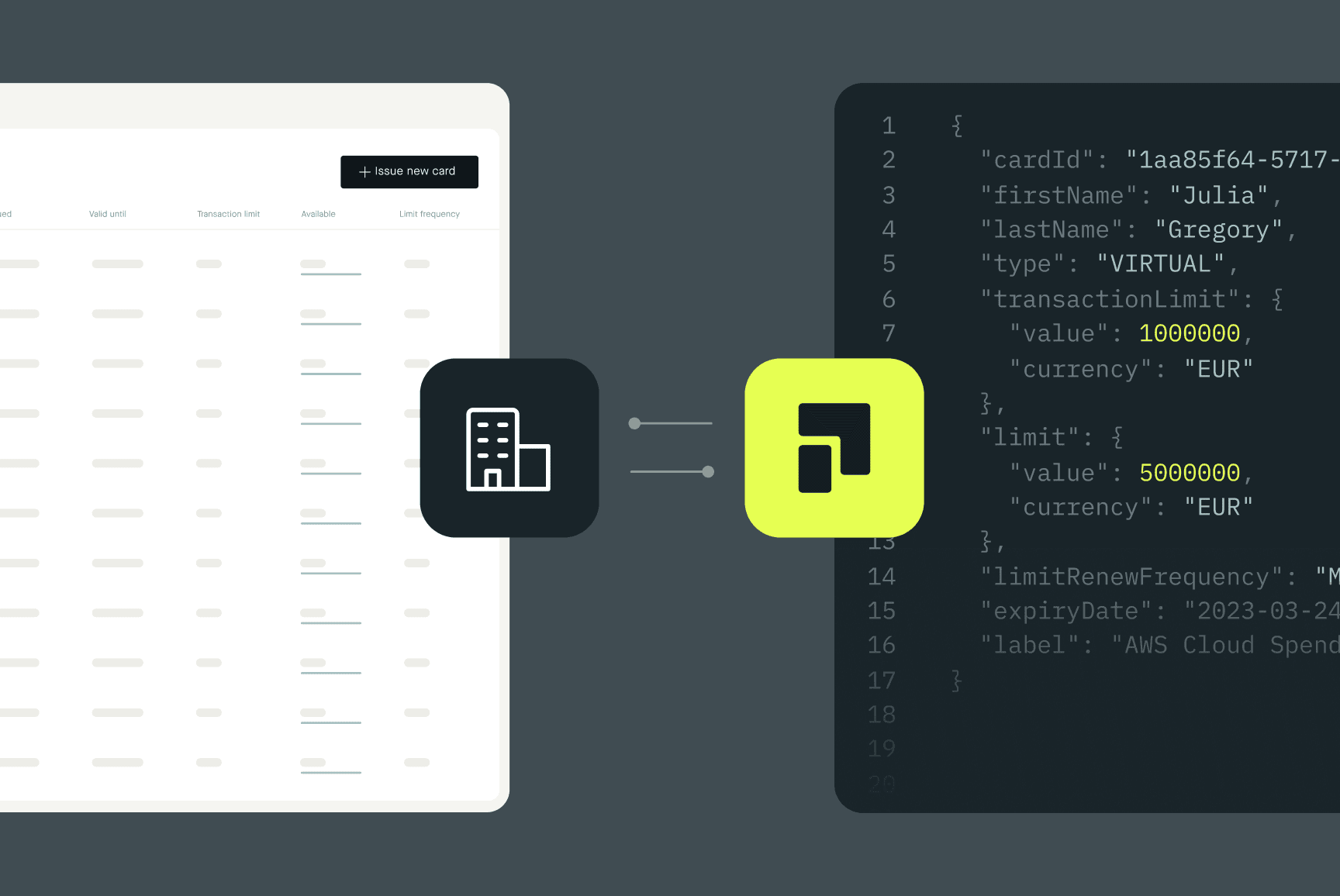

Streamlined expense management: Quick issuance of virtual credit cards across multiple accounts and employees simplifies the payment process and reduces time and effort tracking expenses.

Increased financial flexibility: With virtual credit cards, marketing agencies gain greater financial flexibility, enabling them to quickly adjust spending limits and budgets as needed to meet changing business needs.

Generous rewards: Offering cashback on every transaction, virtual credit cards can be a lucrative supplemental revenue source.

Disadvantages marketers face with traditional credit cards

Physical (and antiquated) credit cards: Many marketing agencies still use physical credit cards that are difficult to manage and track. These cards require manual processes for reconciliation and expense tracking, which can be time-consuming and error-prone. In addition, physical cards can be lost or stolen, leading to fraudulent activity and financial loss.

Lack of credit card limits and flexibility: Marketing agencies may face challenges in obtaining high enough credit limits on their physical credit cards to support larger campaigns or investments. In addition, physical cards may not offer the same level of flexibility as virtual credit cards, which can limit the agency's ability to efficiently manage complex financial transactions.

Unreliable fraud detection systems: Operating physical credit cards can be challenging due to fraud detection systems that can disable cards without warning. This can disrupt ongoing campaigns or cause delays in critical payments.

High monthly or annual fees: Some marketing agencies may turn to expensive solutions, such as business credit cards with high monthly or annual fees, to solve their payment challenges. This can be costly and may not provide the necessary level of flexibility or convenience.

Misleading travel-only mileage schemes: Some credit card companies offer misleading mileage programs that can only be used for travel-related expenses. This can limit an agency's ability to use rewards or cashback programs for other types of expenses.

Complicated receipt collection and general card issuance for employees: Managing receipts and issuing cards to employees can be a challenge with physical credit cards. This can lead to delays or errors in expense tracking and reconciliation.

Difficulty balancing profitability and workload: Agencies are constantly looking for ways to increase margins and profits without increasing workloads. Adopting virtual credit cards can help streamline their operations, reduce costs and improve efficiency, ultimately leading to higher profits.

The benefits of VCCs for marketing agencies: A scenario-based analysis

The rise of virtual credit cards has revolutionized the way marketing agencies manage their expenses. While some agencies have embraced this technology and are reaping the benefits, others are struggling to keep up with outdated payment systems.

Let's take a closer look at a scenario in which a performance marketing agency is using virtual credit cards effectively, while a social media agency is struggling to manage their expenses with a traditional physical credit card.

The performance marketing agency, which uses virtual credit cards, is able to issue cards instantly to their clients and staff members for various expenses. They have integrated their payment system with a virtual card provider, allowing them to easily create and manage multiple cards with customized spending limits for each individual. This means that staff members can make purchases without having to wait for approval from their managers, and clients can receive reimbursement for expenses quickly and easily.

In contrast, the social media agency is struggling to manage their expenses with a traditional physical credit card that has a blocked credit limit. Since the credit card is shared by the entire company, it can be difficult to track who made each purchase and for what purpose. Additionally, if multiple staff members need to make purchases at the same time, they may be unable to do so if the credit limit has been reached or blocked. This can lead to delays in payment and a lack of transparency in the company's financial records, causing frustration for both staff and management.

In a nutshell…

Virtual credit cards can offer numerous benefits to marketing agencies looking to optimize their payment solutions.

For starters, these digital payment solutions allow agencies to enjoy increased purchasing power with higher spending limits.

They also enable streamlined expense management and greater financial flexibility.

Agencies can also take advantage of better foreign exchange rates with their virtual credit cards.

Finally, virtual credit cards offer generous per-transaction rewards that can further strengthen agency finances.

In conclusion, virtual credit cards are a powerful tool for marketing agencies looking to stay ahead of the competition and achieve long-term success in today's fast-paced business environment.

To discover how other marketing agencies are experiencing the advantages of our best-in-class corporate credit card solution, click here.