How Pliant protects financial transactions for corporations

Corporations have complex financial processes that are often vulnerable to security risks. Fortunately, Pliant delivers streamlined processes, greater control, and valuable benefits by addressing common challenges organizations face with payment solutions and expense tracking.

Let's explore how Pliant tackles key pain points with its advanced features:

2-Factor authentication for uncompromised security

Protecting financial transactions from unauthorized access is a paramount concern for corporations. Pliant prioritizes security by implementing 2-factor authentication on each individual card. This robust security measure ensures that only authorized personnel can access and utilize corporate credit cards, minimizing the risk of fraudulent activities and maintaining the integrity of financial operations.

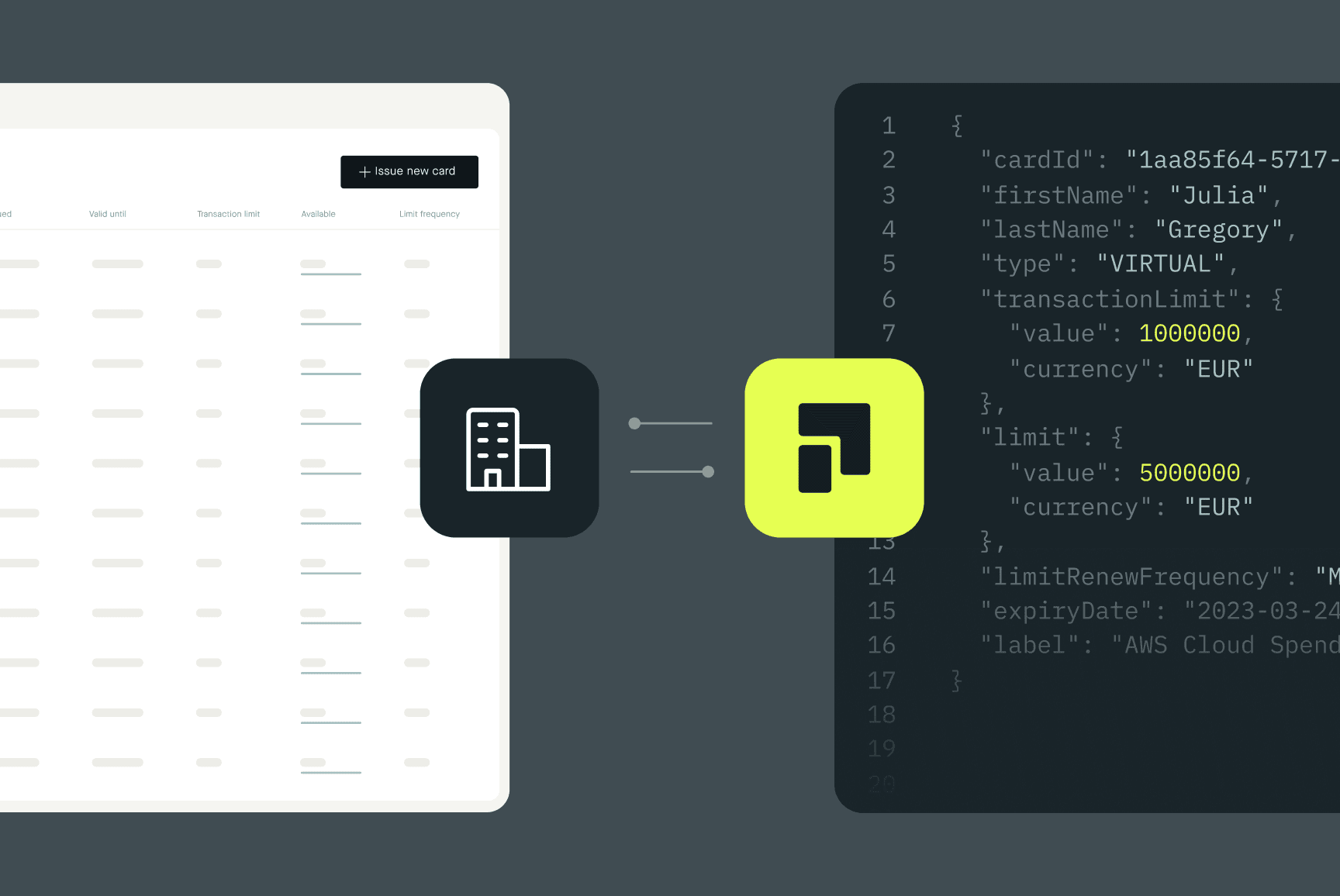

Swift and secure virtual card issuance

Say goodbye to the delays and logistical challenges associated with physical credit cards. Pliant enables instant issuance of virtual cards, empowering employees to make transactions promptly and effortlessly. This instantaneous access to virtual cards streamlines daily operations, eliminating the need to rely on physical cards and expediting business processes in a secure and user-friendly manner.

Streamlined receipt collection and automated pre-accounting

Pliant simplifies the arduous task of receipt collection and automates pre-accounting processes. By leveraging cutting-edge technology, Pliant digitizes receipt management, reducing manual efforts and minimizing the risk of errors. With seamless integration into existing accounting systems, Pliant ensures accurate and efficient expense tracking, freeing up valuable time for corporations to focus on strategic initiatives.

Maximizing cost savings with cashback rewards

Unlike traditional payment methods, Pliant goes beyond facilitating transactions. It empowers corporations to earn cashback rewards on their spending, effectively reducing costs and enhancing financial benefits. With every eligible transaction made using Pliant, corporations unlock an opportunity to boost their bottom line, ensuring that expenses contribute to a tangible return on investment.

Tailored flexible payment terms

Recognizing the diverse cash flow needs of corporations, Pliant offers flexible payment terms tailored to individual requirements. Corporations can negotiate and establish payment terms that align with their financial realities, providing greater flexibility and liquidity. Whether it's accommodating large one-time payments or adjusting payment schedules, Pliant ensures that financial constraints never hinder operations.

Empowering budget management for teams and employees

Efficient budget allocation and control are vital for effective financial management. With Pliant, managers gain the ability to assign budgets per team and employee, ensuring greater control over spending. By setting spending limits and assigning cost centers, Pliant enables corporations to maintain oversight while empowering teams to manage their budgets autonomously. Real-time visibility into spending and cash flow ensures accurate decision-making and cost control.

Digital agency diva-e found the right payment solution for their complex company structure in Pliant

Pliant’s credit card platform is a flexible solution that adapts to corporations’ existing setup and structure.

One of our clients, German digital agency diva-e, found in Pliant a solution that fit their complex company structure and provided several attractive features, like virtual cards with individual spending limits, flexible credit limits, and powerful integrations.

To learn more about diva-e’s experiences with Pliant, click here.