What is a Card Issuance Provider? And who would benefit from issuing their own credit cards?

In the constantly evolving landscape of financial services, card issuers are playing an increasingly important role. But what exactly does a card issuance provider do? Simply put, these entities are the engine behind the creation and management of payment cards. They offer businesses the tools to launch their own branded cards, either physically or digitally, opening up new opportunities for revenue, customer engagement, and financial management.

As the demand for customized financial solutions grows, so too does the interest in card issuance. More and more companies across various sectors are exploring the benefits of issuing their own credit cards. This surge is driven by a combination of market trends and the desire for more integrated financial solutions. In this article, we’ll dive into why the appetite for credit card issuance is on the rise and explore the five key industries that stand to gain the most from this opportunity. From banking and ERP systems to invoice management and expense management, we'll reveal how these sectors can leverage card issuance to their advantage.

Whether you're looking to enhance customer loyalty, unlock new revenue streams, or gain valuable spending insights, understanding the role of card issuance providers is crucial. So, let’s unpack the fundamentals and discover who could benefit from stepping into the world of credit card issuance.

What is a Card Isscuance Provider?

Why the Demand for Credit Card Issuance is growing?

5 Industries that would Benefit from Credit Card Issuance

Banking

Enterprise Resource Planning (ERP)

Invoice Management

Specialized Lending

Expense Management

Pliant: Your Credit Card Issuance Provider

What Is a Card Issuance Provider?

A card issuance provider is an entity that enables institutions to create, manage, and issue payment cards—including credit, debit, and prepaid cards. This enablement is known as a card issuing service.

Companies that conduct a card issuing service will help customers—typically other businesses—establish their own branded physical or virtual cards, or a digital payment platform, designed for either open loop or closed loop payments. Open loop cards can be used anywhere the brand of the card is accepted, while closed loop cards can only be used at specific, pre-designated stores.

To help a business launch a card program, a card issuing provider will either directly provide the business with cards that they can brand and issue (a process called “white-labelling”), or program and embed a digital payments infrastructure into the business’s existing application/platform (via an API integration).

Why the Demand for Credit Card Issuance is growing

The demand for credit card issuance, in particular, is currently skyrocketing. According to Statista, 55% of non-financial firms plan to offer integrated financial services over the next two years. And according to Accenture, out of all integrated financial services, businesses are the most interested in credit card issuance.

The rising popularity of card issuance is no coincidence. When a company creates and issues their very own credit card, they tap into a variety of exciting benefits. Let’s take a closer look at these benefits.

New Revenue Stream

When a company issues their own credit card, and their customers use that card to make purchases, that company can collect interchange fees from other merchants.

An interchange fee is the fee that a merchant pays the issuer of the card that a customer used to make a purchase from their store. Card issuers collect these fees to cover handling costs, fraud or bad debt costs, and the risk of approving the transaction. So, let’s say that company X issues their own credit card. If a customer of company X uses that card to make a purchase from Nike, then company X can collect an interchange fee from Nike.

Furthermore, a company can save money by issuing their own credit card. When a company accepts payments from another issuer’s credit card, they must pay that issuer interchange fees. However, when a company accepts payments from their own credit card (via a card acquirer), they no longer have to pay interchange fees to an outside entity, keeping that money within the company. For many companies, this move would save them a lot of money and boost their profit margins. For example, by launching their own credit card, Uber saved approximately $750 million annually in credit card processing fees.

On top of saving money, a company could earn money from their credit card program. As long as customers are using their credit card to make purchases from other merchants, the company can collect interchange fees from those merchants, thereby creating a new stream of revenue.

Enhanced Customer Loyalty and Branding

Companies can leverage a credit card program to strengthen their relationship with their customers. A company can design their card program to offer customers incentives and rewards for using their card, such as discounts on purchases, gifts from the store, etc. Moreover, by integrating a virtual card into their product or platform, a company creates a seamless and convenient payment option that improves a customer’s experience with their offering. Both the rewards and the high quality user experience encourage cardholders to return to the company and become frequent, long-term customers, thereby ensuring consistent usage of the company’s products and services.

Furthermore, a well-designed credit card program is a powerful marketing tool. By publicising the exclusive rewards and benefits of their card program, a company can attract and acquire new customers, thereby expanding their revenue base.

In addition, when a company issues a card with their logo on it, they enhance their brand visibility and recognition with each time their card is used for a transaction. Indeed, by becoming the cardholder’s payment provider, the company essentially integrates their brand into the cardholder’s life and into the markets where the cardholder conducts transactions.

Access to Customer Spending Data

A credit card program would enable a company to access their cardmembers’ shopping data, so long as the cardholder doesn’t opt out of disclosing that data. With this information, a company can gain valuable insight into how, how often, and how much their customers spend. The company can then leverage their knowledge on customer spending behaviour to develop new products, services, and pricing structures that better appeal to common consumption patterns and preferences.

5 Industries That Would Benefit from Credit Card Issuance

There are various industries in which businesses would benefit from launching their own credit card program. We will highlight the top 5 industries that are positioned to reap the most benefits from card issuance. Companies in these industries should seriously consider working with a card issuance provider (like Pliant) to launch their own credit card program.

Banking

Banks are the original physical credit card issuers, since they have the financial assets to launch and operate their own credit lines. But traditional banks can conveniently digitalise their card offering by partnering with a fintech company. With the necessary financial and regulatory infrastructure all set up, banks can easily integrate digital credit cards into their platform, and capitalise on an opportunity to enhance their product offering and profits.

Enterprise Resource Planning (ERP)

When it comes to modern-day enterprise resource planning, clients seek a seamless financial management experience. Launching a credit card program is the perfect way for ERP companies to provide their customers with that experience. An ERP company can integrate a credit card payment solution into their system. This enables the payment technology to directly upload transaction data and receipts to the system, helping customers view and process their financial data in real time. This unlocks many positive effects on a customer’s accounting, budgeting, and cash management. Additionally, access to real time transaction and receipt data improves business intelligence and financial reporting, which optimises business processes and informs decision-making.

Invoice Management

An invoice management company can simplify their offering by integrating a business credit card into their platform. Normally, a business would need to manually upload transaction data to an invoice management system. But if the invoice management company offers a credit card that is linked to their system, then a business’s transaction data (amount spent, invoice number, date & time, etc.) would be automatically recorded in the system after every purchase made with the card. This enables companies to monitor their transactions in real-time. And the automated data recording streamlines the invoice management process, improving organisation, reducing payment processing times, and simplifying accounting.

Specialised Lending

For specialised lending companies, credit cards present a new method of lending to businesses. By issuing credit cards, a lending company can build a new revenue stream of interchange fees, and use the additional revenue to improve their unit economics, make their service more affordable for customers, and boost sales. Furthermore, the lending company would exceed expectations by offering credit cards that give customers instant access to loans whenever and wherever they need them. Finally, a credit card would give a lending company greater control over funds paid out because the firm can customise permissions to allow spending on approved merchant categories only.

Expense Management

When it comes to business expenses, the largest pain point for employees is having to cover work-related expenses out-of-pocket and then wait for reimbursement. If an expense management company issues credit cards to their client businesses, and empowers their customers’ employees to make purchases without spending their own money, then they solve this critical pain point. Additionally, by integrating corporate credit cards into their solution, an expense management company enables their customers to conveniently make payments without having to navigate through multiple platforms or undergo complex procedures to complete a transaction.

Companies in these industries can benefit significantly from launching their own credit card programs. Starting a credit card is historically a time consuming and resource intensive process. But fortunately, modern card issuance providers like Pliant enable companies to launch their very own card programs in just months or even weeks at a fraction of the cost.

Pliant: Your Credit Card Issuance Provider

The Layers

Pliant’s card issuing service consists of 5 different layers.

Support Layer: Pliant provides expert technical assistance throughout all project phases, including technical implementation and ongoing card issuance. This enables smooth operations and quick issue resolution.

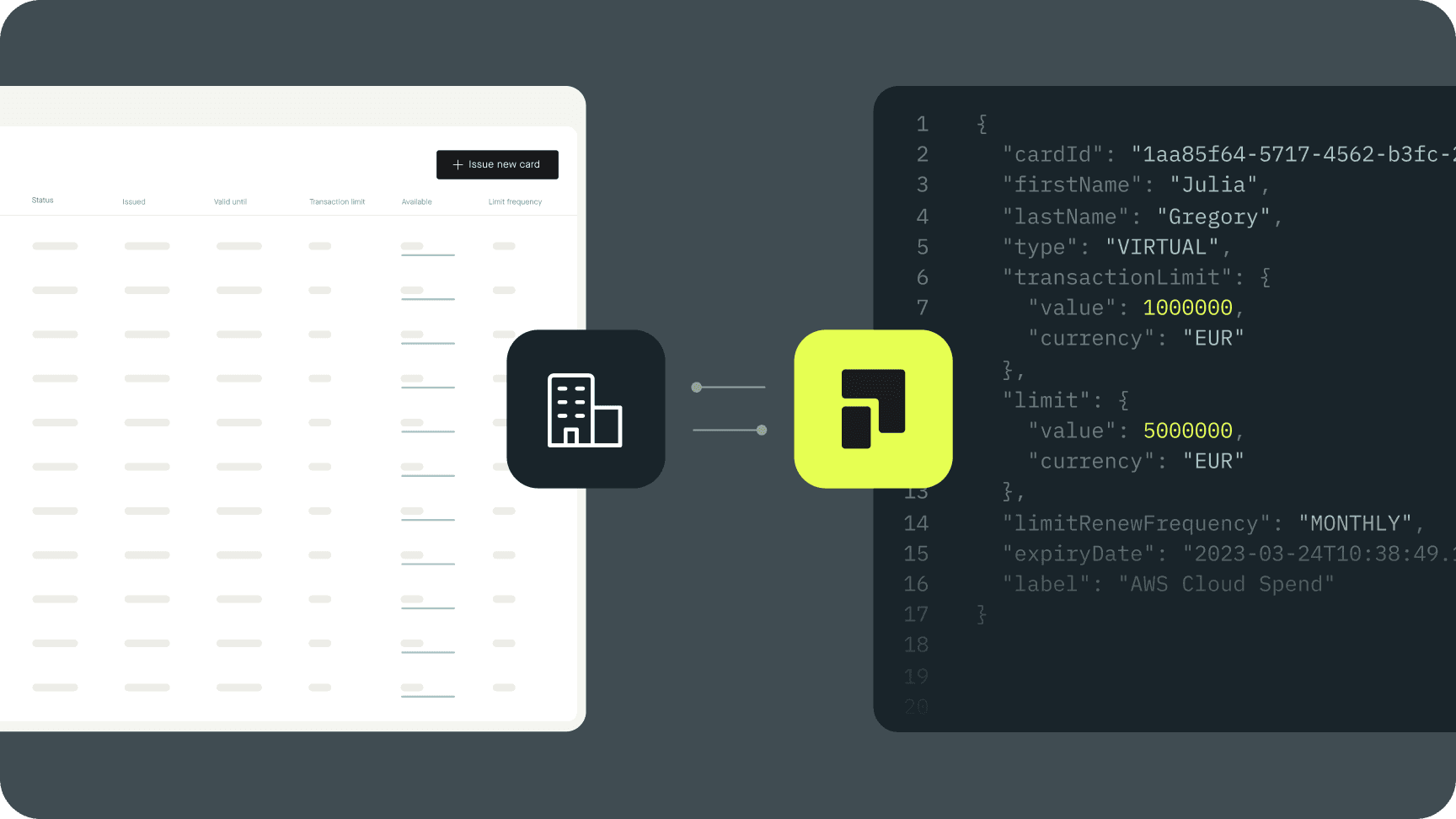

Frontend Layer: We created user-friendly administrative and cardholder applications, equipped with real-time management capabilities for an intuitive user experience.

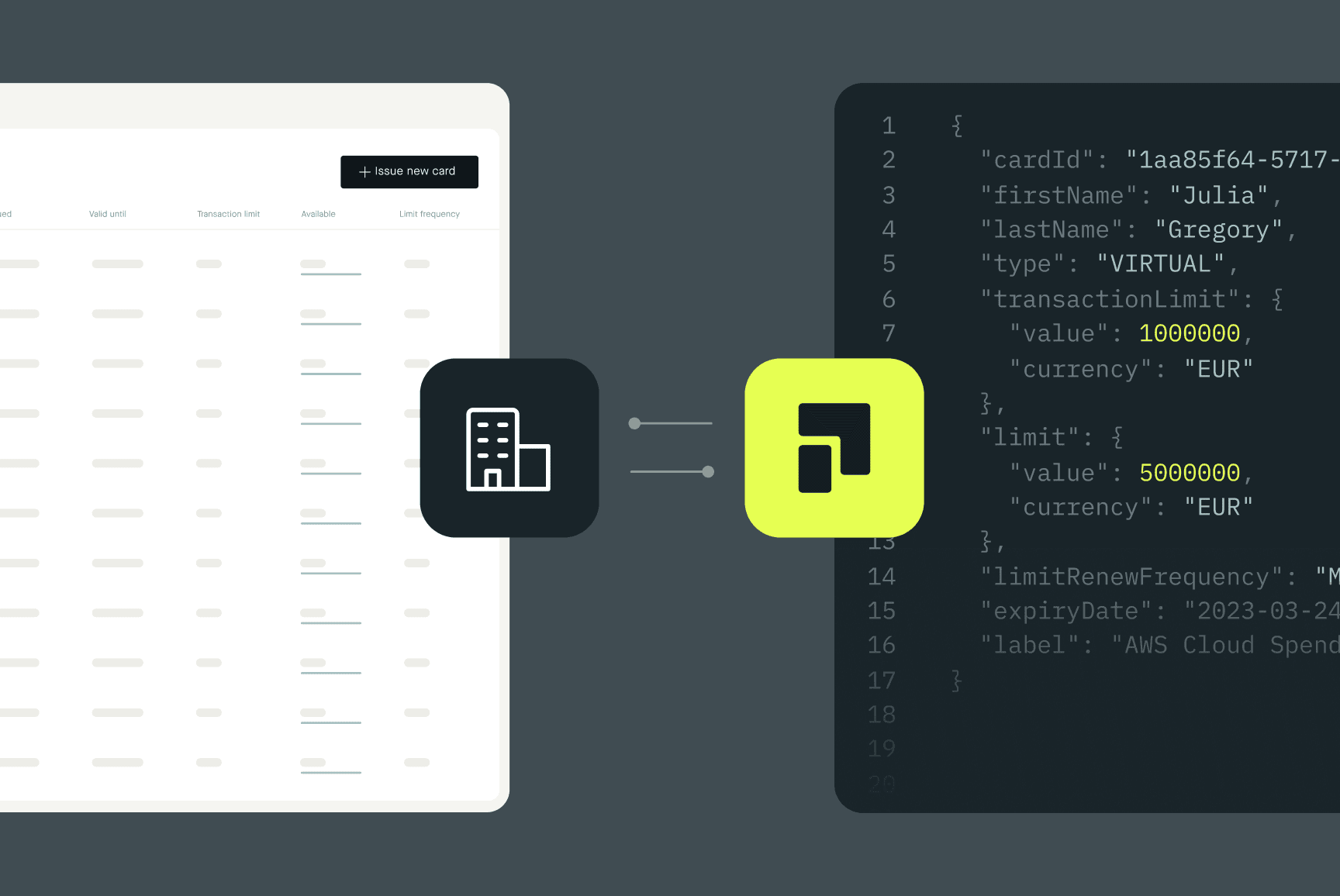

Backend Layer: Our state-of-the-art API infrastructure facilitates easy and flexible product or application integration.

Regulatory Layer: Our expert legal team can ensure your credit card program’s compliance with KYC/AML checks. Additionally, we provide continuous risk and compliance monitoring, which is essential for maintaining trust and legality.

Banking Layer: We design your card program to address all credit card requirements, simplifying the launch and management of your program. Moreover, we provide you with access to our credit line if necessary. Our highly-trained credit team conducts in-depth due diligence on debtors to minimise risk and ensure the viability of the credit line.

Our card issuing service is not a rigid package, but a flexible, versatile, and modular solution. You can pick and choose layers according to your specific needs. Every layer of our service is capable of efficient and optimal customization.

The Pliant Advantage

Why choose Pliant to be your credit card issuance provider? Let’s discuss the key components of the Pliant advantage.

Comprehensive service: Pliant’s card issuing service is the most comprehensive in the industry. While most card issuance providers will offer only the backend and frontend layers, Pliant supplements the software with expert technical, legal, and financial support. You don’t need to have any knowledge on card issuance—our team is here to guide you through every step of the process.

Expense tracking platform: Pliant enables companies to not only issue credit cards, but also build a complementary expense tracking platform that is based on the Pliant app. This platform centralises the payments made by issued cards, and empowers businesses with a real-time spend monitoring system. This system enables companies to analyse real-time data on customer spending and gain valuable insights into consumer behaviour. Such insights can inform strategic decisions to meet customer needs and preferences.

Seamless integration: With our API technology, we can seamlessly integrate a premium corporate card into your existing infrastructure. In other words, our payment solution becomes an embedded component of your product suite.

Personally-tailored customization: When you issue a credit card with Pliant, you can customise the frontend layer of our product according to your needs, designing the user experience to fit with your brand, your platform, and the needs and preferences of your customers.

Elite card management: The cards that you issue with Pliant come with high-level card management tools that enable your customers to manage, in real time, how their teams use the card. Customers can set high or low limits on spending, pick and choose specific merchant categories to approve spending for, and more. By issuing cards with Pliant, you would be providing your customers with a highly flexible payment platform that they can manage from anywhere and at any time.

Global acceptance: Pliant’s Visa cards are accepted by over 40 million online and offline merchants in over 200 countries around the world. This makes our payment solution an ideal choice for all travel related expenses.

White-label v.s. API

There are two types of card programs that you can issue with Pliant: a white-labelled card program, and an embedded card program.

A white-label credit card program entails branding an existing card product from a third-party provider. This approach enables faster deployment and minimises technical investment, as it eliminates the need for development efforts on your part.

Meanwhile, an embedded credit card program is fully integrated into your platform via an API, delivering a customised user experience and enhanced control over features and functionalities. However, this option demands more development resources.

Thus, the largest difference between the two types of card programs lies in the depth of system integration. While a white-labelled card is a surface-level integration, an embedded card program is a payment solution that is deeply integrated into your existing infrastructure.

The Ideal Characteristics of a Company that Issues Credit Cards

Not every company that wants to issue credit cards is prepared to find success with a card program. Here are the key characteristics of a company that is primed for successful card issuance:

A Well-Suited Product: If you plan to integrate your credit card program into your product, ensure it aligns seamlessly with your existing offerings.

Established Brand Reputation: A reputable brand image instils trust and confidence among cardholders, which is essential for them to entrust you with their finances. Companies known for their reliability, transparency, and excellent customer service are more likely to attract and retain cardholders.

Existing Customer Base: Your existing customer base offers a ready-made audience for credit card offerings, making it simpler to "upsell" financial services compared to introducing them directly. Sometimes, customers even request payment cards from their software providers. Utilising these established customer relationships can streamline marketing efforts, boost customer acquisition, and promote long-term loyalty.

Marketing Capabilities: While Cards-as-a-Service (CaaS) can save you from the burden of implementing extensive financial infrastructure or gaining regulatory expertise, the responsibility for sales efforts will primarily rest on your shoulders. Therefore, your company should be ready to market branded credit cards to your existing customer base. Although customer support is another area to consider, your CaaS partner, including Pliant, can assist you with this aspect.

Launching Your Credit Card with Pliant

If you’re a business that has decided to launch your very own credit card program with Pliant, then here are the 3 steps you need to take to accomplish that.

Define your goals: Decide what you want to accomplish with a card program. What specific objectives and key results do you hope to achieve? You can reference the section earlier in this article about the benefits of card issuance for inspiration.

Create a strategy: A solid launch strategy should clearly outline how your card program will attract and retain customers. If you can't identify a viable way to gain new clients with your credit card offering or increase revenue from your existing ones, it might not be the best solution for you.

Choose between White-Labelled and Embedded: Based on your product, you'll need to determine the extent to which your card program should be integrated into your system. This decision will shape the technical effort required to develop your card program and the overall look and feel of the financial services that you offer to your customers. So think carefully about whether a white-labelled card program or an embedded card program is a better fit for your business.