Payment Automation: How Travel Companies Can Increase Efficiency with Virtual Credit Cards (VCCs)

As an intermediary, success in the travel industry is all about efficiency: moving your slice of the billion-dollar market from your customers to your suppliers, and keeping as healthy a margin as possible for yourself. In an environment where seamless transactions and operational efficiency are must-haves, the travel industry is undergoing rapid changes in financial technology (fintech): with innovative solutions to make transactions faster, easier, and more profitable. At Pliant, payment automation for travel companies is an area we’re passionate about – because we’re helping customers around the world implement the tools they need to maximize their gains.

Embracing virtual credit cards (VCCs) for your travel company is a huge step toward enhancing financial processes, optimizing resource allocation, and fortifying against potential risks. In this blog post, we’ll explore payment automation, discover what makes it so important, and look into its transformative impact on the travel sector. Whether you’re involved with an Online Travel Agency (OTA), Travel Management Company (TMC), Tour Operator, or Bed Bank, this is your one-stop guide. Specifically, we’ll cover:

What is Payment Automation?

What Are the Benefits of Payment Automation?

Payment Automation and Travel:

For OTAs

For TMCs

For Tour Operator

For Bed Banks

Meet Pro API: Payment Automation for the Travel Industry

How Travel Companies Benefit from Payment Automation

Improve Process Efficiency

Skip 3DS Checks

Reduce Fraud

Integrate With Tools You Already Use

Pliant: Your Credit Card Partner for the Travel Industry

At Pliant, we understand the challenges of establishing healthy working capital in the travel industry – as well as countless other financial obstacles faced by travel agencies, TMCs, and OTAs – because we talk to business owners about them every day. We’re here to help you succeed. Throughout a series of articles, we’re diving deep into the potential ways to increase margins, working capital, and efficiency: providing you with the inspiration and expertise to grow your business with Pliant.

Want to talk to us about it? Get in touch with a Pliant expert today for a free, non-binding demo.

What is Payment Automation?

A payment is, according to Investopedia, the transfer of money, goods, or services in exchange for goods and services in acceptable proportions that have been previously agreed upon by all parties involved. An automation, according to IBM, is the use of technology to perform tasks where human input is minimized. Together, they make payment automation: the process of using technology to perform the process of transferring money for services automatically.

Instead of doing things like processing invoices and transferring money manually, payment automation lets companies set up systems to handle these tasks on their behalf. This simplifies the way companies pay their suppliers: they can use virtual credit cards and other tools to perform the transfer of money without needing someone to do it all by hand, and a lot of the “drone work” is taken care of at the same time.

The general idea is that, by automating payments, companies can save time and reduce the chance of mistakes or security issues: reducing paperwork and focusing more on the activities that actually grow their business. However, the flip side to this is that it places an incredible amount of trust in the system responsible for payment automation, which makes the choice of payment automation method – e.g. wire transfers, direct debits or (virtual) credit card – as well as the individual supplier extremely important.

Payment Automation: Making Payments vs. Receiving Payments

If you look at the recent transactions on your online banking app, you’ll quickly notice that payment automation is everywhere: from Netflix and Spotify to tax authorities, big players have become very adept at moving money from the customer to the business.

However, it's important to clarify that this article focuses on the process of making payments rather than receiving them. While both aspects are integral to financial operations, payment automation with virtual credit cards (VCCs) is an area that Pliant is well placed to help you and your travel company solve: from improving process efficiency to reducing fraud risk.

What Are the Benefits of Payment Automation?

Payment Automation Makes Business Faster

Compared to manual alternatives, payment automation is incredibly fast: boosting the speed of transactions and enabling the swift, efficient processing of payments. This agility is particularly beneficial for time-sensitive transactions, ensuring that funds are disbursed promptly and that they are paid to the correct accounts with the relevant reference information.

However, if you consider that 591 million hotel rooms were reserved with booking.com in 2021, then you begin to understand the true benefit of the ability to process payments rapidly: scale. At a conservative 1 minute per transaction to do this manually, booking.com would need more than 3000 full time staff just to process the payments that the company needed to make to hotels and other accommodation… and nothing else. Likewise, actually growing the business would be problematic, as the ratio of sales growth to staffing growth would be 1:1 – less than ideal.

As such, if your travel company has ambitious growth goals, payment automation needs to be an essential part of your outlook.

Payment Automation Saves You Money

All business owners navigate the minefield of staffing costs: investing in the right people can propel your business to success, but an inefficient team can drag a company down. Payment Automation helps companies save significant money by streamlining payment processes such as invoice processing and fund transfers.

Although you’re unlikely to be operating at the same scale as booking.com, the staff hours spent processing manual payments will accrue to the stage that they cost noticeable sums of money per month – hurting your cash flow. By reducing labor costs, you can free up valuable resources for other activities.

Better yet, payment automation – specifically with Virtual Credit Cards – offers the opportunity to open new revenue streams with rebates. You can find out more about that in our article on growing margins for your travel company.

Payment Automation Is Reliable

People make mistakes: they can mistype account numbers, forget to make payments, or omit crucial information. Likewise, trying to locate and rectify mistakes retroactively can be enormously time consuming. In fact, exactly this happened in the financial industry, when a clerical error resulted in $900 million being “accidentally” dispersed by Citibank. Countless smaller errors occur in every company, most days of the week.

However, payment automation significantly reduces the occurrence of errors in payment processes within companies. By automating tasks like data entry and reconciliation, the likelihood of human error is greatly diminished. Automated systems also employ validation checks and algorithms to ensure accuracy in payment amounts, recipient details, and transaction records.

With fewer errors, travel companies can maintain stronger financial control, uphold trust with vendors and suppliers, and avoid the potential costs associated with resolving mistakes.

Payment Automation and Travel

Largely because of the sheer size of the industry and the number of payments within it, payment automation is immensely important for travel companies: particularly for intermediaries like Online Travel Agencies (OTAs), Travel Management Companies (TMCs), Tour Operators, and Bed Banks. As if the number of flight tickets and hotel rooms booked wasn’t enough, with the increasing popularity of the Merchant of Record model (and the shift from the “pass-through” model), it’s possible that the same flight or hotel room will be sold multiple times. This, in turn, increases the comparative advantages of effective automation.

By automating payments, OTAs and Bed Banks using the Merchant of Record Model can ensure timely disbursements, maintain strong relationships with partners, and offer seamless booking experiences to customers – all the while staying in control of spend and maintaining a healthy cash flow. Similarly, payment automation enables Travel Management Companies (TMCs) and Tour Operators to streamline the reconciliation of client invoices, automate expense reporting, and manage chargebacks effectively.

However, whichever segment of the travel industry you work in, the road to successful payment automation all starts with choosing the right technology, and the right tool.

The Role of Virtual Credit Cards (VCCs)

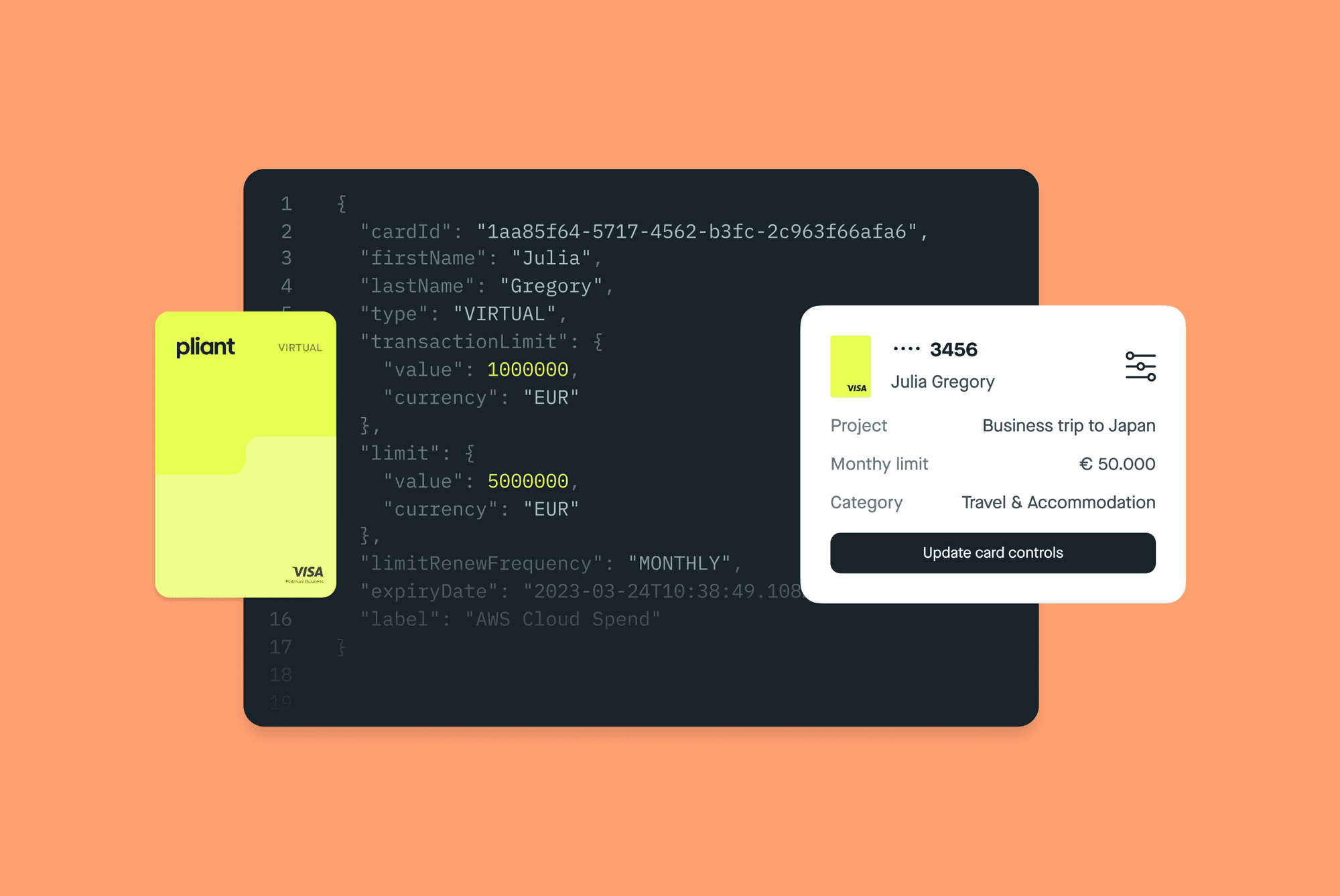

1. Customer Purchase. The process begins when a customer makes a booking through the intermediary. In an automated system, this will trigger the reservation of the flight or hotel room from the supplier.

2. Intermediary creates a VCC. The intermediary uses a platform like Pliant to issue a virtual credit card, which helps them make a payment to the airline, hotel, or bed bank. As each transaction has its own VCC number, an automated system can track the transaction and match it with internal payment records.

3. Payment to the supplier or intermediary. Using the VCC, the intermediary’s automated system completes the transaction. As no human interaction is involved, this is generally much more efficient than manual invoicing.

However, as your booking system will most likely not include a facility for issuing VCCs, you need a platform that does: look no further than Pro API.

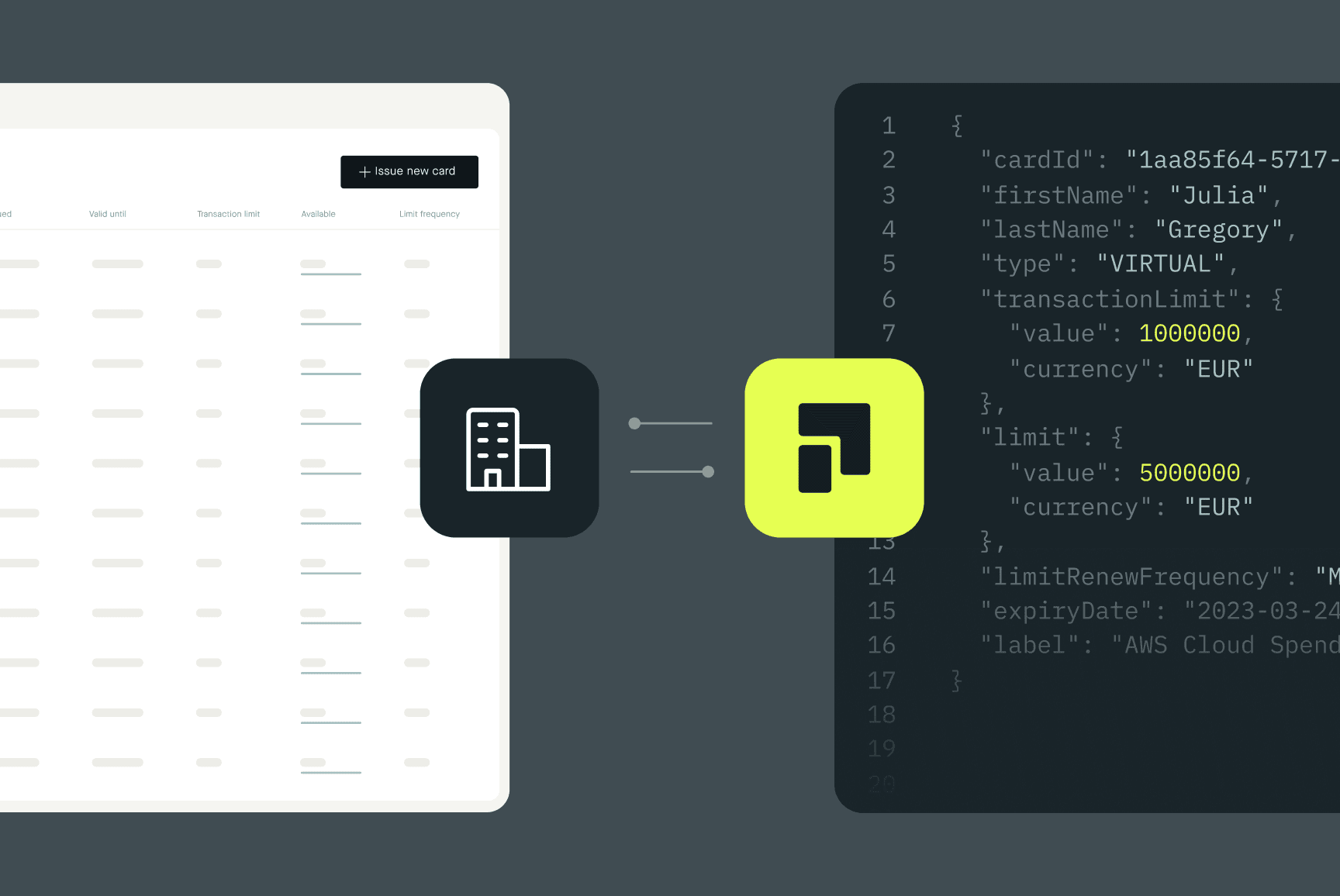

Pro API: Plugs Right In

With Pro API, you can:

Create and manage cardholders

Issue, lock, unlock, terminate, and replace cards

Process transactions and receipts

Access payment data and credit card statements

Access relevant accounting data

Configure accounting data fields

However, integrating Pro API into your existing systems helps with much more than simply executing payment: you can seamlessly automate tasks such as invoice processing, too, making it a comprehensive solution for travel companies to exploit the benefits of payment automation and drive operational excellence.

Reduce Obstacles: Skip 3DS Checks

Pliant Virtual Credit Cards offer a distinct advantage for travel companies looking to benefit from payment automation: like all VCCs, they’re exempted from 3DS (3-D Secure) checks. Unlike traditional credit card transactions, which often require manual input for additional security verification, VCC transactions bypass these steps altogether.

This reduces yet another time-consuming obstacle in the purchase of travel inventory, streamlining payment authentication processes. With Pliant VCCs, travel companies can enjoy a seamless payment experience without compromising on security.

Reduce Fraud

Although it may seem counterintuitive given the lack of 3DS checks, payment automation with Pliant Virtual Credit Cards (VCCs) significantly reduces the risk of fraud for travel companies. VCCs offer single-use card numbers and spending limits, minimizing the potential for unauthorized transactions and fraudulent activity. Additionally, the automation of payment processes reduces the likelihood of human error or manipulation, further bolstering security measures.

Better yet, with the travel purchasing card, you can ensure that your Pliant VCCs are only ever used to purchase travel-related items, minimizing the risk of misuse to practically negligible levels.

By utilizing Pliant VCCs, travel companies can safeguard their financial transactions, protect sensitive customer data, and mitigate the costly consequences of fraud, ultimately enhancing trust and confidence among stakeholders.

Get Started. Automate Your Travel Company’s Payments Today.

Payment automation is an opportunity – and Pliant Virtual Credit Cards (VCCs) are the perfect way to drive positive change in your financial processes. By embracing automation, your travel company can improve process efficiency, streamline authentication with 3DS checks, reduce the risk of fraud, and seamlessly integrate with your existing stack – all while staying in control of your spend. As the travel industry continues to evolve, we can help you stay ahead of the curve and deliver exceptional experiences to travelers worldwide: book your demo today and find out exactly what Pliant can do for you.