5 Ways to Increase Margins for Your Travel Company: Boosting Profitability with Credit Cards.

Running a travel company can feel like walking a tightrope. With competition at an all time high, the pressure to reduce prices has left margins across the industry razor thin. Whether you’re a Travel Management Company (TMCs), Tour Operator, or an Online Travel Agency (OTA), it’s always a good time to think about increasing your margins.

In this blog post, we’ll show you five ways in which a flexible credit card platform can help you reach the margins you're looking for. We'll explore:

Why Travel Companies Need to Increase Margins

What Do Travel Companies Spend Money On?

5 Ways to Increase Margins as a Travel Company – and How Pliant Can Help.

Get Cashback on Essential Purchases

Stop Wasting Money on Foreign Exchange Fees

Control Your Spending

Reduce Support Costs

Buy in Bulk… but Better

How You Can Start Increasing Your Margins Today.

If you work in the travel industry, you’ll know the challenge of maintaining the profit margins needed to keep your business growing… or even just to keep it going.

In fact, you’ve probably already tried to find a solution: this Travel Weekly article showed that travel agencies were prepared to cut staff and reduce opening hours to stay afloat during the Covid-19 pandemic, but cost cutting measures have been a natural reaction to rising inflation and economic uncertainty long after travel restrictions were eased.

While the way you choose to increase margins for your travel company may not be as drastic, even small measures could have significant effects. As a result of the challenging climate, travel companies need solutions that improve financial health and achieve stable, meaningful growth.

Why Travel Companies Need to Increase Margins: Understanding the Economic Landscape

The travel industry is growing. The good news is that demand is still high. The world wants to travel and, according to the 2023 GBTA Business Travel Index™ Outlook, the global business travel industry alone will tip over the trillion dollar mark in 2023.

Price pressure is real. Despite the increase, Deloitte categorizes the current outlook as “murky” owing to factors like inflation and the impact on the average consumer’s purchasing power. This will make it difficult for travel companies to increase margins simply by raising prices.

Expenses are rising. Although not the worst-hit industry, travel companies are still affected by macroeconomic trends. For example, companies in the UK may have to pay their staff 8% more in salary, while rent for commercial premises are up by almost 10%.

Despite being “squeezed at both ends”, it is still possible for travel companies to increase margins – and the expenditure side of the equation is a good place to start.

What Do Travel Companies Spend Money On?

However, what your travel company spends its money on will depend on your business model and the type of travel company you run.

For Travel Management Companies (TMCs) the most significant expenses include:

Payments to airlines, hotels, and car rental companies.

Operational costs related to client support and providing travel management services.

The financial responsibility of ensuring seamless travel experiences for clients.

Tour Operators incur slightly different costs, owing largely to the need to buy in bulk. These bulk acquisitions typically include:

Flights

Hotel rooms

Transfers

Other elements of tour packages, including meals and experiences.

In addition to these purchases, Tour Operators have a greater burden of operating expenses because of the need to manage intricate travel itineraries and provide a higher level of customer support.

Online Travel Agencies (OTAs) operate in a digital landscape, and their spending patterns generally reflect this as well. Although there is usually no need to keep an inventory, commissions paid to hotels, airlines, and other service providers constitute a significant portion of OTA expenditures. These may include:

Online advertising and digital marketing campaigns.

Fees to online tools and platforms.

Technological infrastructure and IT. In fact, the travel industry is spending more than ever before on IT services, looking to get a competitive edge over the competition.

How Do Travel Companies Pay for their Expenses?

Companies in the travel industry use a variety of payment methods in order to pay for their expenses. These range in terms of their flexibility and efficiency: some can be extensively automated in order to reduce operational costs, while others require less technical expertise but more manual effort. If you run a travel company, the following will probably already be familiar to you.

IATA BSP. The Billing and Settlement Plan (BSP) is a global electronic billing system designed by IATA (International Air Transport Association) to perform and facilitate transactions and data exchange between travel agencies and airlines. It is supported by a technology called BSPlink, which enables payments, refunds and communications between parties. Naturally, this isn’t free, and IATA receives a commission on the 157.6 billion dollars (2022) of annual throughput.

Manual invoicing and wire transfers. Many travel companies will make payments to their suppliers using wire transfers, electronic or manual. As well as being a complex process, especially at scale, there are other drawbacks to consider. Traditional banks in many countries are slow to process international payments – on which the travel industry depends – while many will charge high fees for foreign exchange and foreign transactions.

Virtual Credit Cards (VCC). Virtual credit cards are credit cards that exist only in the digital space – they have a card number, CVC and billing address, but no physical card exists. The result of this is more flexibility: rather than heaping expenses onto a single credit card, VCCs can be issued quickly by travel companies and limited to certain purchases. This, in turn, simplifies the reconciliation process. While VCCs are only useful so far as the merchants they’re used to buy from actually accept credit card payments, the widespread adoption of card payments means that this issue is becoming less important.

Pliant: A Better Way?

At Pliant, we specialize in credit cards – and credit card technology that can reduce your expenses and help increase your travel company’s margins. In fact, travel companies all around the world are benefiting from our solution.

Our easy-to-use web application and Pliant Pro API for instant card issuance, as well as generous cashback offers and foreign payments with low surcharges and fees, means there are endless ways to succeed in travel with us.

5 Ways to Increase Margins as a Travel Company – and How Pliant Can Help.

There are many ways in which Pliant can help your travel company succeed, enabling you to focus more on customer experience and less on accounting. Let's explore how our credit card platform can transform the financial landscape for the different types of travel companies.

1. Get Cashback on Essential Purchases

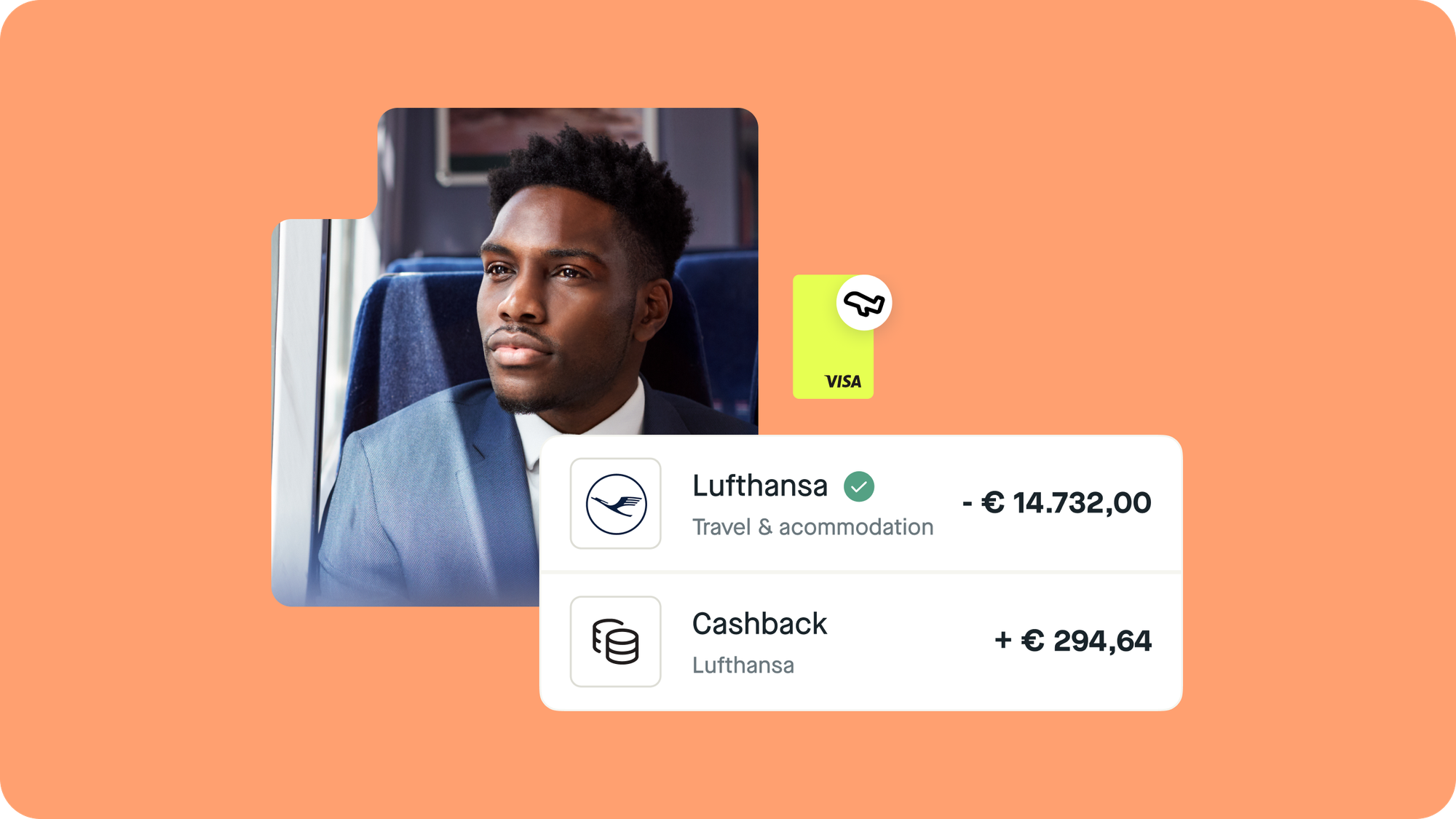

This led us to an idea: if even just a small percentage of money spent on purchases were to be reinvested in your business, the outlook would be a lot brighter. So, that’s exactly what we do: real cashback, not miles or points, to turn your expenses into a new revenue stream.

How Pliant Can Help: More Cashback for You.

With Pliant credit cards, your travel company can earn substantial cashback on high card spending. The process is straightforward: we’ll give you a custom cashback quote based on your transaction volume and payment terms, and you’ll get cash rewards without worrying about points that expire or lose value once you start using your Pliant cards.

How It Works Now. Imagine you spend $50,000 monthly on airline tickets, hotels, and car rentals. Under normal circumstances, this would simply be money that was spent with no return.

How It Might Work with Pliant: With Pliant, your travel company could potentially earn a significant cashback percentage on this monthly spend. Although rates vary, at 3%, that would be five figures of additional revenue per year. That’s just on money that you were going to spend anyway. The result: increased margins for your travel company.

2. Stop Wasting Money on Currency Exchange

Help is at hand. When you choose Pliant, we’ll help you to manage foreign exchange with our multi-currency product. With low fees or mark-ups for the first year, your company can save money whenever you do business in another currency.

How Pliant Can Help: Eliminate Exchange Fees

Pliant understands international business. We don’t want to stop you from spending on the purchases that grow your business, so we simply apply the VISA exchange rate with low surcharges or additional fees when you make purchases in a foreign currency.

This ensures that you retain more revenue, minimizing unnecessary expenses associated with currency exchange and increasing your travel company’s margins.

How It Works Now. You frequently book accommodation in various international destinations, incurring substantial foreign exchange fees with every payment you make. This will increase your expenditures by an industry standard of 3% if you’re with Chase, Citi, or U.S. Bank (2.7% for American Express).

How It Might Work with Pliant. By using Pliant credit cards for these transactions, you’ll eliminate or significantly reduce foreign exchange fees, contributing to increased profit margins. The more you spend, the more you save.

3. Control Your Spending

For travel companies with thin profit margins, overspending on transactions can have disastrous consequences. Implementing effective spending controls is a good way to avoid financial pitfalls – and Pliant’s real-time monitoring is the best tool to do it with.

With Pliant Apps or Pro API, you can keep an eye on transactions as they happen, making real-time decisions that can save your travel industry serious money and hassle. Don’t wait until the end of the month: deal with unexpected surprises from an easy-to-use interface that keeps you in control.

How Pliant Can Help: Real-Time Monitoring

Rather than letting your team run wild with a single company credit card, Pliant gives you the possibility to issue virtual cards with custom controls. From the Pliant app, you’ll have complete oversight and be able to prevent excessive expenditures before they happen.

How It Works Now. You have multiple employees making travel-related purchases, and one of them uses your credit card to make a purchase that doesn’t fit with your company policies. You may need to wait until the end of the month to know what’s happened, by which time your margins have been wiped out.

How It Might Work with Pliant. By issuing virtual cards with spending limits and specific controls, you can limit what types of merchants your cards can be used for, giving you peace of mind and extra control. Likewise, you can see all employees' expenditures at a glance, blocking and unblocking individual transactions if necessary.

4. Reduce Support Costs

Increasing margins for your travel company means reducing the operating expenses associated with providing your services as much as possible. This can include the cost of employing support staff or outsourcing support to agencies.

Manual payments and paperwork contribute significantly to your support burden, so by simplifying your accounting with Pliant, you can take a big step toward business efficiency.

How Pliant Can Help: Integrations to Your Accounting Tools

Pliant cards integrate with the accounting software you already use: automatically matching transactions to receipts and eliminating the associated paperwork. With faster reconciliation processes, there’ll be fewer support costs, and higher margins for your travel company.

How It Works Now. You make a high volume of manual payments, leading to increased support staff requirements and operational costs when it comes to documenting and accounting your expenses.

How It Might Work with Pliant. With Pliant apps and APIs, you can streamline payment processes: reducing the need for support staff and cutting down on operational expenses.

5. Buy in Bulk. Better.

One of the best ways to increase margins for your travel company is to get a better deal from merchants by purchasing flights and hotel rooms in bulk. However, managing these bulk purchases can be a significant challenge.... but not with our Pro API.

With Pro API, you can automate the entire ticket purchasing process, saving time and reducing errors. Once your back-office system is connected to Pliant, you can make automated ticket purchases with instant payment reconciliation – vastly increasing your efficiency and enabling you to make the most of bulk purchasing.

How It Works Now. You purchase a bulk quantity of airline tickets for upcoming tours, leading to a complex and time-consuming reconciliation process that occupies an in-house accountant on an almost full-time basis.

How It Might Work with Pliant. With Pliant Pro API, you can free up your internal resources by simplifying the reconciliation process. The result: even bigger margins for your travel company.

Keep Those Profit Margins High

By turning routine expenditures into cashback opportunities, eliminating foreign exchange fees, controlling spending, reducing support costs, and optimizing bulk purchases, Pliant helps your travel company to increase margins – and succeed despite the current economic challenges.

Embrace the future of travel finance with Pliant and unlock a new era of financial efficiency for your business by booking your demo today.