What is a credit card limit?

After a careful credit check, each credit card applicant receives an individual credit card limit. In this guide, you’ll learn what credit card issuers take into account in their credit assessment and why a high credit limit isn’t always a good thing.

Credit card limit in a nutshell

A credit limit is the total amount available to you during a billing period.

Card issuers determine the credit card limit individually based on the customer's creditworthiness and preferences.

It’s not always advisable to apply for the highest possible limit. The risk of credit card misuse increases and your credit rating may deteriorate.

What is a credit card limit?

A credit card limit is the maximum amount you can regularly spend with your card. In other words: the amount you have at your disposal with your credit card is not unlimited.

Usually, it’s a monthly limit, which is reset on the first day of a calendar month. You may also see it referred to as a drawing limit or credit card with a drawing limit.

Other relevant terms include:

Daily limit: This is the amount you can spend and transfer per day.

Weekly limit: The maximum amount you can spend each week.

Transaction limit: This is the maximum amount that you can spend on a single transaction. Each card payment, such as a hotel booking, counts as one transaction.

Company limit: If you have a corporate credit card and you issue additional cards to employees, the total credit limit is assigned to the company rather than individual cards. This limit can then be distributed across all issued cards.

What is a normal credit limit on a card?

The credit limit is always set individually for each customer and it can vary depending on where you live. In Germany, for example, the average credit card limit on a personal card starts from roughly €500 and can go up to €10 000 or even higher. With the exclusive black credit cards, the credit limits can be very high.

If you want an estimate of your credit limit, you can try an online credit card limit calculator. But remember that it’s only an estimate and your final credit limit is determined by the card provider after a credit check.

How does the limit on a credit card work?

When you use a credit card, you actually borrow money from your card issuer. That’s the credit limit. You are free to use the limit for all your payments.

At a predetermined payment frequency, you either pay in full the total of all transactions or a part of it. If you only pay a part of your credit card bill, the rest will accrue interest.

Usually after 30 days, at the end of a calendar month, you receive a credit card bill. Depending on where you live, your credit card bill is either charged from your bank account with direct debit or you pay it with a bank transfer.

How is the credit card limit determined?

The amount of the credit card limit depends on the applicant's financial situation. No card issuer grants a credit limit without a prior credit check.

This way banks and card issuers limit their risk of a payment default. The higher the credit, the bigger their risk of loss.

But what criteria does the card issuer use to determine the credit card limit? Of course, this always depends on the bank or card provider.

But generally speaking, in addition to creditworthiness, the card issuer usually considers the customer’s preferences as well.

Here’s what affects your credit limit:

Credit check to assess your creditworthiness

When you apply for a credit card, the card issuer assesses your creditworthiness. They look into your current income situation, as well as the type and duration of your employment.

Card issuers obtain further data about your creditworthiness from credit agencies. If you live in Germany, you’ll likely have to deliver your Schufa report. This provides the card issuer with information about the reliability of payments and existing debts.

Anyone who has regularly overdrawn their account in the past, or has fallen into arrears with expenses, is considered to have an increased risk of default. This can lead to a low credit limit or the application being rejected completely.

Here you can learn more about how the credit check for a corporate credit card works.

Your preferences as a customer also play a role

The card issuer will likely ask about your preferences. This is your chance to request a credit card limit that fits your needs. If you know your typical spending and know that you need a fairly high credit limit, you should mention this in the application.

Specify how much card turnover you expect each month. Otherwise, you may receive a credit card that doesn’t quite meet your requirements or match your spending.

Is it possible to increase the credit card limit?

If you want to increase your credit limit, you need to apply for a higher limit. The card issuer will then carry out a new credit check.

A good reason for requesting a bigger credit limit is, for example, an increase in your income. You may have to provide proof of your financial situation again.

How much can I go over my credit card limit?

You cannot overdraw your credit card limit. Payments in one billing period are only possible up to the agreed total amount.

But as mentioned, you can request a higher credit limit. If you meet the card provider’s criteria, your credit limit will be increased and you can spend more without going over your credit limit.

When to increase your credit limit

Before you apply for a bigger credit limit, you should be aware of the pros and cons of high credit lines.

On one hand, you get more financial flexibility. But on the other hand, the risks of card misuse and getting into debt increase.

Advantages

More room to maneuver. Whether it's booking a trip or placing a large order, you can make bigger payments with your credit card without maxing out your credit limit.

Increased liquidity. Your credit limit is basically an interest-free loan (if you pay it back on time). This means that you'll have more money available each month until your credit card bill is due. Unlike a debit card that charges money directly from your account, you benefit from a longer billing cycle.

Disadvantages

Increased risk of debt. A credit card is not suitable for minimizing payment difficulties. You don’t want to risk falling behind on payments.

Increased risk of credit card misuse. The credit line limits your risk in case your card is stolen. If scammers gain access to your credit card data, the amount of damage is limited to the amount of your credit limit.

Lower credit rating. Depending on where you live, your credit rating may be affected by the amount of your credit limit. This is the case in Germany. A high credit limit is a risk factor for other creditors. For example, if you need to take out a loan, your application may be rejected or the terms of the loan may be less favorable.

Always consider carefully how big a credit limit you really need. Even if you’re eligible for a large limit, the downsides may outweigh the upsides.

In the long term, the increased liquidity won’t help you with financial hurdles. And if you don’t need extra leeway in your day-to-day finances, it can be smart to settle for a lower, more moderate credit limit. Otherwise, your credit rating may suffer. And in the event of credit card fraud, you'll incur greater damages.

How to request a change for your Pliant credit card limit

Pliant's corporate credit card solution features both virtual and physical credit cards.

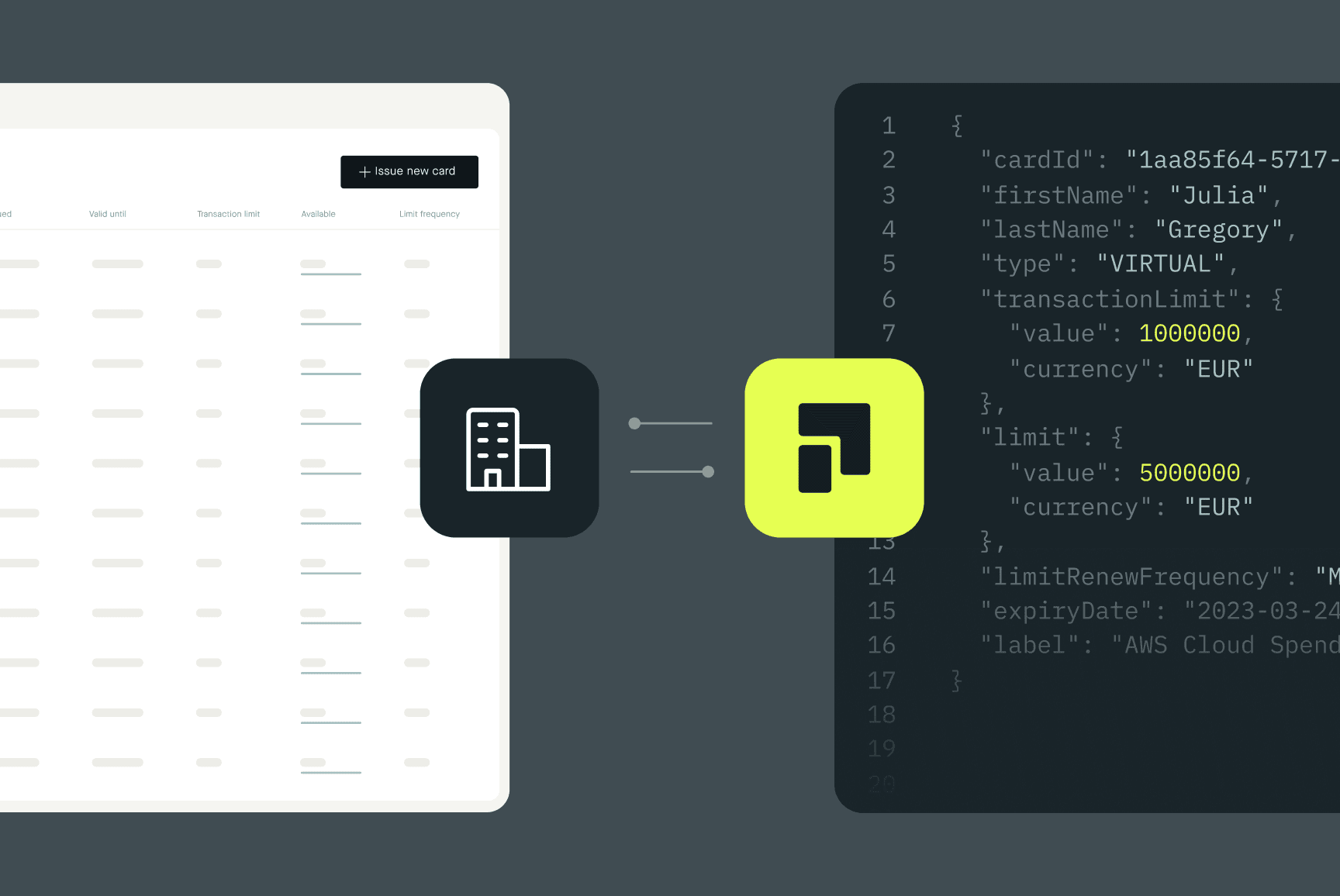

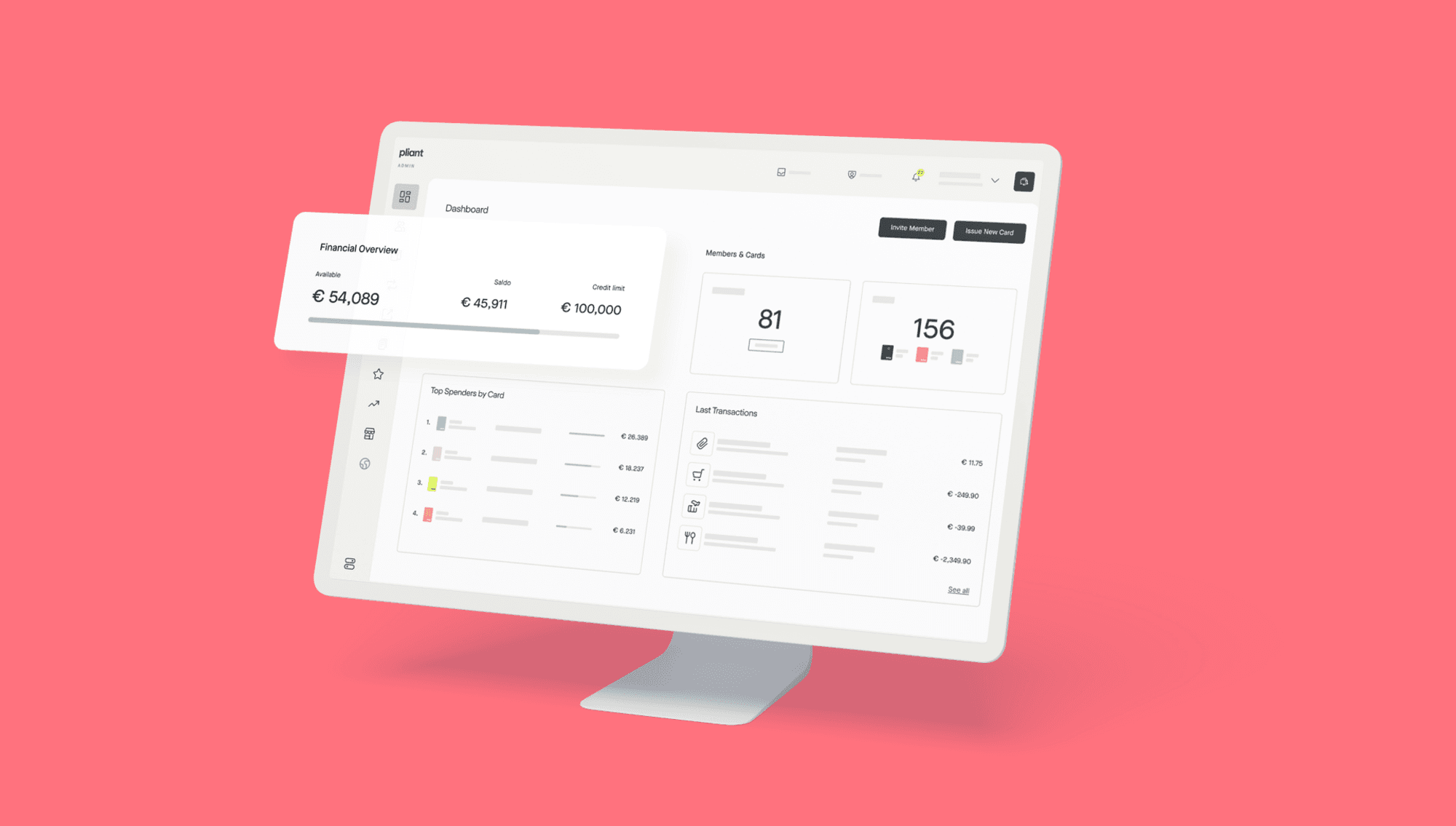

Our credit cards have a company-level credit limit. The limit is assigned to your organization, which can then be distributed among the individual cards. If you need a limit change for your organization, you can apply for it at any time.

You can manage individual card limits directly in the Pliant app. Employees can view all expenses and the spending limits of their cards in the app. If they need a higher limit, they can request limit changes from their managers with just a few clicks.

Once the manager approves the limit change, the new limit is immediately available to the employee. Whether traveling on business or working at the home office, team members can pay for unexpected, bigger expenses without having to contact the credit card issuer.

💳 Want to learn more about Pliant business credit cards?

Book a demo