Why a credit card without a business account is the best option

For many businesses, introducing a new payment method into their financial processes can be a significant challenge. It's essential not only to integrate it into existing finance and accounting software but also to manage payments through the business account. There are business credit cards without an account that can be linked to an existing account, while others are only available with a specific account. Both systems have their advantages and disadvantages, which we will explore in this article.

Key answers about business credit cards and account linking:

Business credit cards must always be linked to a business account. It's not possible to manage payments from a credit card through a personal account.

There’s a distinction between business cards linked to an account and those that can be associated with any business account.

Credit cards without account linking are easier to integrate into existing financial processes.

How does a credit card without a business account work?

To ensure proper payment management, each credit card must be linked to a business bank account, which must have sufficient funds at the time of debit. The expenses incurred on the card are deducted from this reference account. With a credit card that doesn’t require a business account, there's no need to open a new bank account; it can be used with any existing company account.

Which credit card model is suitable for whom?

Businesses that don’t yet have a suitable bank account will likely choose a card linked to a business account. Many banks offer a debit card alongside the business account as a standard option. However, a full credit card often comes with a fee and is only available upon request. Moreover, it generally can only be linked to the issuing bank's account.

Credit cards that do not require linking to an account are less common, but if you’re not satisfied with your bank’s offerings, they can be the best choice. Without switching accounts, businesses can use free credit cards indefinitely.

Having an additional account that is not regularly used adds more administrative work. Companies find it more challenging to manage all transactions and ensure there is always a sufficient balance, thereby avoiding costly overdraft fees.

Advantages of a business account with a credit card

A single provider to manage both the business account and the credit card.

Simplified application process if the business account is already open.

A wide range of credit card options linked to business accounts.

Advantages of a credit card without a business account

No need to switch bank accounts.

Free cards are available on an ongoing basis.

Reduced administrative burden.

Better control over expenses.

You’re not limited to the offerings of a single bank.

Disadvantages of an additional business account

Businesses that use full credit cards benefit from free liquidity due to the delay in charging expenses. However, if obtaining the desired credit card requires opening an additional account, some of this flexibility is lost.

When the additional account is not used for other transactions, administrative management in accounting increases significantly due to the control of unnecessary accounts.

To ensure that the account always has sufficient funds, there are two options: companies must either transfer the amount of credit card expenses before the debit date or maintain an amount in the account equivalent to the credit limit.

Both alternatives require a manual adjustment each month, and additionally, businesses lose some liquidity by keeping capital immobilized either permanently or in advance.

The same drawbacks apply to prepaid business credit cards, where it's necessary to load a balance beforehand.

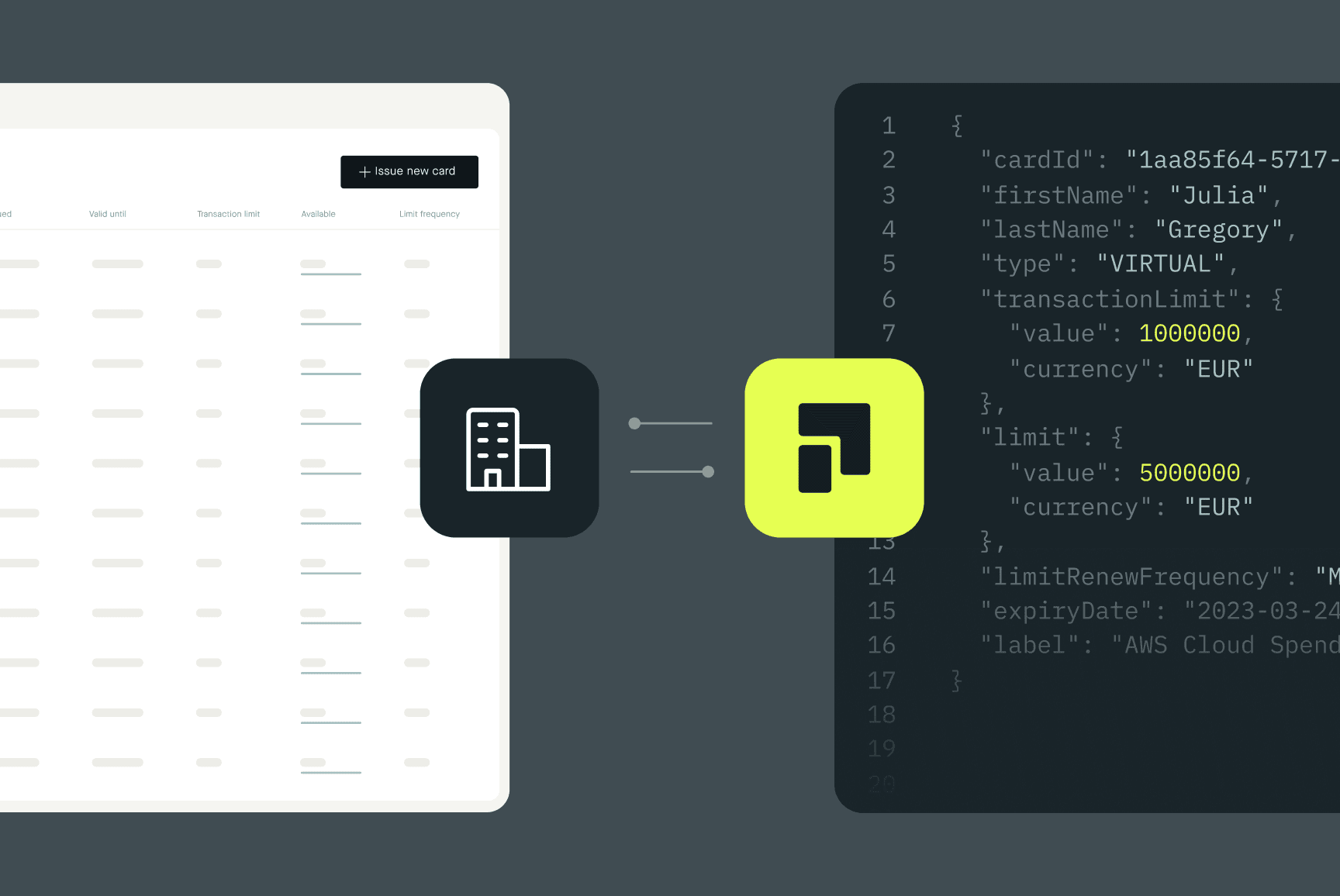

Pliant cards work with any existing business account

Pliant's digital credit card solution can be linked to any business account. For free credit cards, there’s no need to open a new business account.

Regardless of the company's account, businesses can obtain real business credit cards with high limits. Moreover, due to their easy integration into existing financial processes, companies do not assume any risk.